Required: Prepare the consolidation journal entries for the elimination of the above inter-company 24

Required: Prepare the consolidation journal entries for the elimination of the above inter-company 24

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 18P

Related questions

Question

please answer wirhin 30 minutes..

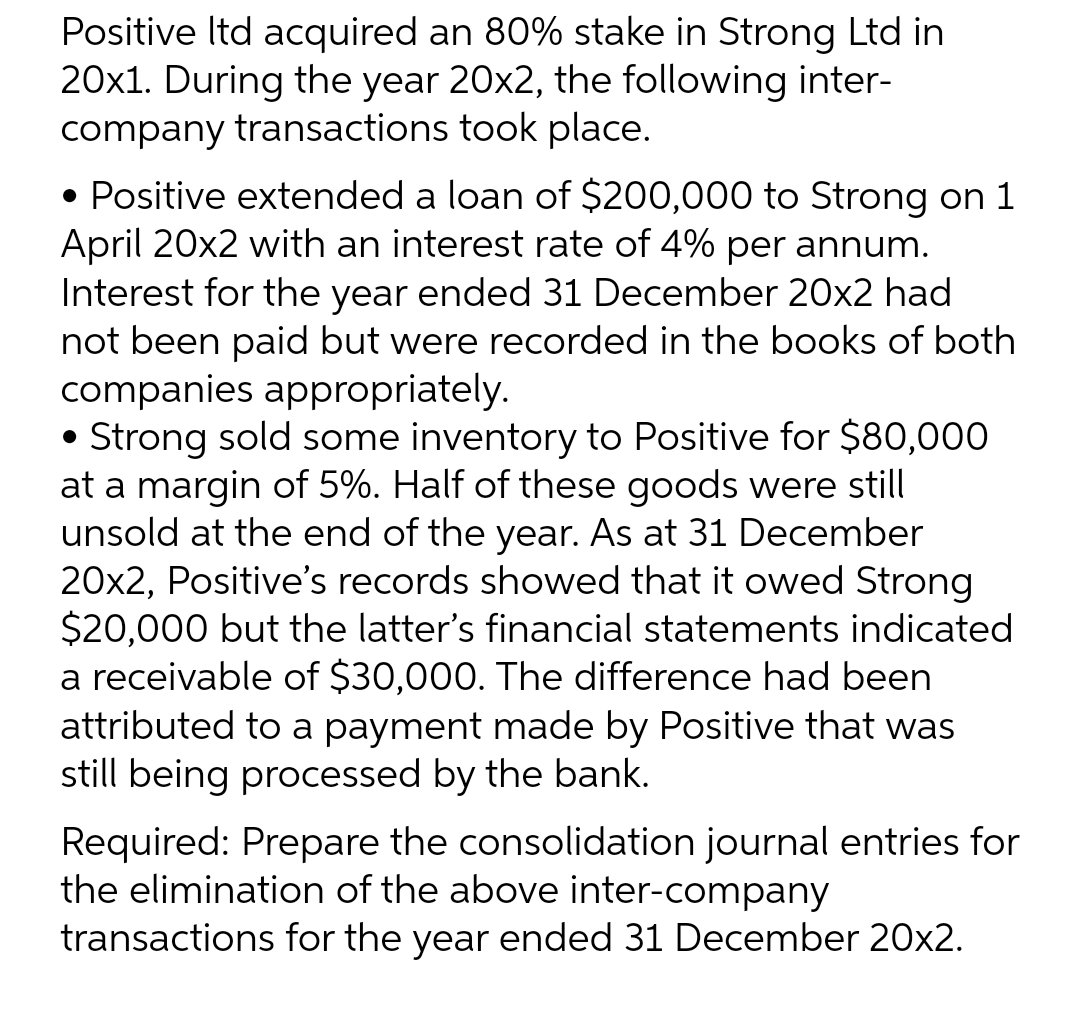

Transcribed Image Text:Positive ltd acquired an 80% stake in Strong Ltd in

20x1. During the year 20x2, the following inter-

company transactions took place.

• Positive extended a loan of $200,000 to Strong on 1

April 20x2 with an interest rate of 4% per annum.

Interest for the year ended 31 December 20x2 had

not been paid but were recorded in the books of both

companies appropriately.

• Strong sold some inventory to Positive for $80,000

at a margin of 5%. Half of these goods were still

unsold at the end of the year. As at 31 December

20x2, Positive's records showed that it owed Strong

$20,000 but the latter's financial statements indicated

a receivable of $30,000. The difference had been

attributed to a payment made by Positive that was

still being processed by the bank.

Required: Prepare the consolidation journal entries for

the elimination of the above inter-company

transactions for the year ended 31 December 20x2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning