Required: Determine the tax effect of the transactions that took place during 2020 and 2021 on Mr. B's Net Income For Tax Purposes (NIFTP) and Taxable Income. Show full calculation in your Excel. Round your answers to the nearest dollar amount.

Required: Determine the tax effect of the transactions that took place during 2020 and 2021 on Mr. B's Net Income For Tax Purposes (NIFTP) and Taxable Income. Show full calculation in your Excel. Round your answers to the nearest dollar amount.

Chapter19: Deferred Compensation

Section: Chapter Questions

Problem 52P

Related questions

Question

5

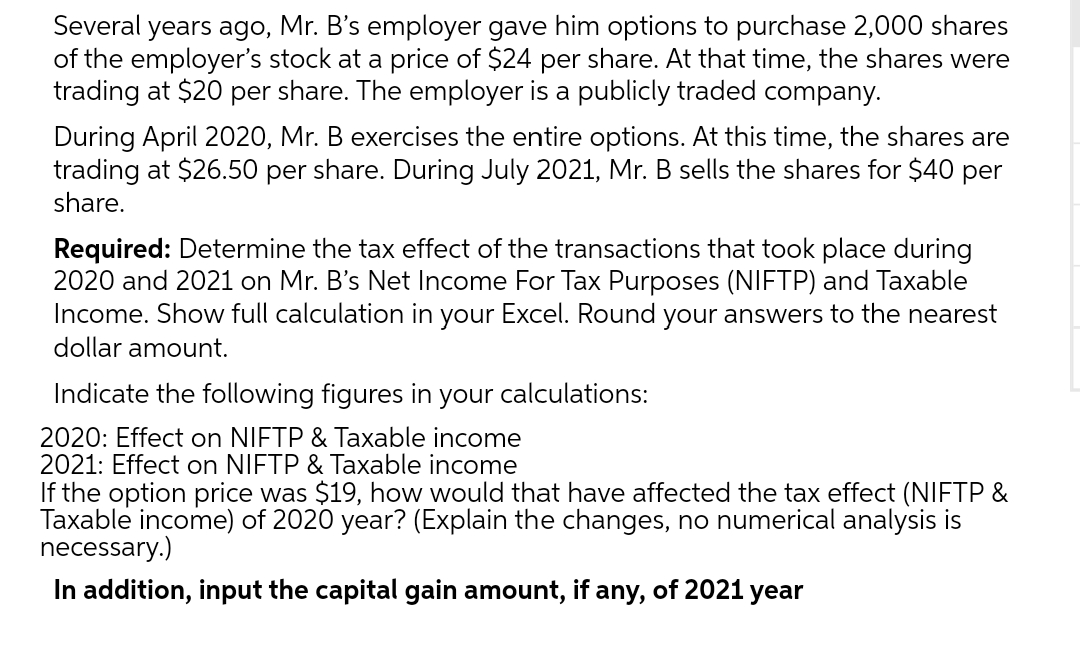

Transcribed Image Text:Several years ago, Mr. B's employer gave him options to purchase 2,000 shares

of the employer's stock at a price of $24 per share. At that time, the shares were

trading at $20 per share. The employer is a publicly traded company.

During April 2020, Mr. B exercises the entire options. At this time, the shares are

trading at $26.50 per share. During July 2021, Mr. B sells the shares for $40 per

share.

Required: Determine the tax effect of the transactions that took place during

2020 and 2021 on Mr. B's Net Income For Tax Purposes (NIFTP) and Taxable

Income. Show full calculation in your Excel. Round your answers to the nearest

dollar amount.

Indicate the following figures in your calculations:

2020: Effect on NIFTP & Taxable income

2021: Effect on NIFTP & Taxable income

If the option price was $19, how would that have affected the tax effect (NIFTP &

Taxable income) of 2020 year? (Explain the changes, no numerical analysis is

necessary.)

In addition, input the capital gain amount, if any, of 2021 year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT