Required information [The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses a perpetual inventory system and is starting to realize all of the work that is created when inventory is involved in a business. The following transactions were selected from among those completed by NGS in August August 2 August 3 August 6 August 10 Sold a bundle of spa services with a merchandise basket. When sold separately, the spa service part of the bundle sells for $432 and the merchandise basket normally sells for $108. Together, the bundle was Isold to Val Amy for cash at a selling price of $480 (total). Val booked a spa treatment for August 10, and she took the basket of goods with her. The goods had cost NGS $90. Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $530 (total); terms n/30. The goods cost NGS $430. Cosmetics R Us returned one of the five items purchased on August 3. The item could still be sold by NGS in the future and credit was given to the customer. Val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on August 2. August 20 Sold two at-home spa kits to Meghan Witzel for $330 cash. The goods cost NGS $106. August 22 Cosmetics R Us paid its remaining account balance in full. 2-a. Calculate the Sales Revenue and Cost of Goods Sold for the transactions listed above (but exclude Service Revenue for spa servirasl

Required information [The following information applies to the questions displayed below.) Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses a perpetual inventory system and is starting to realize all of the work that is created when inventory is involved in a business. The following transactions were selected from among those completed by NGS in August August 2 August 3 August 6 August 10 Sold a bundle of spa services with a merchandise basket. When sold separately, the spa service part of the bundle sells for $432 and the merchandise basket normally sells for $108. Together, the bundle was Isold to Val Amy for cash at a selling price of $480 (total). Val booked a spa treatment for August 10, and she took the basket of goods with her. The goods had cost NGS $90. Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $530 (total); terms n/30. The goods cost NGS $430. Cosmetics R Us returned one of the five items purchased on August 3. The item could still be sold by NGS in the future and credit was given to the customer. Val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on August 2. August 20 Sold two at-home spa kits to Meghan Witzel for $330 cash. The goods cost NGS $106. August 22 Cosmetics R Us paid its remaining account balance in full. 2-a. Calculate the Sales Revenue and Cost of Goods Sold for the transactions listed above (but exclude Service Revenue for spa servirasl

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 2TP: You have decided to open up a small convenience store in your hometown. As part of the initial...

Related questions

Question

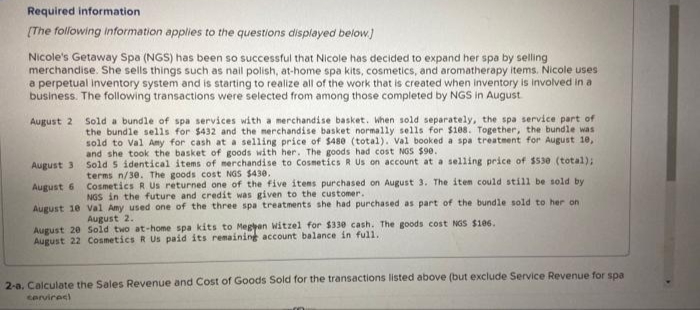

Transcribed Image Text:Required information

(The following information applies to the questions displayed below.)

Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling

merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses

a perpetual inventory system and is starting to realize all of the work that is created when inventory is involved in a

business. The following transactions were selected from among those completed by NGS in August

Sold a bundle of spa services with a merchandise basket. When sold separately, the spa service part of

the bundle sells for $432 and the merchandise basket normally sells for $108. Together, the bundle was

sold to Val Amy for cash at a selling price of $480 (total). Val booked a spa treatment for August 10,

and she took the basket of goods with her. The goods had cost NGS $90.

Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $530 (total);

terms n/30. The goods cost NGS $430.

Cosmetics R Us returned one of the five itens purchased on August 3. The iten could still be sold by

NGS in the future and credit was given to the customer.

August 2

August 3

August 6

August 10 Val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on

August 2.

gust 20 Sold two at-home spa kits to Megyan witzel for $330 cash. The goods cost NGS $106.

August 22 Cosmetics R Us paid its remaining account balance in ful1.

2-a. Calculate the Sales Revenue and Cost of Goods Sold for the transactions listed above (but exclude Service Revenue for spa

cervires)

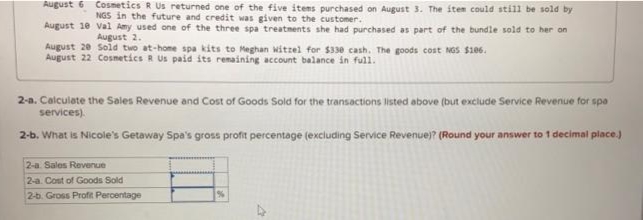

Transcribed Image Text:August 6 Cosmetics R Us returned one of the five items purchased on August 3. The item could still be sold by

NGS in the future and credit was given to the customer.

August 10 val Amy used one of the three spa treatments she had purchased as part of the bundle sold to her on

August 20 Sold two at-home spa kits to Meghan Witzel for $330 cash. The goods cost NGS $106.

August 22 Cosnetics R Us paid its renaining account balance in full.

z asnany

2-a. Calculate the Sales Revenue and Cost of Goods Sold for the transactions listed above (but exclude Service Revenue for spa

services).

2-b. What is Nicole's Getaway Spa's gross profit percentage (excluding Service Revenue)? (Round your answer to 1 decimal place.)

2-a. Sales Revenue

2-a. Cost of Goods Sold

2-b. Gross Profe Percentage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning