Required: a-1. Prepare all journal entries for Shandra Corporation related to this transaction and hedge. a-2. What amount should Shandra Corporation report in net income as cost of goods sold for the quarter ending June 30? b. What amount should Shandra Corporation report in net income as foreign exchange gain or loss for the quarter ending June 30?

Required: a-1. Prepare all journal entries for Shandra Corporation related to this transaction and hedge. a-2. What amount should Shandra Corporation report in net income as cost of goods sold for the quarter ending June 30? b. What amount should Shandra Corporation report in net income as foreign exchange gain or loss for the quarter ending June 30?

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 26QA

Related questions

Topic Video

Question

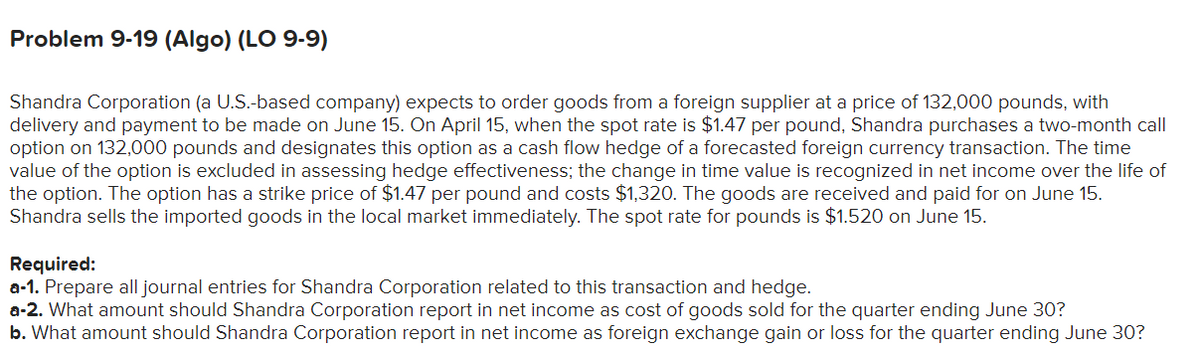

Transcribed Image Text:Problem 9-19 (Algo) (LO 9-9)

Shandra Corporation (a U.S.-based company) expects to order goods from a foreign supplier at a price of 132,000 pounds, with

delivery and payment to be made on June 15. On April 15, when the spot rate is $1.47 per pound, Shandra purchases a two-month call

option on 132,000 pounds and designates this option as a cash flow hedge of a forecasted foreign currency transaction. The time

value of the option is excluded in assessing hedge effectiveness; the change in time value is recognized in net income over the life of

the option. The option has a strike price of $1.47 per pound and costs $1,320. The goods are received and paid for on June 15.

Shandra sells the imported goods in the local market immediately. The spot rate for pounds is $1.520 on June 15.

Required:

a-1. Prepare all journal entries for Shandra Corporation related to this transaction and hedge.

a-2. What amount should Shandra Corporation report in net income as cost of goods sold for the quarter ending June 30?

b. What amount should Shandra Corporation report in net income as foreign exchange gain or loss for the quarter ending June 30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you