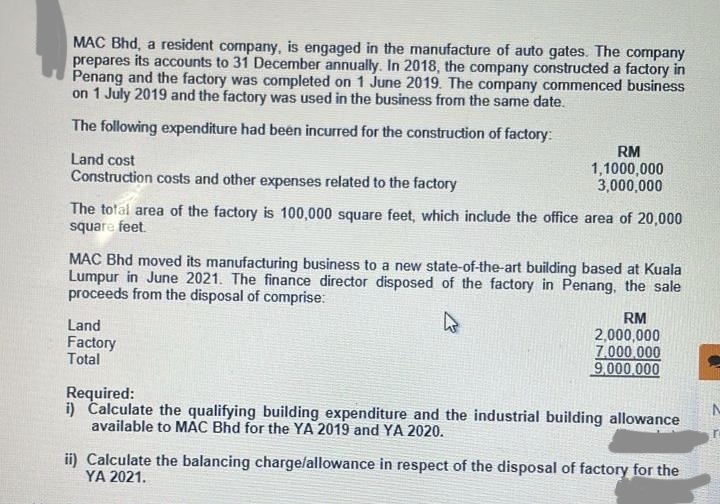

Required: i) Čalculate the qualifying building expenditure and the industrial building allowance available to MAC Bhd for the YA 2019 and YA 2020. ii) Calculate the balancing charge/allowance in respect of the disposal of factory for the YA 2021.

Q: A credit sale of $4,000 is made on April 25, terms 2/10, n/30, on which a return of $250 is granted…

A: Formula used: Net sales = Sales - Sales returns. Deduction of sales returns from sales value derives…

Q: Cash paid in June for a credit purchase made in May will: A.decrease cash and increase accounts…

A: The question is based on the concept of Financial Accounting.

Q: Example 5-10 The following unemployment tax rate schedule is in effect for the calendar year 2020…

A: Reserve ratio is the ratio of contribution to the average annual payroll.

Q: A tool is purehased for $500,000. The expected life is 25 years. The salvage value is $100,000. what…

A: Depreciation represents the reduction in the value of the asset over a useful life of the asset. It…

Q: Consider the following information pertaining to OldWest's inventory: Net Realizable Value Quantity…

A: Formula: Inventory value = Quantity x Cost or NRV which ever is lower

Q: The auditor should test for unrecorded retirements of properties by _______________. This procedure…

A: The question is related to Auditing and it is of verification of properties.

Q: 3. Assume that sales increase by P400,000 next year If cost behavis patterns remain unchanged, by…

A: Solution:- 2)Computation of Break-even point in units and sales as follows under:-

Q: Gelbart Company manufactures gas grills. Fixed costs amount to $16,335,000 per year. Variablecosts…

A: The break-even point seems to be the output level where the total revenues equals total costs. In…

Q: 1. Straight line. 2.Double-Declining Method 3. Units of production using miles driven as a measure…

A: Miles driven per annum is not given in the question. So, depreciation per mile is calculated only .

Q: On January 1, 2022, Tatay, Co. and Walanay, Inc. combined. As of this date, the book values of the…

A: The excess of the purchase amount paid for an acquired firm above the amount of the price not…

Q: movie production studio incurred the following costs related to its current movie: Purchased office…

A: In case of credit purchases the accounts payable will be credited.

Q: Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic…

A: Cost of goods of sold in simple terms is the amount or price at which the seller sells the goods or…

Q: Q L. From the following Trial Balance prepare Trading and Profit and Loss Account for the year ended…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: QUESTION I Sam Bhd. is registered with an authorised capital of 600,000 ordinary sha following trial…

A: A profit and loss statement is a financial statement that shows the revenues, expenditures, and…

Q: Question one Discuss the strengths and weakness of the Newer Innovative health financing mechanisms…

A: the healthcare movement has brought about positive changes in the society which has erase in…

Q: For each item that follows, indicate whether a debit or acredit applies A. increase in prepaid…

A: Introduction: Each and every business effects two aspects one is giving and taking aspect. 1 ) debit…

Q: a. Prepare a cash budget for September, October, November, and December. Enter all amounts as…

A: Introduction:- A cash budget shows estimation of cash inflows and outflows over a specific period of…

Q: Which of the following is NOT true about managing nonprofit corporations? Multiple Choice They are…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Imagine you are the project manager at an investment firm and given the task of preparing a report…

A: Note: Hi! Thank you for the question, As per the honor code, we are allowed to answer three…

Q: Carla Corporation traded a used truck (cost $21,200, accumulated depreciation $19,080) for a small…

A: A journal entry is used to document a business arrangement in a company's accounting records. A…

Q: C18R G19R Direct materials per unit $10.20 $50.50 Direct labour per unit $8.40 $25.20 Direct…

A: Disclaimer : As Per above mention We have to solve only part d ,e, f Activity-based costing…

Q: What are the components of Audit Risk? Use the Audit risk equation and briefly explain the…

A: Audit risk means the risk that the auditor gives an inappropriate audit opinion when the financial…

Q: Compute the income tax payable, if any. Relevant information: YOU are the Accountant of Pa-Mine…

A: VAT in Phillipines for 2015 was 12%. Corporate tax 30%…

Q: Home ownership has other expenses, including taxes, homeowner's insurance and utilities. The annual…

A: Amount borrowed = $145,000 a) Annual property tax = 1% of amount borrowed = $145,000×1%=$1,450…

Q: Closing Entries (Net Income) Use the following partial listing of T accounts to complete this…

A: The closing entries are prepared at year end to close the temporary accounts of the business at year…

Q: PROBLEM 2 - 15 A and B Partnership's statement of financial position as of December 31, 2020…

A: Partnership means the form of business where two or more than two person do the business jointly and…

Q: Under the Acquisition Method, regardless of the purchase price, identifiable net assets of the…

A:

Q: Betram Chemicals Company processes a number of chemical compounds used in producing industrial…

A: Sales- Sales are a word used to explain the activities that guide to the selling of goods or…

Q: Prepare journal entries to record the following transactions. A. November 19, purchased merchandise…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The following information were taken from the statement of realization and liquidation of ABC…

A: Introduction: The balance sheet serves as the foundation for determining investor rates of return…

Q: Big Cup Berhad engages in the manufacturing business. The financial year end is 30 April annually.…

A: Here discuss about the details of the applicability of MFRS 9 in the expected credit losses (ECL)…

Q: egarding the confirmation of accounts payable is true? Group of answer choices The confirmation of…

A: it is important to understand the client account payable and account receivable valences in order to…

Q: Prepare Trial Balance Cash Accounts Receivable Capital Withdrawals Service Fees Rent Expense $1,200…

A: Trial balance consists of list of all general ledger accounts.The total debits of trial balance…

Q: Entries for Isuing Par Stock On October 31, Pidgeon Stones Inc., a marble contractor, issued for…

A: Amount received for issue of shares in excess of par value will be credited to paid in capital…

Q: Cash 56500 Receivables short term 25800 Invertory Payables short term Payables long term salaries…

A: The working capital is calculated as difference between current assets and current liabilities.

Q: Determine whether the balance in each of the following accounts increases with a debit or a credit.…

A: Introduction: Accounts: Accounts are of 2 types: 1 ) Debit Account - Recording debit side called…

Q: I need the answer as soon as possible

A: Cash Budget: Cash budget is statement, which shows the cash inflows and outflows for the specific…

Q: 12. The units of Product PKO available for sale during the year were as follows: Apr 1 Apr 16 Apr 20…

A: Under FIFO method, it is assumed that units purchased first will be sold first. Total units sold= 60…

Q: In October, the cost of materials transferred into the Rolling Department from the Casting…

A: Journal entry is the act of keeping records of the financial transactions in an accounting journal.…

Q: You are a mortgage broker at Interamerican Bank. One of your clients, Bill Cramer, has submitted an…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: It is hypothesized that, of the students completing their degree in physical therapy in the state of…

A: Answer: It is estimated that 35 percent of students who complete their physical therapy degree in…

Q: Sam Bhd. is registered with an authorised capital of 600,000 ordinary shares of RMI. The following…

A: Preparation of Balance sheet and Profit & Loss A/c

Q: You are working as a practice pharmacist and have been asked to help the practice reduce expenditure…

A: In the context of the given question, we need to determine the total saving for the practice per 84…

Q: 10 Slosh Cleaning Corporation services both residential and commercial customers. Slosh expects the…

A:

Q: Larry Mattingly turned 20 years old today His grandfather had establshed a trust fund that will pay…

A: Present value or PV is the discounted worth of a future cash flow taking into consideration the time…

Q: Problem 14-20A (Static) Preparing a cash budget LO 14-5 Fayette Medical Clinic has budgeted the…

A: The cash budget is prepared to record cash receipts and cash payments during the period and further…

Q: Which of the following is not an example of control procedures to safeguard cash received from…

A: Cash is one of the important current asset of the business. It's management and valuation is very…

Q: main reason that U.S. currency cannot be turned in to the government in exchange for a tangible…

A: The answer is stated below:

Q: Exercise 6.17 FIFO Method, Valuation of Goods Transferred Out and Ending Work in Process K-Briggs…

A: Process costing is employed by the firms which are involved in the production of goods which require…

Q: Appraised Value Percentage of Percentage Appraised Value (in $) First Mortgage Lender's Balance of…

A: Formula used: Potential credit = Percentage of Appraised value - Balance of first mortgage

Please help me to solve this problem

Step by step

Solved in 2 steps with 2 images

- The trial balance of LBC Limited, a manufacturing firm for the year ended 31" December, 2019 is shown below: Debit GHe Credit GHe Inventories (1" January, 2019): Raw materials Work-in-progress Finished goods Fuel and light Administration salaries Rent and business rates Purchases of raw materials Sales Carriage outwards Royalties Direct wages Returns inward General office expenses Repairs to plant and machinery Trade Receivables and Payables Capital account Frechold premises Plant and machinery Accumulated depreciation on plant and machinery 21,000 14.000 23.000 21,000 17.000 21,000 258,000 482,000 4.000 20.000 39.000 7.000 9.000 9.000 20,000 37.000 457.000 410,000 80,000 8.000 Cash 11,000 984,000 984,000 You are given the following additional information: Inventories in hand at 31" December, 2019: Raw materials GH&25,000 Work in progress GH&11,000 Finished goods GH&26,000 11) Depreciation of 10% on plant and machinery using the straight line method. 80% of fuel and light…A company in the manufacturing sector prepares its account to 31.12 annually. In July 2019, the company completed the construction of its own factory as follows: Land - RM580,000 Legal fees for an agreement to purchase land - RM11,000 Legal fees for an agreement with the building contractor - RM10,000 Consultant's fees and building plan - RM80,000 Stamp duty for the purchase of land - RM9,000 Construction cost - RM1,510,000 Required: Calculate the qualifying building expenditure. Select one: A. RM2,200,000 B. RM1,620,000 C. RM1,590,000 D. RM1,600,000The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company. Advertising expense $ 28,750 Depreciation expense—Office equipment . 7,250 Depreciation expense—Selling equipment 8,600 Depreciation expense—Factory equipment . 33,550 Factory supervision 102,600 Factory supplies used (indirect materials) 7,350 Factory utilities . 33,000 Direct labor 675,480 Indirect labor . 56,875 Miscellaneous production costs $ 8,425 Office salaries expense 63,000 Raw materials purchases (direct materials) 925,000 Rent expense—Office space 22,000 Rent expense—Selling space . 26,100 Rent expense—Factory building 76,800 Maintenance expense—Factory equipment 35,400 Sales . 4,462,500 Sales salaries expense . 392,560 Required 1. Classify each cost as either a product or period cost. 2. Classify each product cost as either direct materials, direct labor, or factory overhead. 3. Classify each period cost as either selling expenses or…

- The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company. Advertising expense $ 28,750 Depreciation expense—Office equipment 7,250 Depreciation expense—Selling equipment 8,600 Depreciation expense—Factory equipment 33,550 Factory supervision 102,600 Factory supplies used (indirect materials) 7,350 Factory utilities 33,000 Direct labor 675,480 Indirect labor 56,875 Miscellaneous production costs 8,425 Office salaries expense 63,000 Raw materials purchases (direct) 925,000 Rent expense—Office space 22,000 Rent expense—Selling space 26,100 Rent expense—Factory building 76,800 Maintenance expense—Factory equipment 35,400 Sales 4,462,500 Sales salaries expense 392,560 Required:Classify each of the costs as either a product or period cost. Then, classify each of the product costs as either…A. Jamal Textile Enterprise is a textile manufacturer operating in Selangor. The company was incorporated on 1June 2019 and closes its account annually on 31 December. All machinery purchased was imported from Taiwan and it was delivered on 1January2020, and the business commenced officially on 1February 2020. The following expenditure was incurred: (i) Purchased machinery that cost RM1,000,000 on 1June 2020 and paid deposit RM100,000 on the day of purchase, while the remaining RM900,000 was paid on 1November 2020. (ii) Purchased forklift on hire purchase term on 1January 2020. The total cost of the forklift is RM125,000, and Jamal Textile paid down payment of RM5,000. The total installment payment was RM48,000, excluding an interest amounting RM9,580. (iii) Purchased a new car (Proton X50) on 30December 2020 for the General Manager of the company costing RM120,000 . (iv) Purchased a computer with printer on 1April 2019 for RM5,500. This computer specification however was found to be…Bopha Ltd, a general construction company which is based in Limpopo, has a financial year end of 31 December. Bopha Ltd was in a process of constructing a new plant which was available for use on 1 January 2022. During the 2021 financial year, it withdrew its tractor loader, purchased on 1 January 2018 from normal construction operations, for the period 1 March 2021 to 30 June 2021 and used it in the construction of a new plant. This tractor loader had a carrying amount of 336 000 on 1 January 2021 and is depreciated at a rate 20% on straight line basis. The cost price of the new plant before capitalization is R1 200 000. Calculate the total cost of the new plant as at 31 December 2021. The new plant will be depreciated at 5% per annum on straight line basis when it becomes available for use. 1. R1 196 000 2. R1 140 000 3. R1 256 000 4. R1 200 000 5. R 840 000

- Spitfire Company was incorporated on January 2, 2021, but was unable to begin manufacturing activities until July 1, 2021, because new factory facilities were not completed until that date. The Land and Buildings account reported the following items during 2021. January 31 Land and buildings $160,000 February 28 Cost of removal of building 9,800 May 1 Partial payment of new construction 60,000 May 1 Legal fees paid 3,770 June 1 Second payment on new construction 40,000 June 1 Insurance premium 2,280 June 1 Special tax assessment 4,000 June 30 General expenses 36,300 July 1 Final payment on new construction 30,000 December 31 Asset write-up 0053,800 399,950 December 31 Depreciation—2021 at 1% 0 (4,000) December 31, 2021 Account balance $395,950 The following additional information is to be considered. 1. To acquire land and building, the company paid $80,000…The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Best Bikes. Advertising expense $ 20,250 Depreciation expense—Office equipment . 8,440 Depreciation expense—Selling equipment 10,125 Depreciation expense—Factory equipment 35,400 Factory supervision 121,500 Factory supplies used (indirect materials) . 6,060 Factory utilities 37,500 Direct labor 562,500 Indirect labor . 59,000 Miscellaneous production costs $ 8,440 Office salaries expense . . . . . . . . . . . . . . . . . . . . 70,875 Raw materials purchases (direct materials) . 894,375 Rent expense—Office space 23,625 Rent expense—Selling space 27,000 Rent expense—Factory building 93,500 Maintenance expense—Factory equipment . 30,375 Sales 4,942,625 Sales salaries expense . 295,300 Required 1. Classify each cost as either a product or period cost. 2. Classify each product cost as either direct materials, direct labor, or factory overhead. 3. Classify each period…The following transaction occurred during Dec 31, 2021, for the Microchip Company. On August 1, 2021, collected 120000 in advance on rent from another company that is renting a portion of Microchip's factory. THe $12,000 represents one year's rent and the entire amount was credited to deferred rent revenue.

- Ayala homes is a construction company who uses the percentage of completion method in accounting for its income. The company began constructing a building in the year 2019 for a contract price of P5,000,000. For the year ended 2019, the company billed its clients a total of 30% of the contract price. The books of the company show the following balances: Costs incurred to date 900,000 Construction income to date 300,000 HOW MUCH IS THE COMPANY'S CONTRACT ASSET(LIABILITY) FOR THE YEAR 2019? Show your solution in a good accounting form. Thank you!Guillen, Inc. began work on a $7,000,000 contract in 2020 to construct an office building. Guillen uses the completed-contract method. At December 31, 2020, the balances in certain accounts were Construction in Process $1,715,000, Accounts Receivable $240,000, and Billings on Construction in Process $1,000,000. Indicate how these accounts would be reported in Guillen's December 31, 2020, balance sheet.A company in the manufacturing sector prepares its account to 31.12 annually. In July 2020, the company completed the construction of its own factory as follows: Land-RM580.000 Legal fees for an agreement to purchase land- RM11.000 Legal fees for an agreement with the building contractor - RM10,000 Consultant's fees and building plan RM80,000 Stamp duty for the purchase of land - RM9.000 Construction cost RM1.510,000 Required: Calculate the qualifying building expenditure.