Required antitative Problem 2: Mitchell Manufacturing Company has $1,600,000,000 in sales and $370,000,000 in fixed assets. Currently, the company's fixed assets are operating 75% of capacity. a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. b.What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. C. If Mitchell's saies increase by 45%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar.

Required antitative Problem 2: Mitchell Manufacturing Company has $1,600,000,000 in sales and $370,000,000 in fixed assets. Currently, the company's fixed assets are operating 75% of capacity. a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. b.What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. C. If Mitchell's saies increase by 45%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar.

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 3PA: The income statement comparison for Forklift Material Handling shows the income statement for the...

Related questions

Question

4

Transcribed Image Text:Finally, management would use the target fixed

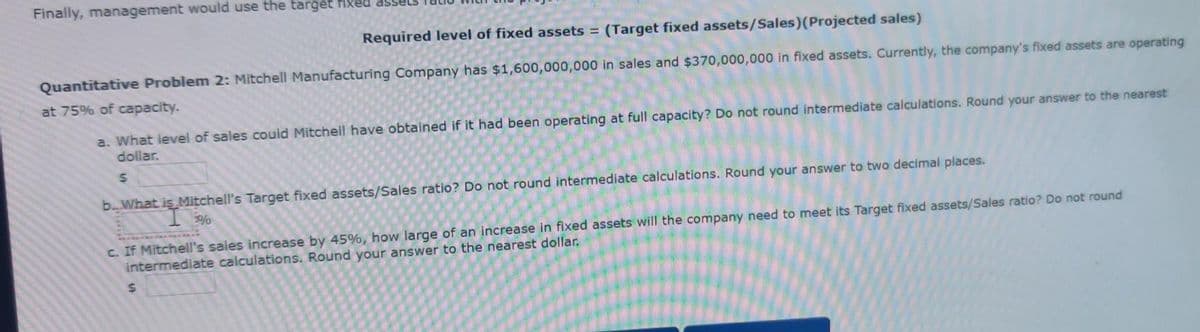

Required level of fixed assets = (Target fixed assets/Sales)(Projected sales)

Quantitative Problem 2: Mitchell Manufacturing Company has $1,600,000,000 in sales and $370,000,000 in fixed assets. Currently, the company's fixed assets are operating

at 75% of capacity.

a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest

dollar.

b.What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places.

c. If Mitchell's sales increase by 45%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round

intermediate calculations. Round your answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub