Required: 1. What is the monthly break-even point in unit sales. 2. What is the total contribution margin at the break-even point? 3. How many units would have to be sold each month to attain a target profit of $56,400? 4. Refer to the original data. Compute the company's margin of safety in dollar terms. 5. If sales increase by $90,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?

Required: 1. What is the monthly break-even point in unit sales. 2. What is the total contribution margin at the break-even point? 3. How many units would have to be sold each month to attain a target profit of $56,400? 4. Refer to the original data. Compute the company's margin of safety in dollar terms. 5. If sales increase by $90,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

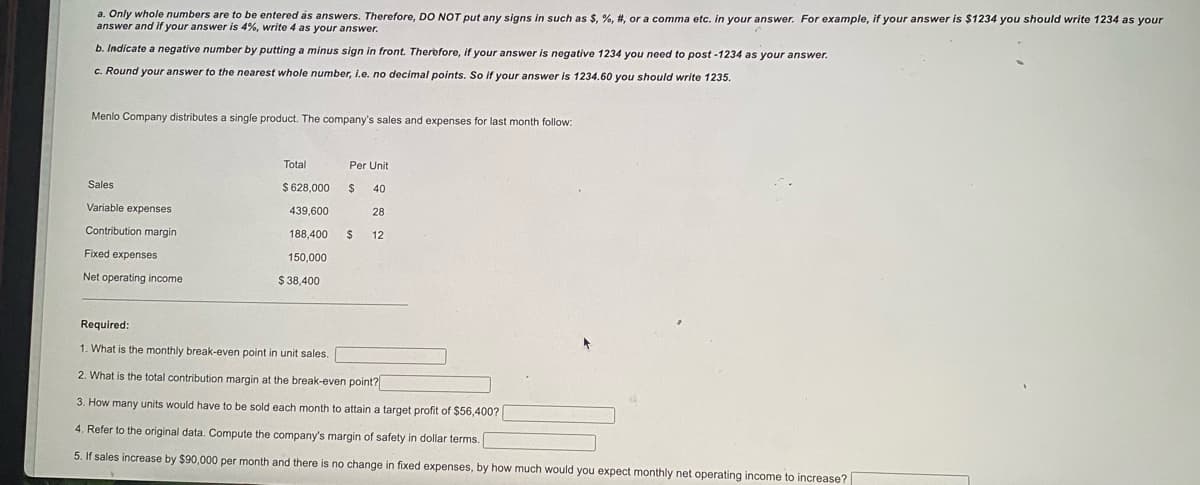

Transcribed Image Text:a. Only whole numbers are to be entered as answers. Therefore, DO NOT put any signs in such as $, %, #, or a comma etc. in your answer. For example, if your answer is $1234 you should write 1234 as your

answer and if your answer is 4%, write 4 as your answer.

b. Indicate a negative number by putting a minus sign in front. Therbfore, if your answer is negative 1234 you need to post -1234 as your answer.

c. Round your answer to the nearest whole number, I.e. no decimal points. So if your answer is 1234.60 you should write 1235.

Menlo Company distributes a single product. The company's sales and expenses for last month follow:

Total

Per Unit

Sales

$ 628,000

40

Variable expenses

439,600

28

Contribution margin

188,400

%24

12

Fixed expenses

150,000

Net operating income

$ 38,400

Required:

1. What is the monthly break-even point in unit sales.

2. What is the total contribution margin at the break-even point?

3. How many units would have to be sold each month to attain a target profit of $56,400?

4. Refer to the original data. Compute the company's margin of safety in dollar terms.

5. If sales increase by $90,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 5 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education