Return on capital employed Acid test ratio iv. V. vi. Current ratio vii. Times interest earned ratio Analyse the firm's performance using the industry norms/aw outlined above. The analysis should be based on: i. Profitability

Return on capital employed Acid test ratio iv. V. vi. Current ratio vii. Times interest earned ratio Analyse the firm's performance using the industry norms/aw outlined above. The analysis should be based on: i. Profitability

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 10SPA: RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem...

Related questions

Question

KINDLY ANSWER PARTS IV & V FOLLOWED BY PART B.i,ii,iii

Transcribed Image Text:A

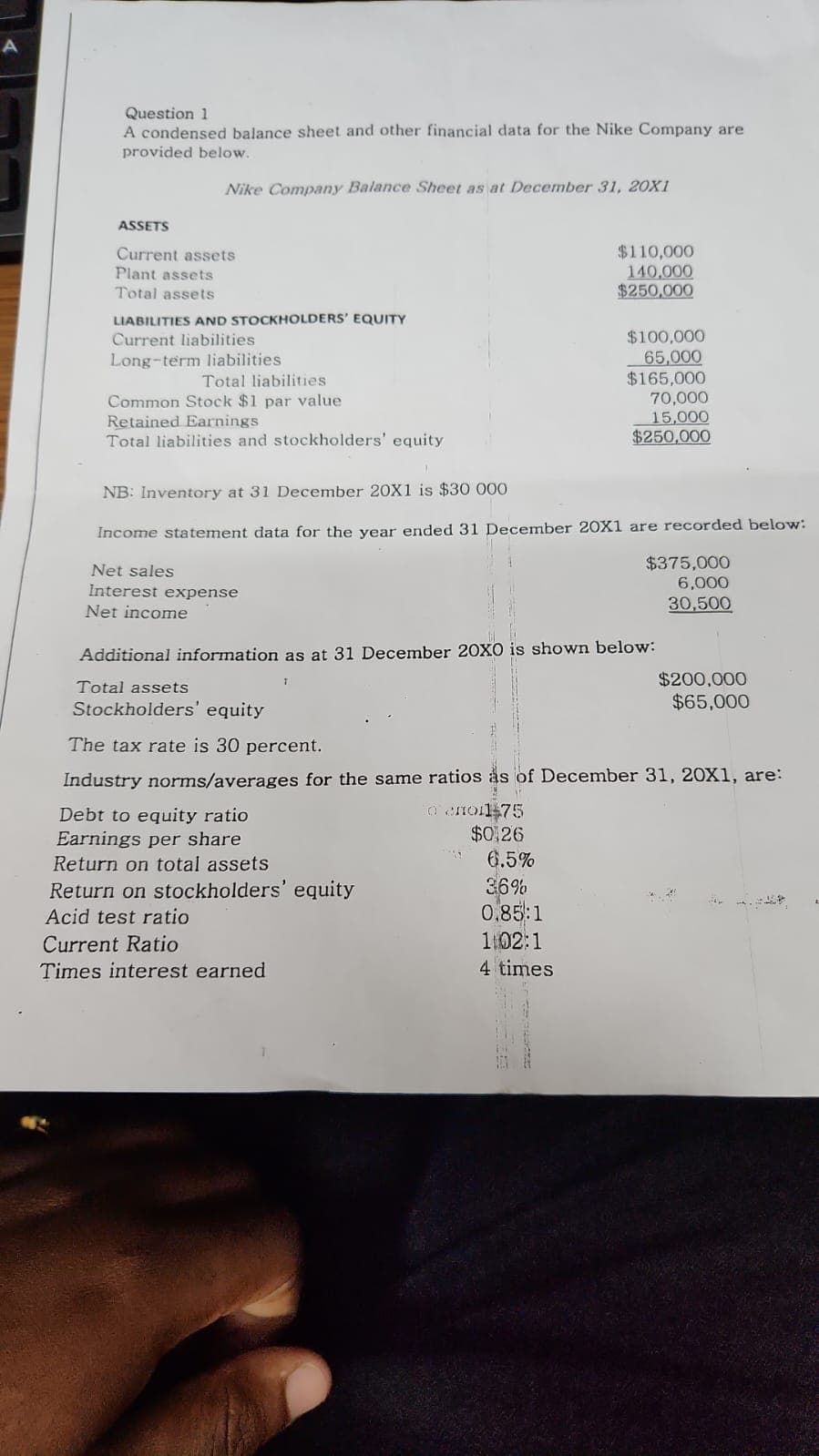

Question 1

A condensed balance sheet and other financial data for the Nike Company are

provided below.

Nike Company Balance Sheet as at December 31, 20X1

ASSETS

Current assets

Plant assets

Total assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities

Long-term liabilities.

Total liabilities

Common Stock $1 par value

Retained Earnings.

Total liabilities and stockholders' equity

Net sales

Interest expense

Net income

NB: Inventory at 31 December 20X1 is $30 000

Income statement data for the year ended 31 December 20X1 are recorded below:

$375,000

6,000

30,500

Current Ratio

Times interest earned

$110,000

140,000

$250,000

6.5%

36%

0.85:1

102:1

4 times

$100,000

65,000

$165,000

Additional information as at 31 December 20X0 is shown below:

Total assets

Stockholders' equity

The tax rate is 30 percent.

Industry norms/averages for the same ratios as of December 31, 20X1, are:

Debt to equity ratio

10 ono11 75

Earnings per share

$0,26

Return on total assets

Return on stockholders' equity

Acid test ratio

alisieren

70,000

15,000

$250,000

$200,000

$65,000

L

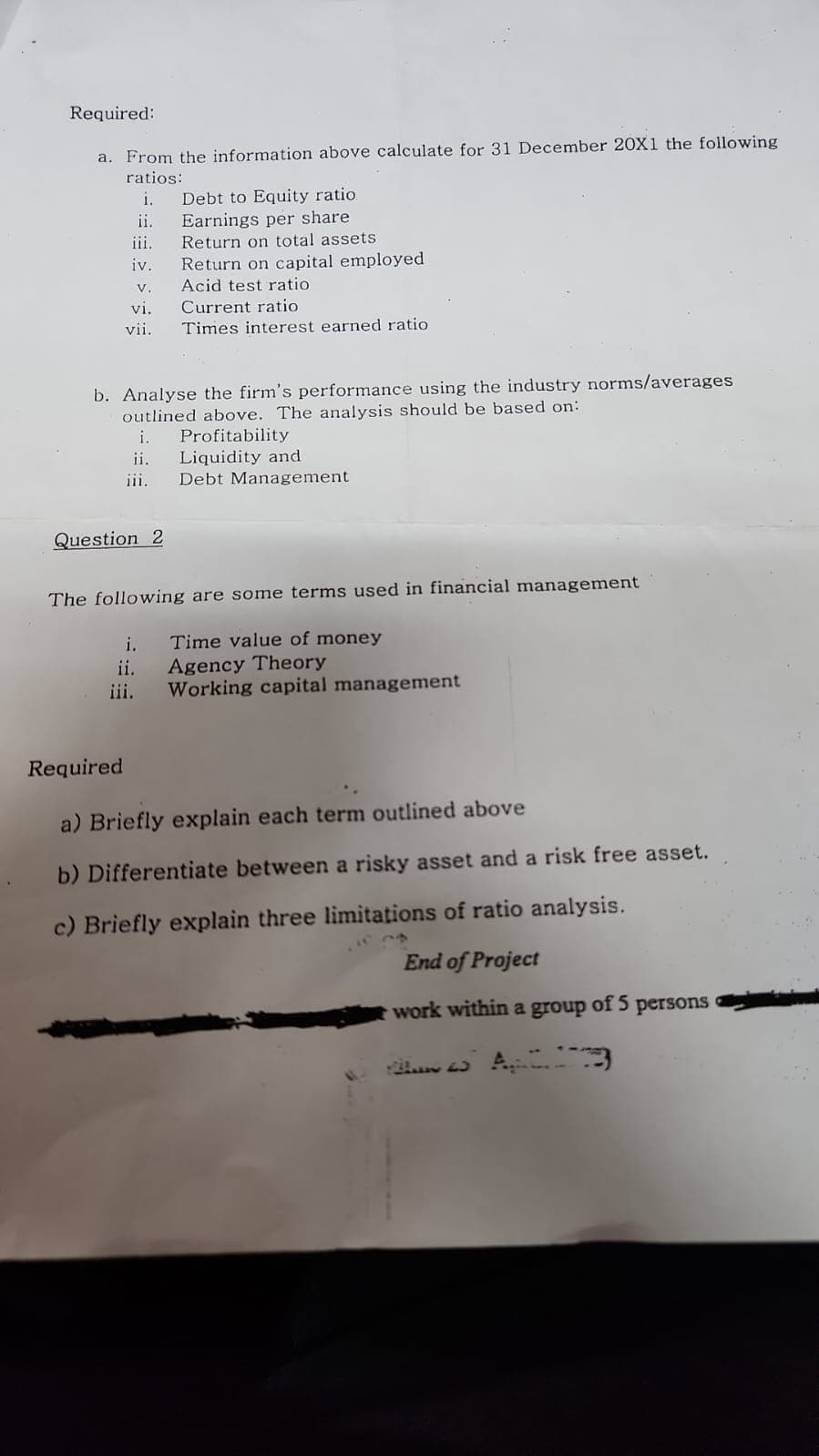

Transcribed Image Text:Required:

a. From the information above calculate for 31 December 20X1 the following

ratios:

i. Debt to Equity ratio

ii.

Earnings per share

Return on total assets

Return on capital employed

Acid test ratio.

iii.

iv.

V.

vi.

vii.

b. Analyse the firm's performance using the industry norms/averages

outlined above. The analysis should be based on:

i. Profitability

ii.

iii.

Question 2

Current ratio

Times interest earned ratio

i.

ii.

iii.

Liquidity and

Debt Management

The following are some terms used in financial management

Time value of money

Agency Theory

Working capital management

Required

a) Briefly explain each term outlined above

b) Differentiate between a risky asset and a risk free asset.

c) Briefly explain three limitations of ratio analysis.

End of Project

work within a group of 5 persons

53

ده ست

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning