Required Prepare journal entries using proper accounting methods for all transactions including the year end accrual of the- bonds' interest.

Required Prepare journal entries using proper accounting methods for all transactions including the year end accrual of the- bonds' interest.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1E

Related questions

Question

Q8

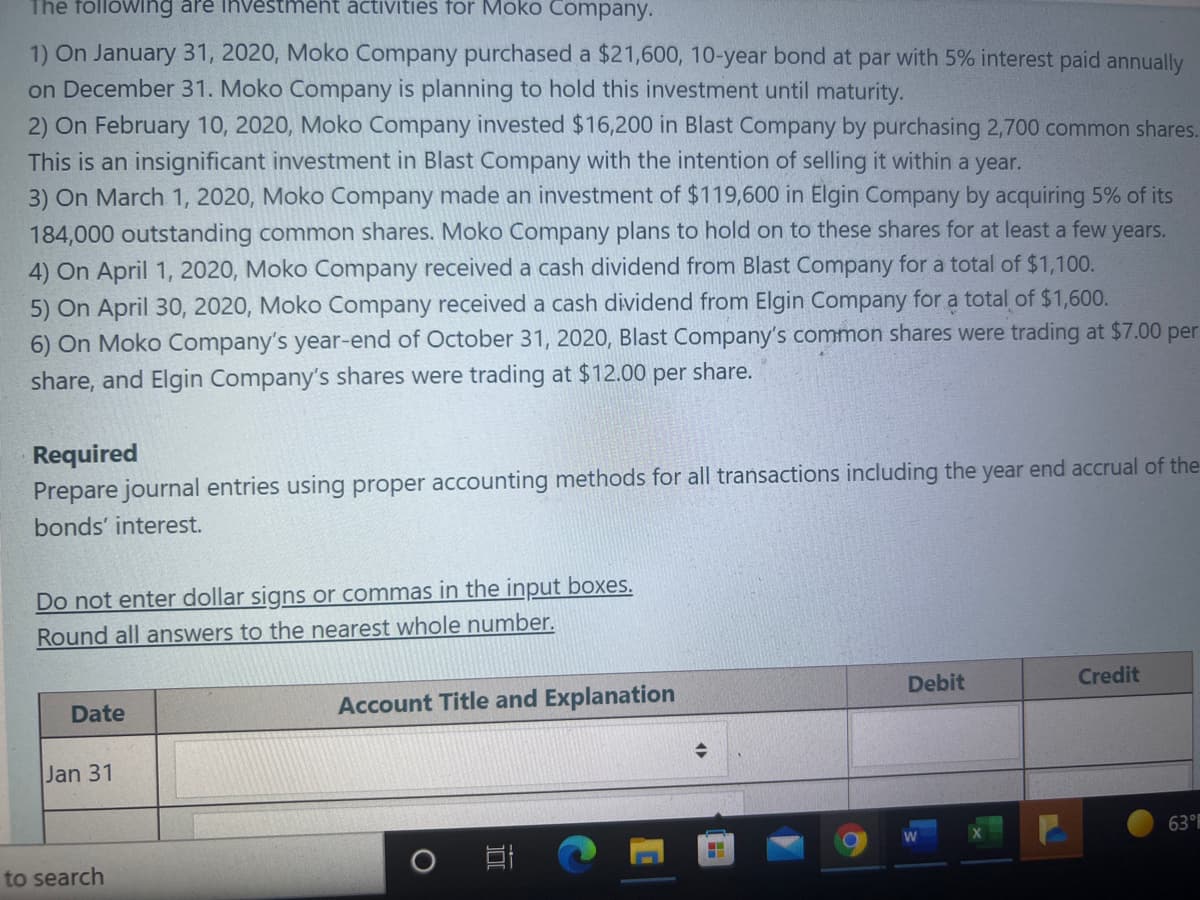

Transcribed Image Text:The following are investment activities for Moko Company.

1) On January 31, 2020, Moko Company purchased a $21,600, 10-year bond at par with 5% interest paid annually

on December 31. Moko Company is planning to hold this investment until maturity.

2) On February 10, 2020, Moko Company invested $16,200 in Blast Company by purchasing 2,700 common shares.

This is an insignificant investment in Blast Company with the intention of selling it within a year.

3) On March 1, 2020, Moko Company made an investment of $119,600 in Elgin Company by acquiring 5% of its

184,000 outstanding common shares. Moko Company plans to hold on to these shares for at least a few years.

4) On April 1, 2020, Moko Company received a cash dividend from Blast Company for a total of $1,100.

5) On April 30, 2020, Moko Company received a cash dividend from Elgin Company for a total of $1,600.

6) On Moko Company's year-end of October 31, 2020, Blast Company's common shares were trading at $7.00 per

share, and Elgin Company's shares were trading at $12.00 per share.

Required

Prepare journal entries using proper accounting methods for all transactions including the year end accrual of the

bonds' interest.

Do not enter dollar signs or commas in the input boxes.

Round all answers to the nearest whole number.

Credit

Debit

Account Title and Explanation

Date

Jan 31

63°

to search

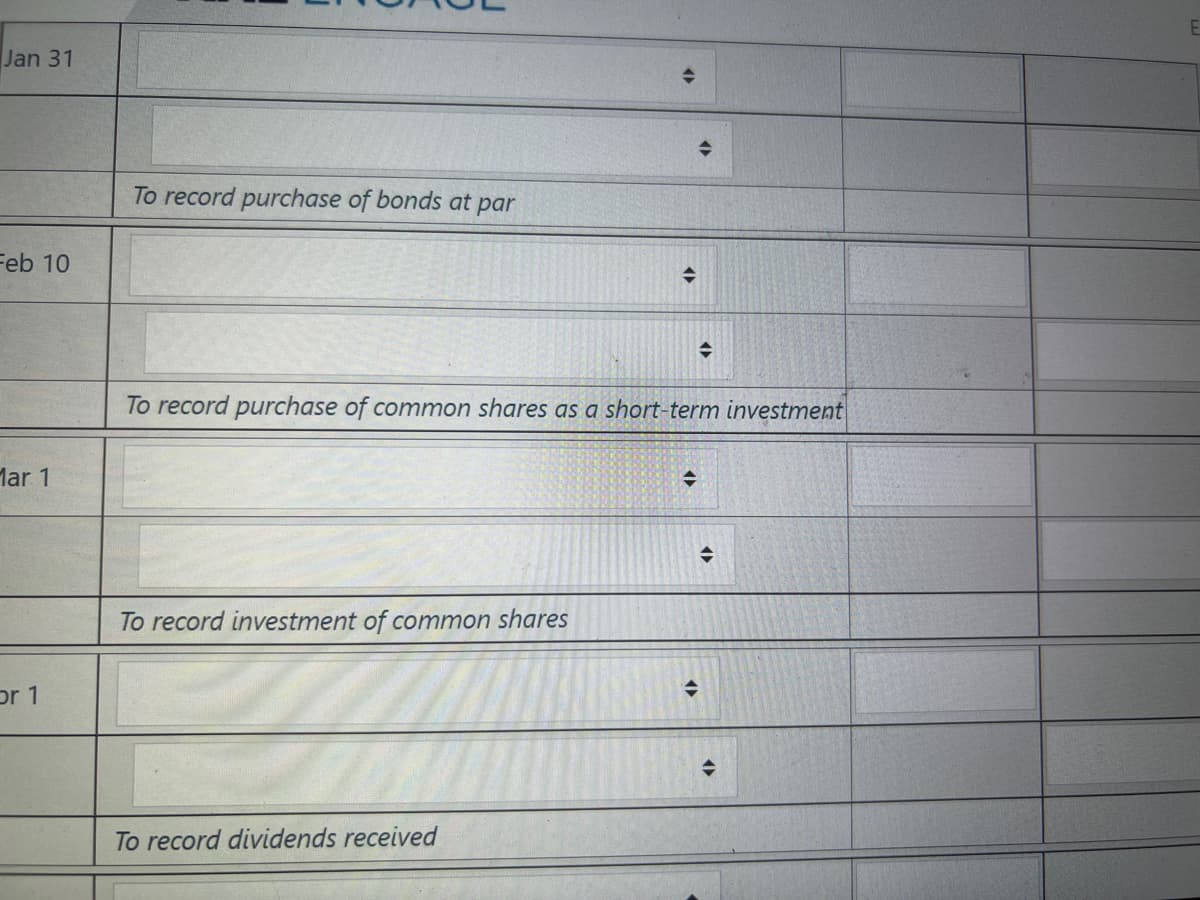

Transcribed Image Text:Jan 31

To record purchase of bonds at par

Feb 10

To record purchase of common shares as a short-term investment

Mar 1

To record investment of common shares

or 1

To record dividends received

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning