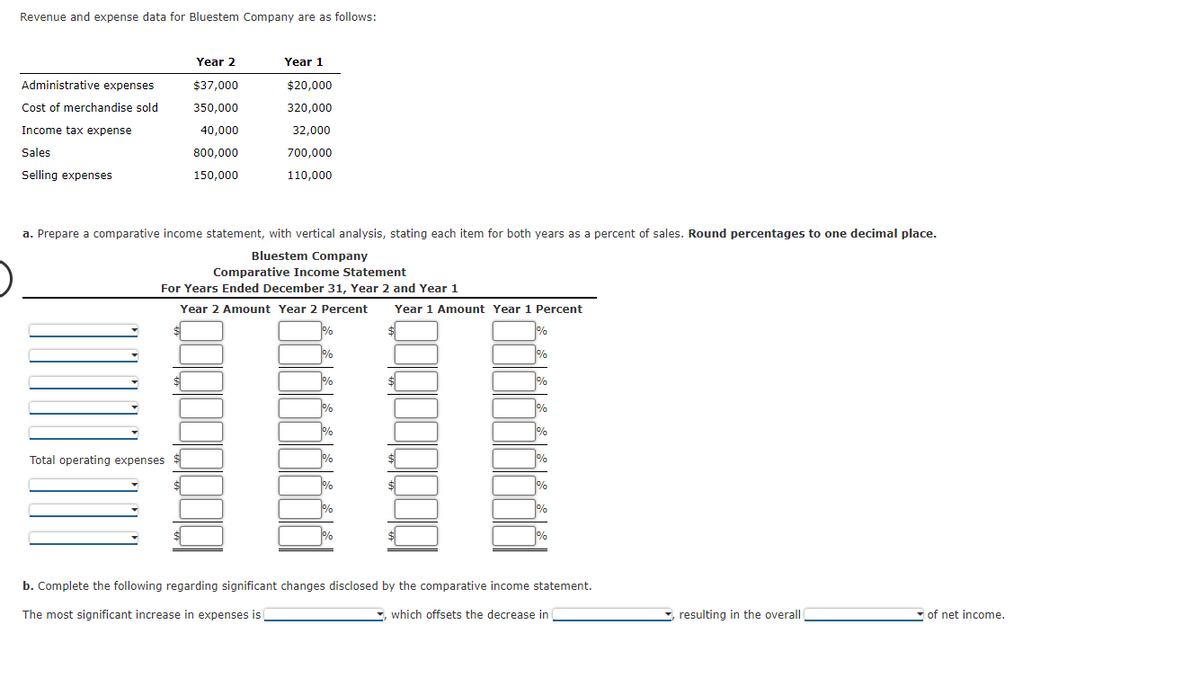

Revenue and expense data for Bluestem Company are as follows: Year 2 Year 1 Administrative expenses $37,000 $20,000 Cost of merchandise sold 350,000 320,000 Income tax expense 40,000 32,000 Sales 800,000 700,000 Selling expenses 150,000 110,000 a. Prepare a comparative income statement, with vertical analysis, stating each item for both years as a percent of sales. Round percentages to one decimal place. Bluestem Company Comparative Income Statement For Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent Total operating expenses b. Complete the following regarding significant changes disclosed by the comparative income statement. The most significant increase in expenses is which offsets the decrease in resulting in the overall of net income.

Revenue and expense data for Bluestem Company are as follows: Year 2 Year 1 Administrative expenses $37,000 $20,000 Cost of merchandise sold 350,000 320,000 Income tax expense 40,000 32,000 Sales 800,000 700,000 Selling expenses 150,000 110,000 a. Prepare a comparative income statement, with vertical analysis, stating each item for both years as a percent of sales. Round percentages to one decimal place. Bluestem Company Comparative Income Statement For Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent Total operating expenses b. Complete the following regarding significant changes disclosed by the comparative income statement. The most significant increase in expenses is which offsets the decrease in resulting in the overall of net income.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Revenue and expense data for Bluestem Company are as follows:

Year 2

Year 1

Administrative expenses

$37,000

$20,000

Cost of merchandise sold

350,000

320,000

Income tax expense

40,000

32,000

Sales

800,000

700,000

Selling expenses

150,000

110,000

a. Prepare a comparative income statement, with vertical analysis, stating each item for both years as a percent of sales. Round percentages to one decimal place.

Bluestem Company

Comparative Income Statement

For Years Ended December 31, Year 2 and Year 1

Year 2 Amount Year 2 Percent

Year 1 Amount Year 1 Percent

%

%

%

Total operating expenses

b. Complete the following regarding significant changes disclosed by the comparative income statement.

The most significant increase in expenses is

which offsets the decrease in

resulting in the overall

of net income.

111111111

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning