Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 21E

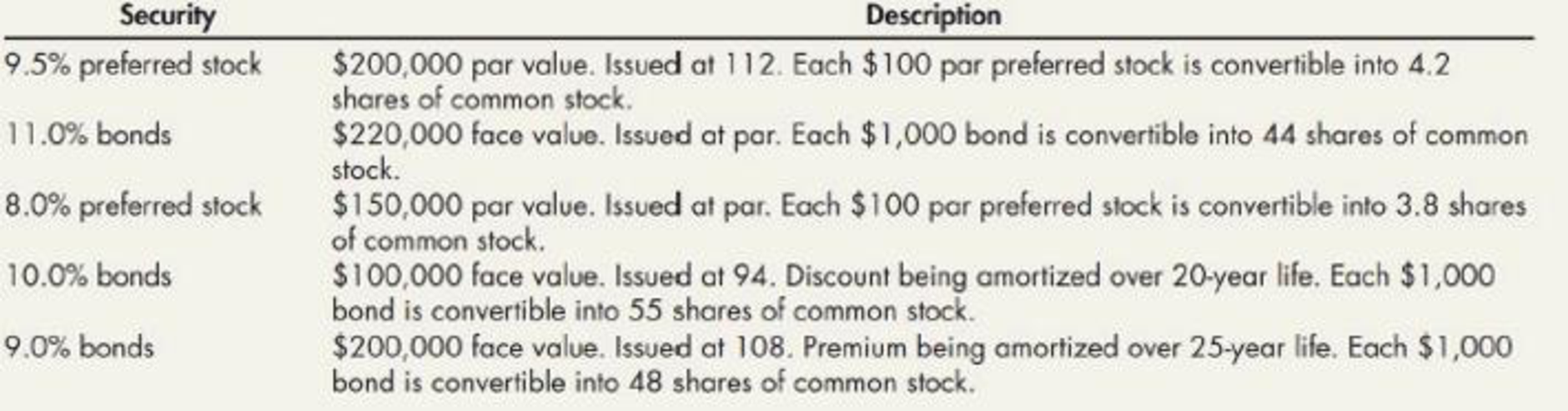

Mills Company had five convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight-line method) and dividends on each security during 2019. Each convertible security is described in the following table. The corporate income tax rate is 30%.

Required:

- 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share.

- 2. Prepare a ranking of the order in which the securities would be included in the diluted earnings per share computations.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 16 - What are the four important dates in regard to a...Ch. 16 - How does the ex-dividend date differ from the date...Ch. 16 - Prob. 3GICh. 16 - Prob. 4GICh. 16 - Prob. 5GICh. 16 - Prob. 6GICh. 16 - How does the accounting for a liquidating dividend...Ch. 16 - Prob. 8GICh. 16 - Prob. 9GICh. 16 - Prob. 10GI

Ch. 16 - What items might a corporation include in the...Ch. 16 - Prob. 12GICh. 16 - Prob. 13GICh. 16 - Prob. 14GICh. 16 - Prob. 15GICh. 16 - On what date are stock dividends and splits...Ch. 16 - Prob. 17GICh. 16 - What two earnings per share figures generally are...Ch. 16 - Prob. 19GICh. 16 - Prob. 20GICh. 16 - Prob. 21GICh. 16 - A company with potentially dilutive share options...Ch. 16 - Prob. 23GICh. 16 - Cash dividends on the 10 par value common stock of...Ch. 16 - A prior period adjustment should be reflected, net...Ch. 16 - Prince Corporations accounts provided the...Ch. 16 - Effective May 1, the shareholders of Baltimore...Ch. 16 - Kent Corporation was organized on January 1, 2014....Ch. 16 - For purposes of computing the weighted average...Ch. 16 - In determining basic earnings per share, dividends...Ch. 16 - Hyde Corporations capital structure at December...Ch. 16 - Iredell Company has 2,500,000 shares of common...Ch. 16 - Prob. 10MCCh. 16 - Prob. 1RECh. 16 - Prob. 2RECh. 16 - Prob. 3RECh. 16 - Use the same facts as in RE 16-3, but instead...Ch. 16 - Given the following current year information,...Ch. 16 - In Year 2, Adams Corporation discovered that it...Ch. 16 - Howard Corporal ion had 10,000 shares of common...Ch. 16 - Given the following year-end information for...Ch. 16 - Aiken Corporation has compensatory share options...Ch. 16 - Marlboro Corporation has 9% convertible preferred...Ch. 16 - Sarasota Corporation has 9% convertible bonds...Ch. 16 - Given the following year-end information, compute...Ch. 16 - Various Dividends Carlyon Company listed the...Ch. 16 - Dividends Andrews Company has 80,000 available to...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Stock Dividend Comparison Although Oriole Company...Ch. 16 - Prior Period Adjustments Scobie Company began 2019...Ch. 16 - Prob. 7ECh. 16 - Prob. 8ECh. 16 - Prob. 9ECh. 16 - Shareholders Equity Herrera Manufacturing...Ch. 16 - Prob. 11ECh. 16 - Weighted Average Shares At the beginning of 2019,...Ch. 16 - Weighted Average Shares At the beginning of the...Ch. 16 - Earnings per Share The 2018 balance sheet for...Ch. 16 - Prob. 15ECh. 16 - Jumbo Corporation reported the following...Ch. 16 - Lucas Company reports net income of 5,125 for the...Ch. 16 - Monona Company reported net income of 29,975 for...Ch. 16 - Lyon Company shows the following condensed income...Ch. 16 - Extreme Company reported the following information...Ch. 16 - Mills Company had five convertible securities...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Prob. 24ECh. 16 - Prob. 25ECh. 16 - Tama Companys capital structure consists of common...Ch. 16 - Percy Company has 15,000 shares of common stock...Ch. 16 - Prob. 28ECh. 16 - Keener Company has had 1,000 shares of 7%, 100 par...Ch. 16 - Otter Tail, Inc., began operations in January 2015...Ch. 16 - On January 1, 2019, Kittson Company had a retained...Ch. 16 - Prob. 4PCh. 16 - Alert Companys shareholders equity prior to any of...Ch. 16 - Prob. 6PCh. 16 - Oakwood Inc. is a public enterprise whose shares...Ch. 16 - Prob. 8PCh. 16 - Prob. 9PCh. 16 - Prob. 10PCh. 16 - Raun Company had the following equity items as of...Ch. 16 - Prob. 12PCh. 16 - Prob. 13PCh. 16 - Gray Company lists the following shareholders...Ch. 16 - Included in the December 31, 2018, Jacobi Company...Ch. 16 - Prob. 16PCh. 16 - Graham Railways Inc. is evaluating its operations...Ch. 16 - Prob. 18PCh. 16 - Anoka Company reported the following selected...Ch. 16 - Winona Company began 2019 with 10,000 shares of 10...Ch. 16 - Waseca Company had 5 convertible securities...Ch. 16 - Roseau Company is preparing its annual earnings...Ch. 16 - Prob. 23PCh. 16 - Frost Company has accumulated the following...Ch. 16 - The controller of Red Lake Corporation has...Ch. 16 - Prob. 26PCh. 16 - Problems may be encountered in accounting for...Ch. 16 - Stock splits and stock dividends may be used by a...Ch. 16 - Earnings per share (EPS) is the most featured...Ch. 16 - The earnings per share data required of a company...Ch. 16 - Prob. 5CCh. 16 - Public enterprises are required to present...Ch. 16 - Prob. 7CCh. 16 - Ryan Company has as a goal that its earnings per...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.arrow_forwardTama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.arrow_forwardDuring 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forward

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.arrow_forwardOn July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be converted into 20 shares of the companys 5 par value stock. On July 3, 2020, when the bonds had an unamortized discount of 7,400 and the market value of the McGraw shares was 52 per share, all the bonds were converted into common stock. Required: 1. Prepare the journal entry to record the conversion of the bonds under (a) the book value method and (b) the market value method. 2. Compute the companys debt-to-equity ratio (total liabilities divided by total shareholders equity, as described in Chapter 6) under each alternative. Assume the companys other liabilities are 2 million and shareholders equity before the conversion is 3 million. 3. Assume the company uses IFRS and issued the bonds for 487,500 on July 2, 2018. On this date, it determined that the fair value of each bond was 930 and the fair value of the conversion option was 45 per bond. Prepare the journal entry to record the issuance of the bonds.arrow_forwardRefer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Bonds 101 (DETAILED EXPLANATION FOR BEGINNERS); Author: It's Your Girl Rose;https://www.youtube.com/watch?v=Gskqx8dy9To;License: Standard Youtube License