Requirements: 1. Compute the net income for each month using variable costing. 2. Compute the monthly breakeven point under variable costing. 3. Explain to Ms. Gale why profits have moved erratically over the three month period shown in the absorption costing statements above and why profits have not been more closely rated to changes in sales volume.

Requirements: 1. Compute the net income for each month using variable costing. 2. Compute the monthly breakeven point under variable costing. 3. Explain to Ms. Gale why profits have moved erratically over the three month period shown in the absorption costing statements above and why profits have not been more closely rated to changes in sales volume.

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.1TIF

Related questions

Topic Video

Question

100%

Requirements:

1. Compute the net income for each month using variable costing.

2. Compute the monthly breakeven point under variable costing.

3. Explain to Ms. Gale why profits have moved erratically over the three month period shown in

the absorption costing statements above and why profits have not been more closely rated to

changes in sales volume.

4. Identify and discuss the advantages and disadvantages of using the variable costing method for

internal reporting purposes.

5. Reconcile the absorption costing and the variable costing net operating income figures for each

month.

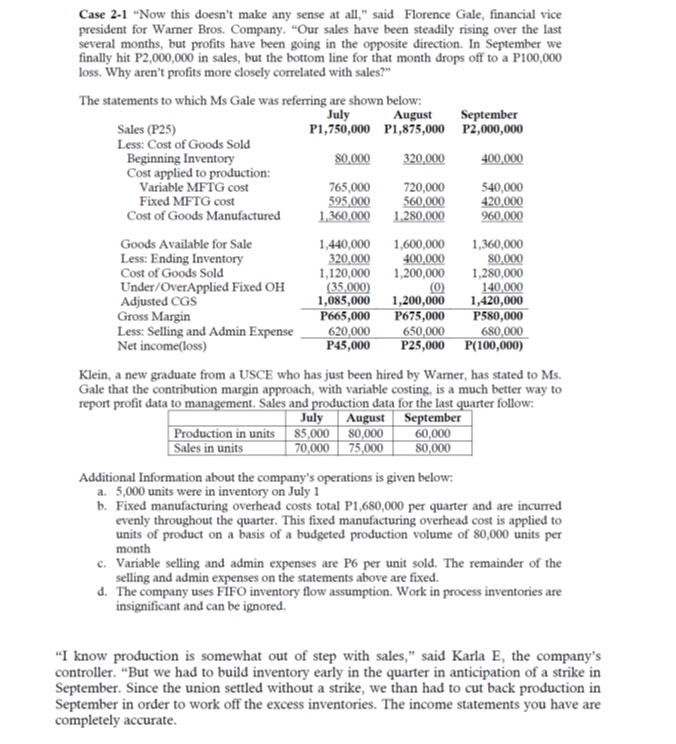

Transcribed Image Text:Case 2-1 "Now this doesn't make any sense at all," said Florence Gale, financial vice

president for Warner Bros. Company. "Our sales have been steadily rising over the last

several months, but profits have been going in the opposite direction. In September we

finally hit P2,000,000 in sales, but the bottom line for that month drops off to a P100,000

loss. Why aren't profits more closely correlated with sales?"

The statements to which Ms Gale was referring are shown below:

July August

P1,750,000 P1,875,000

Sales (P25)

Less: Cost of Goods Sold

Beginning Inventory

Cost applied to production:

Variable MFTG cost

Fixed MFTG cost

Cost of Goods Manufactured

Goods Available for Sale

Less: Ending Inventory

Cost of Goods Sold

Under/OverApplied Fixed OH

Adjusted CGS

Gross Margin

Less: Selling and Admin Expense

Net income(loss)

80,000

765,000

595,000

1,360,000

Production in units

Sales in units

320,000

720,000

560,000

1,280,000

1,440,000 1,600,000

320,000

400,000

1,120,000 1,200,000

(35,000)

(0)

1,085,000 1,200,000

P665,000 P675,000

620,000

650,000

P45,000

P25,000

85,000 80,000

70,000 75,000

September

P2,000,000

Klein, a new graduate from a USCE who has just been hired by Warner, has stated to Ms.

Gale that the contribution margin approach, with variable costing, is a much better way to

report profit data to management. Sales and production data for the last quarter follow:

July August

September

60,000

80,000

Additional Information about the company's operations is given below:

a. 5,000 units were in inventory on July 1

400,000

540,000

420,000

960,000

1,360,000

80,000

1,280,000

140,000

1,420,000

P580,000

680,000

P(100,000)

b. Fixed manufacturing overhead costs total P1,680,000 per quarter and are incurred

evenly throughout the quarter. This fixed manufacturing overhead cost is applied to

units of product on a basis of a budgeted production volume of 80,000 units per

month

c. Variable selling and admin expenses are P6 per unit sold. The remainder of the

selling and admin expenses on the statements above are fixed.

d. The company uses FIFO inventory flow assumption. Work in process inventories are

insignificant and can be ignored.

"I know production is somewhat out of step with sales," said Karla E, the company's

controller. "But we had to build inventory early in the quarter in anticipation of a strike in

September. Since the union settled without a strike, we than had to cut back production in

September in order to work off the excess inventories. The income statements you have are

completely accurate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning