Elegant Home Company operates a number of home improvement stores in a metropolitan area. Elegant Home's management estimates that if it invests $300,000 in a new computer system, it can save $69,000 in annual cash operating costs. The system has an expected useful life of 8 years and no terminal disposal value. The required rate of return is 10%. Ignore income tax issues and assume all cash flows occur at year-end except for initial investment amounts. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Euture Valve oFAnnuivo Eabr Read the requirements Reference a. Calculate the net present value for the new computer system. (Abbreviations used: FV = future value; PV = present value. Use factor amounts rounded to three decimal places. Round your answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) First, select the formula labels, then enter the amounts and calculate the net present value. Net present value b. Calculate the internal rate of return (IRR) for the computer system (using the interpolation method). To calculate the IRR, begin by selecting the formula labels, then enter amounts and calculate the discount factor for the computer system. (Round the discount factor to three decimal places, XXXX.) Discount factor

Elegant Home Company operates a number of home improvement stores in a metropolitan area. Elegant Home's management estimates that if it invests $300,000 in a new computer system, it can save $69,000 in annual cash operating costs. The system has an expected useful life of 8 years and no terminal disposal value. The required rate of return is 10%. Ignore income tax issues and assume all cash flows occur at year-end except for initial investment amounts. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Euture Valve oFAnnuivo Eabr Read the requirements Reference a. Calculate the net present value for the new computer system. (Abbreviations used: FV = future value; PV = present value. Use factor amounts rounded to three decimal places. Round your answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) First, select the formula labels, then enter the amounts and calculate the net present value. Net present value b. Calculate the internal rate of return (IRR) for the computer system (using the interpolation method). To calculate the IRR, begin by selecting the formula labels, then enter amounts and calculate the discount factor for the computer system. (Round the discount factor to three decimal places, XXXX.) Discount factor

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 2CE

Related questions

Question

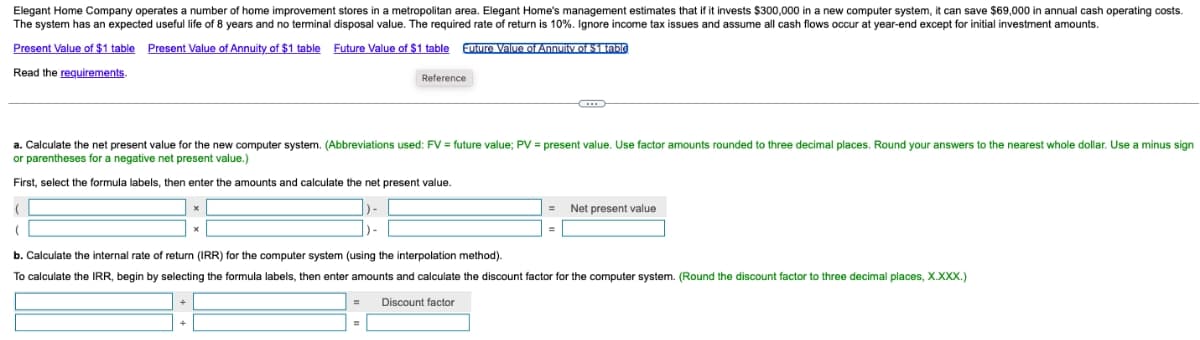

Transcribed Image Text:Elegant Home Company operates a number of home improvement stores in a metropolitan area. Elegant Home's management estimates that if it invests $300,000 in a new computer system, it can save $69,000 in annual cash operating costs.

The system has an expected useful life of 8 years and no terminal disposal value. The required rate of return is 10%. Ignore income tax issues and assume all cash flows occur at year-end except for initial investment amounts.

Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table

Euture Value oT Annuity of $1 tabt

Read the requirements.

Reference

a. Calculate the net present value for the new computer system. (Abbreviations used: FV = future value; P = present value. Use factor amounts rounded to three decimal places. Round your answers to the nearest whole dollar. Use a minus sign

or parentheses for a negative net present value.)

First, select the formula labels, then enter the amounts and calculate the net present value.

Net present value

b. Calculate the internal rate of return (IRR) for the computer system (using the interpolation method).

To calculate the IRR, begin by selecting the formula labels, then enter amounts and calculate the discount factor for the computer system. (Round the discount factor to three decimal places, X.XXX.)

Discount factor

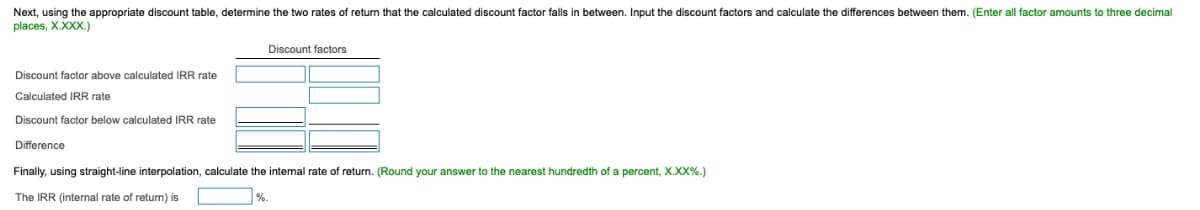

Transcribed Image Text:Next, using the appropriate discount table, determine the two rates of return that the calculated discount factor falls in between. Input the discount factors and calculate the differences between them. (Enter all factor amounts to three decimal

places, X.XXX.)

Discount factors

Discount factor above calculated IRR rate

Calculated IRR rate

Discount factor below calculated IRR rate

Difference

Finally, using straight-line interpolation, calculate the internal rate of return. (Round your answer to the nearest hundredth of a percent, X.XX%.)

The IRR (internal rate of return) is

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning