Required: a Compile a consolidated statement of profit or loss for P Ltd's group for the year ended 31 December 2020. Please be reminded that in the consolidated statement of profit or loss, you must clearly consider or include: the extra depreciation charge owing to any difference as regards the original costs of assets and their fair values; 'non-controlling interest’ (NCI); and net profit that is only attributable to the group (i.e. after deducting NCI). Note: reserves brought forward of S Ltd is determined to be $53,760 b Explain what goodwill is in the context of HKFRS 3 and if the recognition of goodwill is generally considered a straightforward matter.

Required: a Compile a consolidated statement of profit or loss for P Ltd's group for the year ended 31 December 2020. Please be reminded that in the consolidated statement of profit or loss, you must clearly consider or include: the extra depreciation charge owing to any difference as regards the original costs of assets and their fair values; 'non-controlling interest’ (NCI); and net profit that is only attributable to the group (i.e. after deducting NCI). Note: reserves brought forward of S Ltd is determined to be $53,760 b Explain what goodwill is in the context of HKFRS 3 and if the recognition of goodwill is generally considered a straightforward matter.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

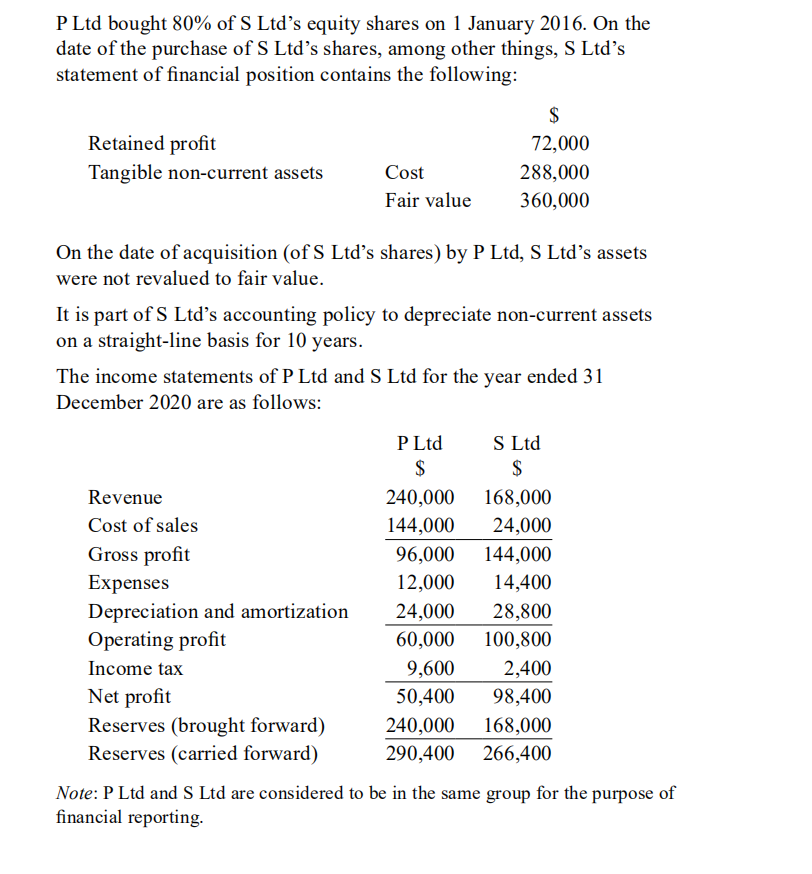

Transcribed Image Text:P Ltd bought 80% of S Ltd’s equity shares on 1 January 2016. On the

date of the purchase of S Ltd's shares, among other things, S Ltd's

statement of financial position contains the following:

$

Retained profit

72,000

Tangible non-current assets

Cost

288,000

Fair value

360,000

On the date of acquisition (of S Ltd's shares) by P Ltd, S Ltd's assets

were not revalued to fair value.

It is part of S Ltd's accounting policy to depreciate non-current assets

on a straight-line basis for 10 years.

The income statements of P Ltd and S Ltd for the year ended 31

December 2020 are as follows:

P Ltd

S Ltd

$

$

Revenue

240,000

168,000

Cost of sales

144,000

24,000

Gross profit

96,000

144,000

Expenses

12,000

14,400

Depreciation and amortization

Operating profit

24,000

28,800

60,000

100,800

9,600

50,400

Income tax

2,400

Net profit

98,400

Reserves (brought forward)

Reserves (carried forward)

240,000

168,000

290,400 266,400

Note: P Ltd and S Ltd are considered to be in the same group for the purpose of

financial reporting.

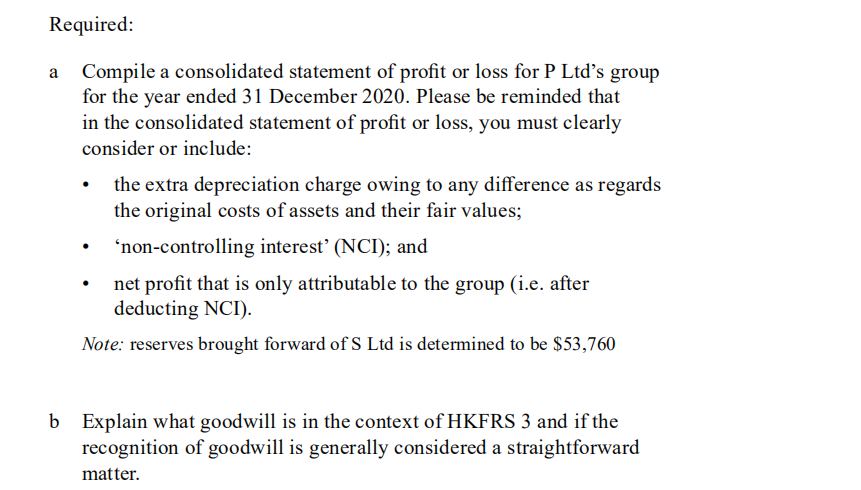

Transcribed Image Text:Required:

Compile a consolidated statement of profit or loss for P Ltd's group

for the year ended 31 December 2020. Please be reminded that

in the consolidated statement of profit or loss, you must clearly

consider or include:

the extra depreciation charge owing to any difference as regards

the original costs of assets and their fair values;

'non-controlling interest’ (NCI); and

net profit that is only attributable to the group (i.e. after

deducting NCI).

Note: reserves brought forward of S Ltd is determined to be $53,760

b Explain what goodwill is in the context of HKFRS 3 and if the

recognition of goodwill is generally considered a straightforward

matter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning