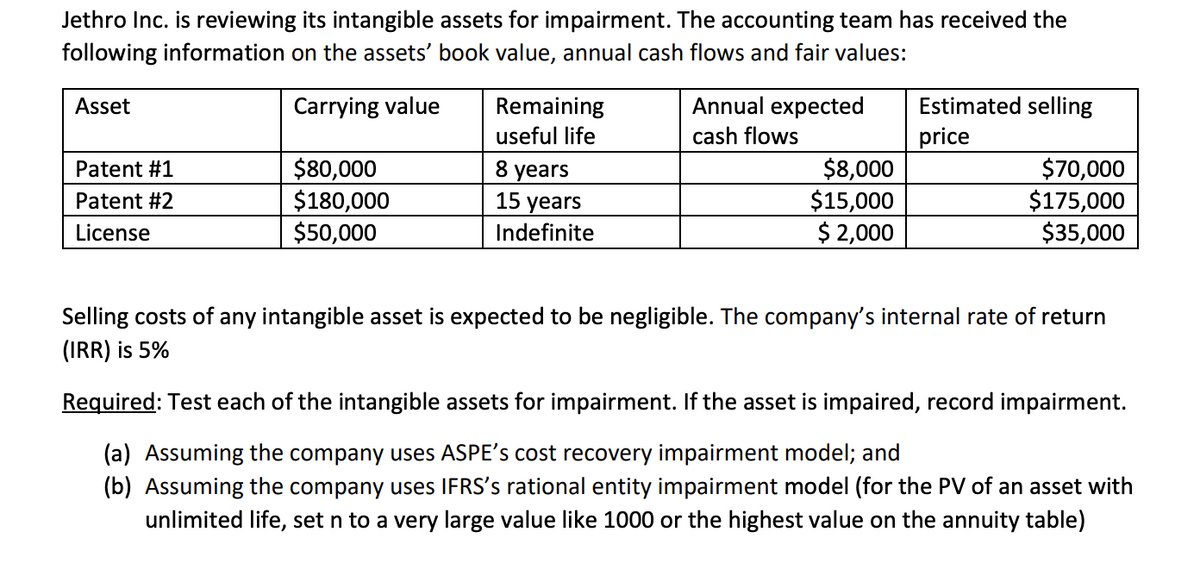

Jethro Inc. is reviewing its intangible assets for impairment. The accounting team has received the following information on the assets' book value, annual cash flows and fair values: Asset Carrying value Remaining Annual expected Estimated selling useful life cash flows price Patent #1 $80,000 $8,000 $70,000 Patent #2 $180,000 8 years 15 years Indefinite $15,000 $175,000 License $50,000 $ 2,000 $35,000 Selling costs of any intangible asset is expected to be negligible. The company's internal rate of return (IRR) is 5% Required: Test each of the intangible assets for impairment. If the asset is impaired, record impairment. (a) Assuming the company uses ASPE's cost recovery impairment model; and (b) Assuming the company uses IFRS's rational entity impairment model (for the PV of an asset with unlimited life, set n to a very large value like 1000 or the highest value on the annuity table)

Jethro Inc. is reviewing its intangible assets for impairment. The accounting team has received the following information on the assets' book value, annual cash flows and fair values: Asset Carrying value Remaining Annual expected Estimated selling useful life cash flows price Patent #1 $80,000 $8,000 $70,000 Patent #2 $180,000 8 years 15 years Indefinite $15,000 $175,000 License $50,000 $ 2,000 $35,000 Selling costs of any intangible asset is expected to be negligible. The company's internal rate of return (IRR) is 5% Required: Test each of the intangible assets for impairment. If the asset is impaired, record impairment. (a) Assuming the company uses ASPE's cost recovery impairment model; and (b) Assuming the company uses IFRS's rational entity impairment model (for the PV of an asset with unlimited life, set n to a very large value like 1000 or the highest value on the annuity table)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 29P

Related questions

Question

Transcribed Image Text:Jethro Inc. is reviewing its intangible assets for impairment. The accounting team has received the

following information on the assets' book value, annual cash flows and fair values:

Asset

Carrying value

Estimated selling

Remaining

useful life

Annual expected

cash flows

price

Patent #1

$80,000

$8,000

$70,000

8 years

15 years

Patent #2

$180,000

$15,000

$175,000

License

$50,000

Indefinite

$ 2,000

$35,000

Selling costs of any intangible asset is expected to be negligible. The company's internal rate of return

(IRR) is 5%

Required: Test each of the intangible assets for impairment. If the asset is impaired, record impairment.

(a) Assuming the company uses ASPE's cost recovery impairment model; and

(b) Assuming the company uses IFRS's rational entity impairment model (for the PV of an asset with

unlimited life, set n to a very large value like 1000 or the highest value on the annuity table)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning