Required information [The following information.applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: Account Cash Accounts receivable Accounts payable Common stock Retained earnings Balance $ 27,500 18,000 13,200 19,100 13,200 The following events apply to Oak Consulting for Year 2: 1. Provided $71,700 of services on account. 2. Incurred $3,400 of operating expenses on account. 3. Collected $46,200 of accounts receivable. 4. Paid $30,100 cash for salaries expense. 5. Paid $14,940 cash as a partial payment on accounts payable. 6. Paid a $9,400 cash dividend to the stockholders.

Required information [The following information.applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: Account Cash Accounts receivable Accounts payable Common stock Retained earnings Balance $ 27,500 18,000 13,200 19,100 13,200 The following events apply to Oak Consulting for Year 2: 1. Provided $71,700 of services on account. 2. Incurred $3,400 of operating expenses on account. 3. Collected $46,200 of accounts receivable. 4. Paid $30,100 cash for salaries expense. 5. Paid $14,940 cash as a partial payment on accounts payable. 6. Paid a $9,400 cash dividend to the stockholders.

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 1PB: Identify whether each of the following accounts would be considered a permanent account (yes/no) and...

Related questions

Question

Answer full question.

![Required information

[The following information .applies to the questions displayed below.]

At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts:

Account

Cash

Accounts receivable

Balance

Accounts payable

Common stock

Retained earnings

$27,500

18,000

13,200

19,100

13,200

The following events apply to Oak Consulting for Year 2:

1. Provided $71,700 of services on account.

2. Incurred $3,400 of operating expenses on account.

3. Collected $46,200 of accounts receivable.

4. Paid $30,100 cash for salaries expense.

5. Paid $14,940 cash as a partial payment on accounts payable.

6. Paid a $9400 cash dividend to the stockholders.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb75e2346-ebf2-4e14-802c-14c74b6109ef%2Fbca63cac-4855-4e08-a353-9627e81780a0%2F0nsq2ch_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information .applies to the questions displayed below.]

At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts:

Account

Cash

Accounts receivable

Balance

Accounts payable

Common stock

Retained earnings

$27,500

18,000

13,200

19,100

13,200

The following events apply to Oak Consulting for Year 2:

1. Provided $71,700 of services on account.

2. Incurred $3,400 of operating expenses on account.

3. Collected $46,200 of accounts receivable.

4. Paid $30,100 cash for salaries expense.

5. Paid $14,940 cash as a partial payment on accounts payable.

6. Paid a $9400 cash dividend to the stockholders.

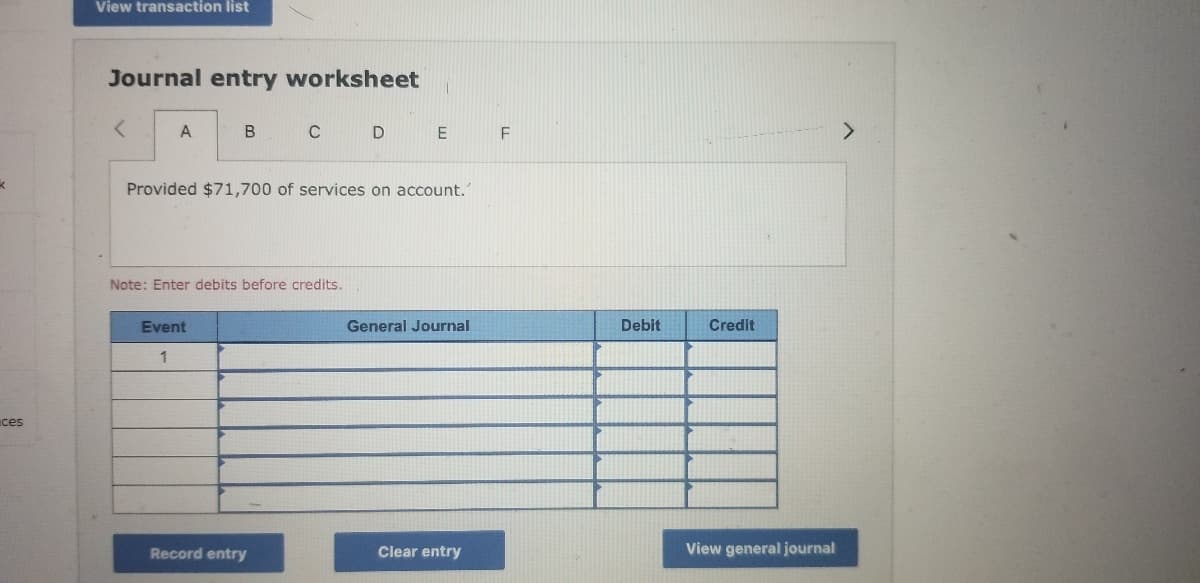

Transcribed Image Text:View transaction list

Journal entry worksheet

A

В

C D

<>

Provided $71,700 of services on account."

Note: Enter debits before credits.

Event

General Journal

Debit

Credit

1

ces

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning