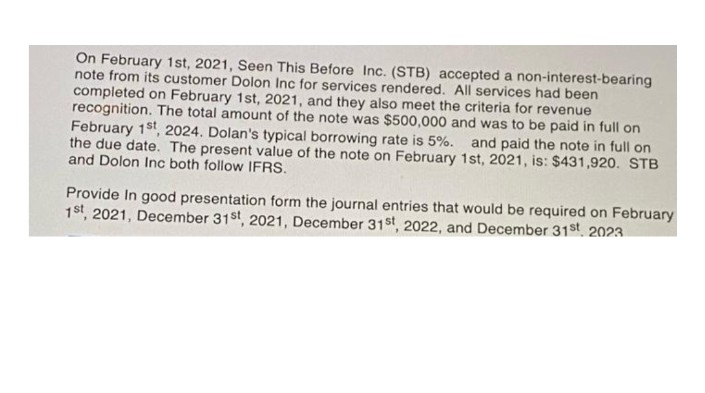

On February 1st, 2021, Seen This Before Inc. (STB) accepted a non-interest-bearing note from its customer Dolon Inc for services rendered. All services had been completed on February 1st, 2021, and they also meet the criteria for revenue recognition. The total amount of the note was $500,000 and was to be paid in full on February 1st, 2024. Dolan's typical borrowing rate is 5%. and paid the note in full on the due date. The present value of the note on February 1st, 2021, is: $431,920. STB and Dolon Inc both follow IFRS.

On February 1st, 2021, Seen This Before Inc. (STB) accepted a non-interest-bearing note from its customer Dolon Inc for services rendered. All services had been completed on February 1st, 2021, and they also meet the criteria for revenue recognition. The total amount of the note was $500,000 and was to be paid in full on February 1st, 2024. Dolan's typical borrowing rate is 5%. and paid the note in full on the due date. The present value of the note on February 1st, 2021, is: $431,920. STB and Dolon Inc both follow IFRS.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 10MC: On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major...

Related questions

Question

Transcribed Image Text:On February 1st, 2021, Seen This Before Inc. (STB) accepted a non-interest-bearing

note from its customer Dolon Inc for services rendered. All services had been

completed on February 1st, 2021, and they also meet the criteria for revenue

recognition. The total amount of the note was $500,000 and was to be paid in full on

February 1st, 2024. Dolan's typical borrowing rate is 5%. and paid the note in full on

the due date. The present value of the note on February 1st, 2021, is: $431,920. STB

and Dolon Inc both follow IFRS.

Provide In good presentation form the journal entries that would be required on February

1st, 2021, December 31st, 2021, December 315t, 2022, and December 31st, 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College