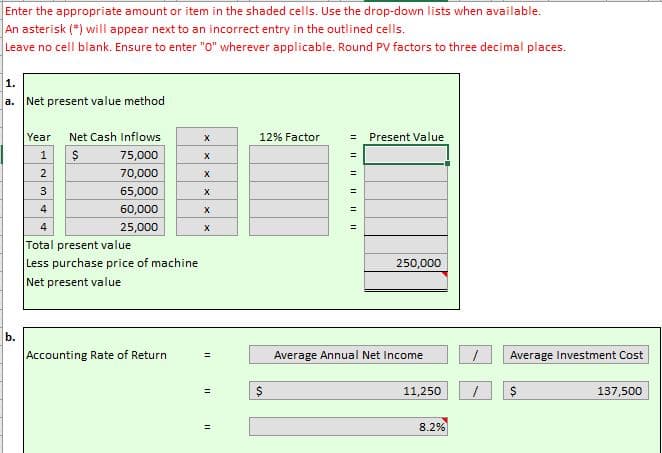

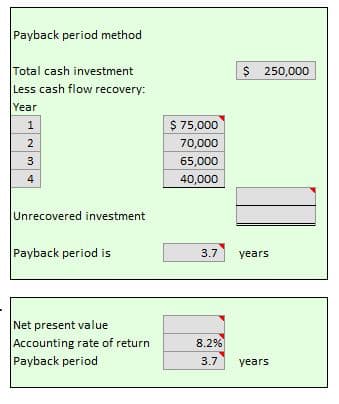

REQUIRED Analyze the data about the machine. Use the following evaluation approaches in your analysis: The net present value method (Round to the nearest dollar.) The accounting rate-of-return method. (Round percentage to one decimal place.) The payback period method (Round to one decimal place.) [Hint: Use Tables 1 and 2 in Appendix C.] ACCOUNTING CONNECTION> Summarize the information generated in requirement 1, and make a recommendation.

Edge Company’s production vice president believes keeping up-to-date with technological changes is what makes the company successful and feels that a machine introduced recently would fill an important need. The machine has an estimated useful life of four years, a purchase price of $250,000, and a residual value of $25,000. The company controller has estimated average annual net income of $11,250 and the following cash flows for the new machine:

Cash Flow Estimates

|

Year |

|

|

Net Cash Inflows |

|

1 |

$325,000 |

$250,000 |

$75,000 |

|

2 |

320,000 |

250,000 |

70,000 |

|

3 |

315,000 |

250,000 |

65,000 |

|

4 |

310,000 |

250,000 |

60,000 |

The company uses a 12 percent minimum

REQUIRED

- Analyze the data about the machine. Use the following evaluation approaches in your analysis:

- The

net present value method (Round to the nearest dollar.) - The accounting rate-of-return method. (Round percentage to one decimal place.)

- The payback period method (Round to one decimal place.) [Hint: Use Tables 1 and 2 in Appendix C.]

- The

- ACCOUNTING CONNECTION> Summarize the information generated in requirement 1, and make a recommendation.

Step by step

Solved in 5 steps with 4 images