Required: Journal entries to record transactions of 2021 to determine the following 1. Total amount of ordinary shares 12/31/21 2. Total number of shares issued and outstanding as of 12/31/21 3. Treasury shares remaining balance 4. Balance of retained earnings 12/31/21

Required: Journal entries to record transactions of 2021 to determine the following 1. Total amount of ordinary shares 12/31/21 2. Total number of shares issued and outstanding as of 12/31/21 3. Treasury shares remaining balance 4. Balance of retained earnings 12/31/21

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

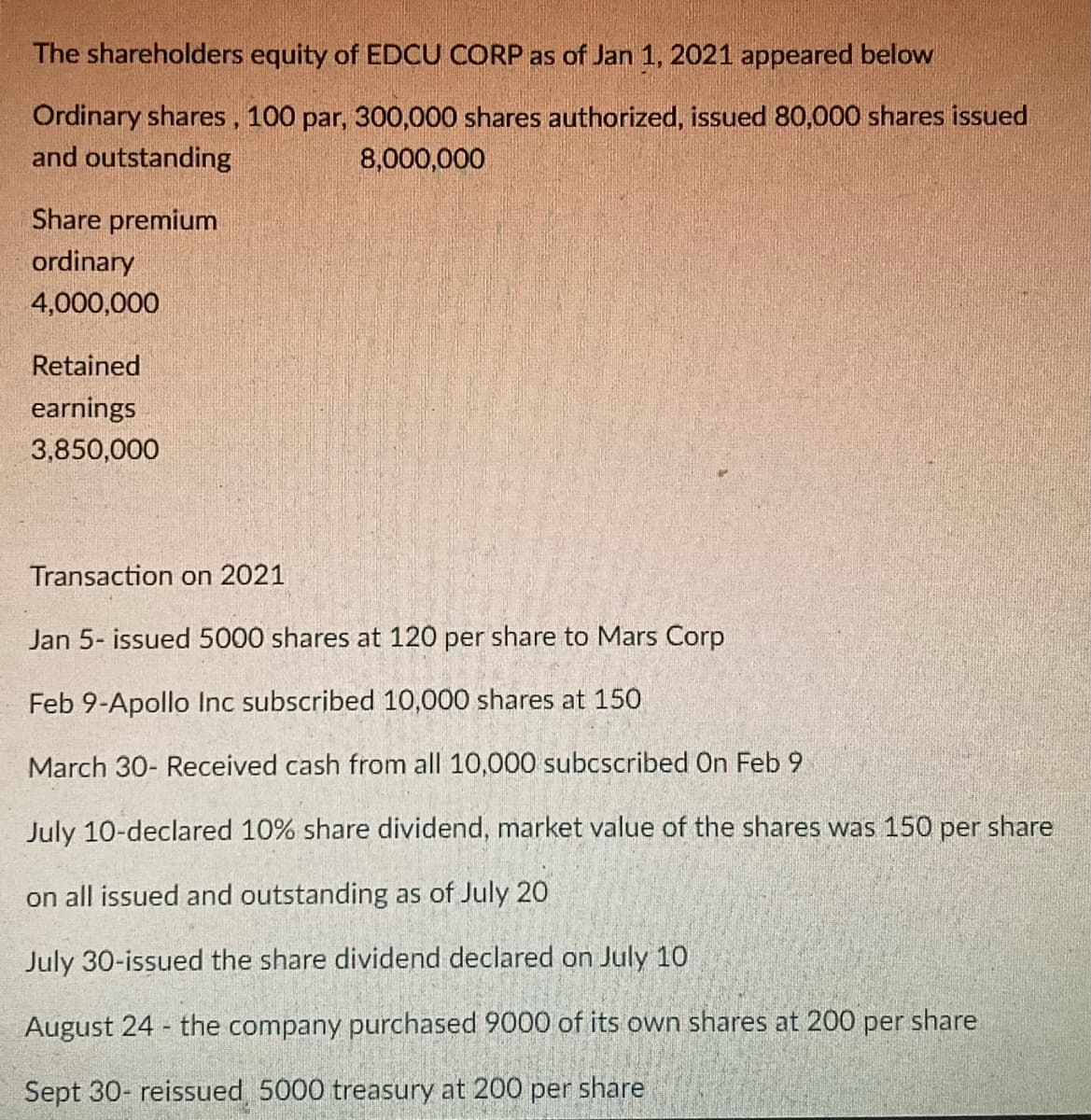

Transcribed Image Text:The shareholders equity of EDCU CORP as of Jan 1, 2021 appeared below

Ordinary shares, 100 par, 300,000 shares authorized, issued 80,000 shares issued

and outstanding

8,000,000

Share premium

ordinary

4,000,000

Retained

earnings

3,850,000

Transaction on 2021

Jan 5- issued 5000 shares at 120 per share to Mars Corp

Feb 9-Apollo Inc subscribed 10,000 shares at 150

March 30- Received cash from all 10,000 subcscribed On Feb 9

July 10-declared 10% share dividend, market value of the shares was 150 per share

on all issued and outstanding as of July 20

July 30-issued the share dividend declared on July 10

August 24 the company purchased 9000 of its own shares at 200 per share

1.

Sept 30- reissued 5000 treasury at 200 per share

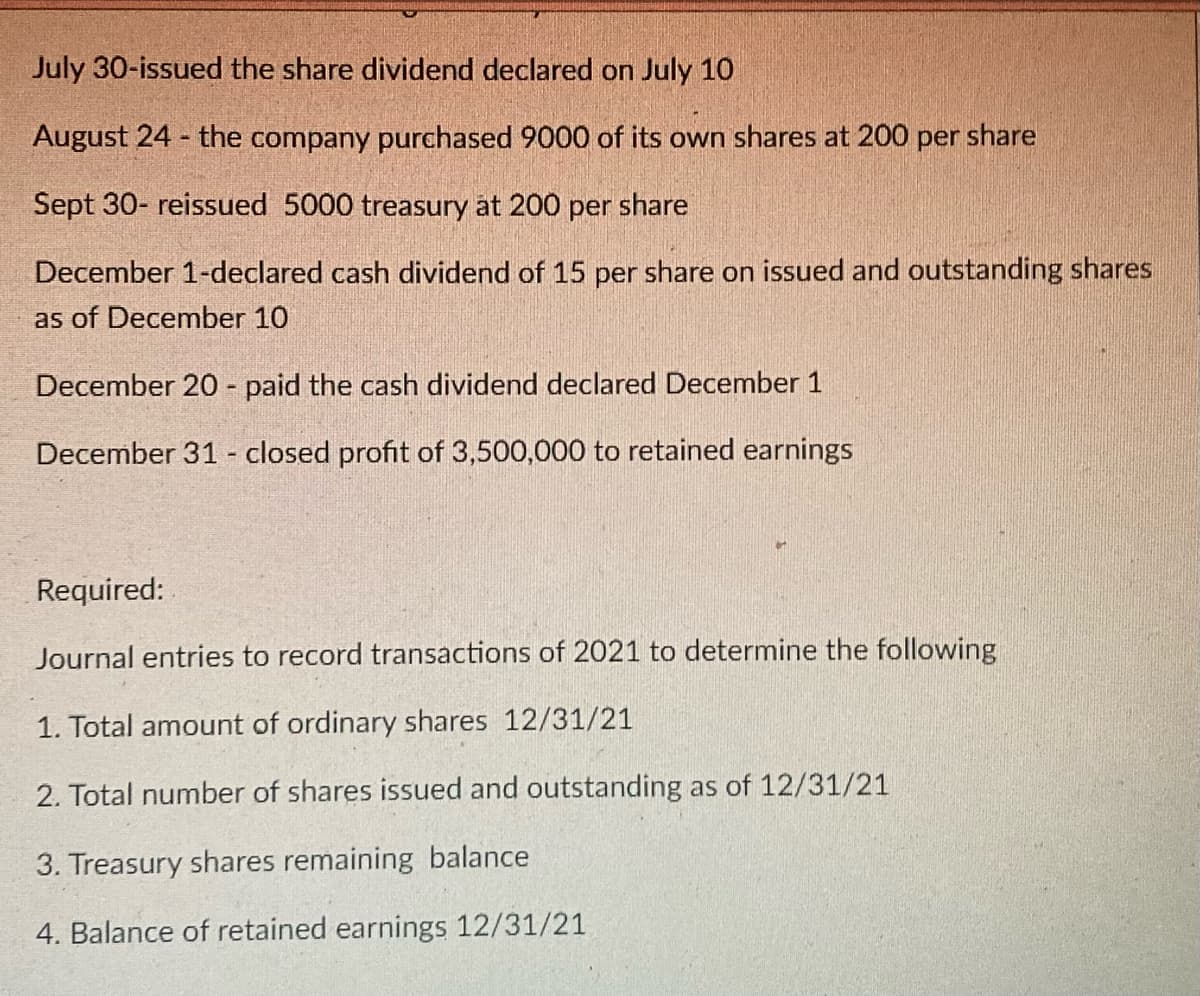

Transcribed Image Text:July 30-issued the share dividend declared on July 10

August 24 - the company purchased 9000 of its own shares at 200 per share

Sept 30- reissued 5000 treasury at 200 per share

December 1-declared cash dividend of 15 per share on issued and outstanding shares

as of December 10

December 20 - paid the cash dividend declared December 1

December 31 - closed profit of 3,500,000 to retained earnings

Required:

Journal entries to record transactions of 2021 to determine the following

1. Total amount of ordinary shares 12/31/21

2. Total number of shares issued and outstanding as of 12/31/21

3. Treasury shares remaining balance

4. Balance of retained earnings 12/31/21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,