Required information [The following information applies to the questions displayed below.] On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $169,900. The interest rate charged by the bank was 8.50%. The bank made the loan on a discount basis. Required: a-1. Calculate the loan proceeds made available to Powell.

Required information [The following information applies to the questions displayed below.] On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $169,900. The interest rate charged by the bank was 8.50%. The bank made the loan on a discount basis. Required: a-1. Calculate the loan proceeds made available to Powell.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter17: Accounting For Notes And Interest

Section: Chapter Questions

Problem 3CE

Related questions

Question

hello, I need help please

![Required information

[The following information applies to the questions displayed below.]

On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed

by the treasurer was $169,900. The interest rate charged by the bank was 8.50%. The bank made the loan on a discount

basis.

Required:

a-1. Calculate the loan proceeds made available to Powell.

Loan proceeds](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F44040561-bc3e-4c0f-83c7-6bff2be49517%2F993760f8-0473-49e1-88cd-c1ad6089707c%2Fs45bz3d_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed

by the treasurer was $169,900. The interest rate charged by the bank was 8.50%. The bank made the loan on a discount

basis.

Required:

a-1. Calculate the loan proceeds made available to Powell.

Loan proceeds

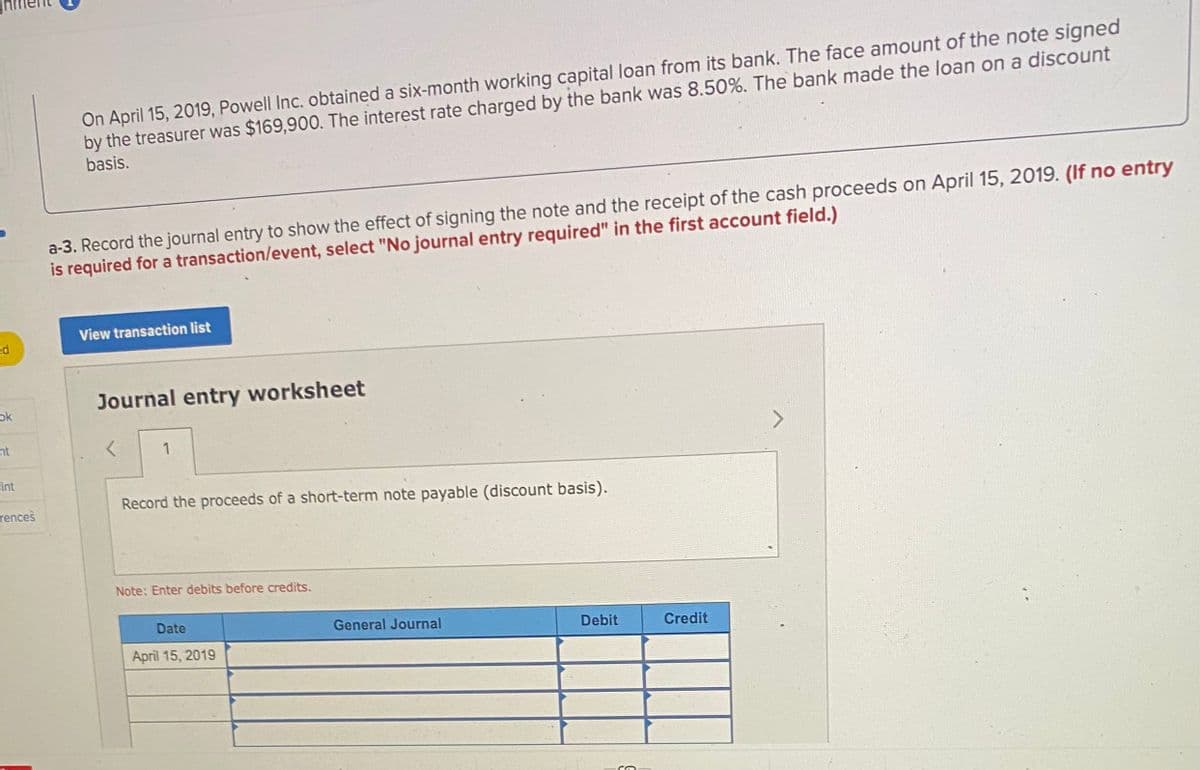

Transcribed Image Text:On April 15, 2019, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed

by the treasurer was $169,900. The interest rate charged by the bank was 8.50%. The bank made the loan on a discount

basis.

a-3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on April 15, 2019. (If no entry

is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

ed

Journal entry worksheet

ok

nt

1

sint

Record the proceeds of a short-term note payable (discount basis).

rences

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

April 15, 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage