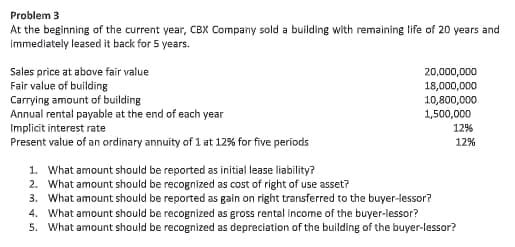

Problem 3 At the beginning of the current year, CBX Company sold a building with remaining life of 20 years and immediately leased it back for 5 years. Sales price at above fair value Fair value of building Carrying amount of building Annual rental payable at the end of each year Implicit interest rate Present value of an ordinary annuity of 1 at 12% for five periods 20,000,000 18,000,000 10,800,000 1,500,000 12% 12% 1. What amount should be reported as initial lease liability? 2. What amount should be recognized as cost of right of use asset? 3. What amount should be reported as gain on right transferred to the buyer-lessor? 4. What amount should be recognized as gross rental income of the buyer-lessor? 5. What amount should be recognized as depreciation of the building of the buyer-lessor?

Problem 3 At the beginning of the current year, CBX Company sold a building with remaining life of 20 years and immediately leased it back for 5 years. Sales price at above fair value Fair value of building Carrying amount of building Annual rental payable at the end of each year Implicit interest rate Present value of an ordinary annuity of 1 at 12% for five periods 20,000,000 18,000,000 10,800,000 1,500,000 12% 12% 1. What amount should be reported as initial lease liability? 2. What amount should be recognized as cost of right of use asset? 3. What amount should be reported as gain on right transferred to the buyer-lessor? 4. What amount should be recognized as gross rental income of the buyer-lessor? 5. What amount should be recognized as depreciation of the building of the buyer-lessor?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:Problem 3

At the beginning of the current year, CBX Company sold a building with remaining life of 20 years and

immediately leased it back for 5 years.

Sales price at above fair value

Fair value of building

Carrying amount of building

Annual rental payable at the end of each year

Implicit interest rate

Present value of an ordinary annuity of 1 at 12% for five periods

20,000,000

18,000,000

10,800,000

1,500,000

12%

12%

1. What amount should be reported as initial lease liability?

2. What amount should be recognized as cost of right of use asset?

3. What amount should be reported as gain on right transferred to the buyer-lessor?

4. What amount should be recognized as gross rental income of the buyer-lessor?

5. What amount should be recognized as depreciation of the building of the buyer-lessor?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning