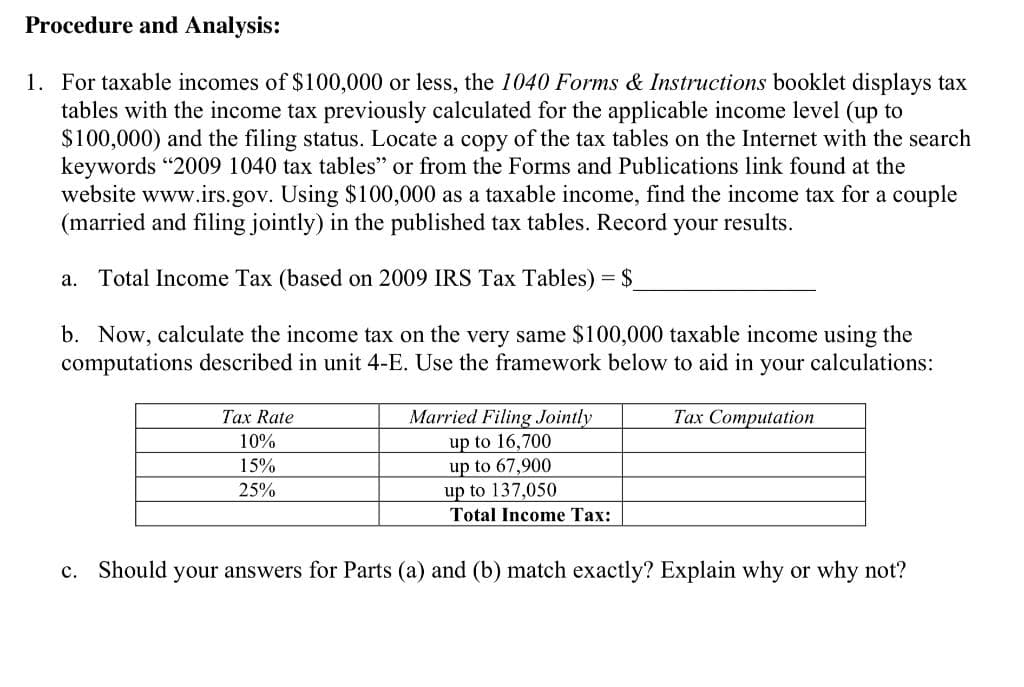

Procedure and Analysis: 1. For taxable incomes of $100,000 or less, the 1040 Forms & Instructions booklet displays tax tables with the income tax previously calculated for the applicable income level (up to $100,000) and the filing status. Locate a copy of the tax tables on the Internet with the search keywords "2009 1040 tax tables" or from the Forms and Publications link found at the website www.irs.gov. Using $100,000 as a taxable income, find the income tax for a couple (married and filing jointly) in the published tax tables. Record your results. a. Total Income Tax (based on 2009 IRS Tax Tables) = $_ b. Now, calculate the income tax on the very same $100,000 taxable income using the computations described in unit 4-E. Use the framework below to aid in your calculations: Tax Computation Tax Rate 10% 15% 25% Married Filing Jointly up to 16,700 up to 67,900 up to 137,050 Total Income Tax: c. Should your answers for Parts (a) and (b) match exactly? Explain why or why not?

Procedure and Analysis: 1. For taxable incomes of $100,000 or less, the 1040 Forms & Instructions booklet displays tax tables with the income tax previously calculated for the applicable income level (up to $100,000) and the filing status. Locate a copy of the tax tables on the Internet with the search keywords "2009 1040 tax tables" or from the Forms and Publications link found at the website www.irs.gov. Using $100,000 as a taxable income, find the income tax for a couple (married and filing jointly) in the published tax tables. Record your results. a. Total Income Tax (based on 2009 IRS Tax Tables) = $_ b. Now, calculate the income tax on the very same $100,000 taxable income using the computations described in unit 4-E. Use the framework below to aid in your calculations: Tax Computation Tax Rate 10% 15% 25% Married Filing Jointly up to 16,700 up to 67,900 up to 137,050 Total Income Tax: c. Should your answers for Parts (a) and (b) match exactly? Explain why or why not?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Transcribed Image Text:Procedure and Analysis:

1. For taxable incomes of $100,000 or less, the 1040 Forms & Instructions booklet displays tax

tables with the income tax previously calculated for the applicable income level (up to

$100,000) and the filing status. Locate a copy of the tax tables on the Internet with the search

keywords "2009 1040 tax tables" or from the Forms and Publications link found at the

website www.irs.gov. Using $100,000 as a taxable income, find the income tax for a couple

(married and filing jointly) in the published tax tables. Record your results.

a. Total Income Tax (based on 2009 IRS Tax Tables) = $

b. Now, calculate the income tax on the very same $100,000 taxable income using the

computations described in unit 4-E. Use the framework below to aid in your calculations:

Tax Computation

Tax Rate

10%

15%

25%

Married Filing Jointly

up to 16,700

up to 67,900

up to 137,050

Total Income Tax:

c. Should your answers for Parts (a) and (b) match exactly? Explain why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning