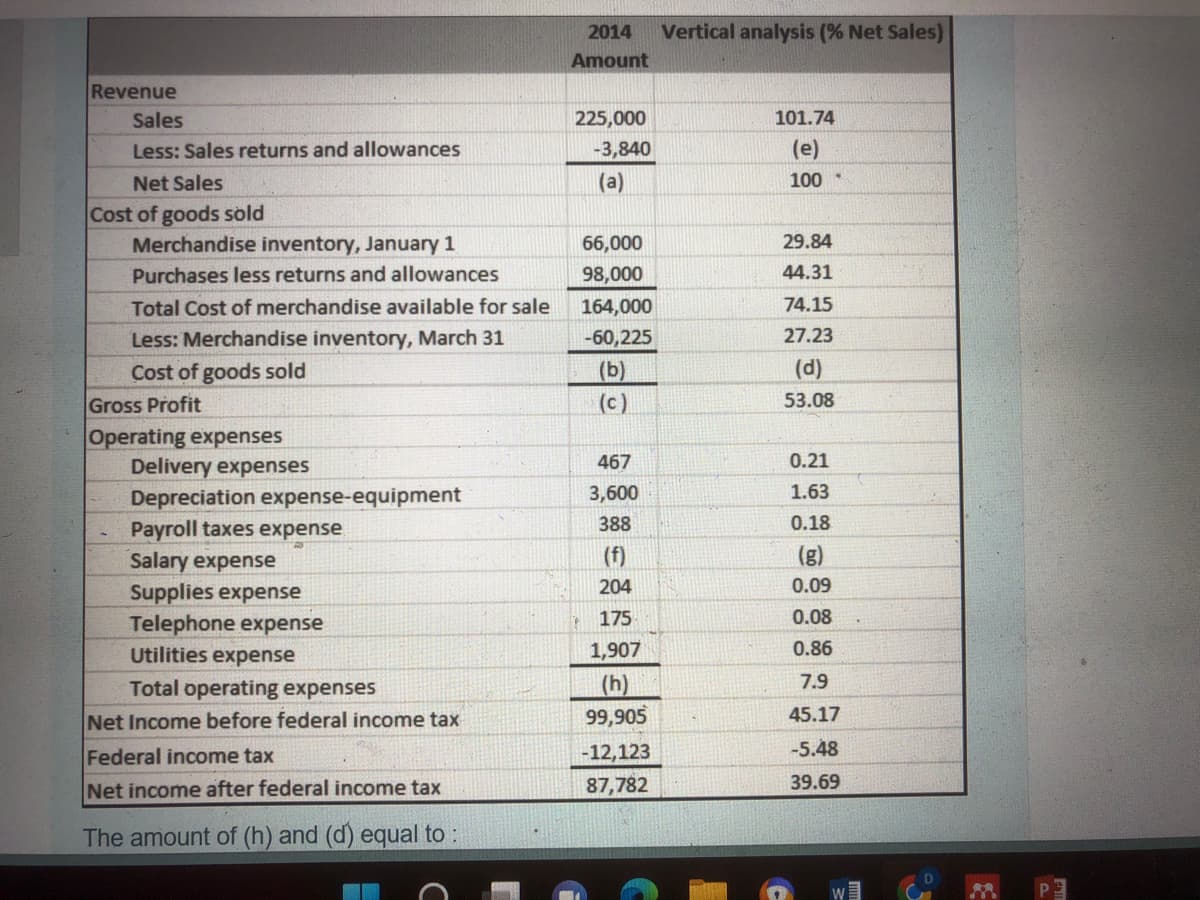

Revenue Sales Less: Sales returns and allowances Net Sales Cost of goods sold Merchandise inventory, January 1 Purchases less returns and allowances Total Cost of merchandise available for sale Less: Merchandise inventory, March 31 Cost of goods sold Delivery expenses Depreciation expense-equipment Payroll taxes expense Salary expense Supplies expense Telephone expense Utilities expense Total operating expenses Net Income before federal income tax Federal income tax Net income after federal income tax The amount of (h) and (d) equal to : Gross Profit Operating expenses 2014 Amount 225,000 -3,840 (a) 66,000 98,000 164,000 -60,225 (b) (c) 467 3,600 388 (f) 204 175 1,907 (h) 99,905 -12,123 87,782 Vertical analysis (% Net Sales) 101.74 (e) 100 29.84 44.31 74.15 27.23 (d) 53.08 0.21 1.63 0.18 (g) 0.09 0.08 0.86 7.9 45.17 -5.48 39.69 .

Revenue Sales Less: Sales returns and allowances Net Sales Cost of goods sold Merchandise inventory, January 1 Purchases less returns and allowances Total Cost of merchandise available for sale Less: Merchandise inventory, March 31 Cost of goods sold Delivery expenses Depreciation expense-equipment Payroll taxes expense Salary expense Supplies expense Telephone expense Utilities expense Total operating expenses Net Income before federal income tax Federal income tax Net income after federal income tax The amount of (h) and (d) equal to : Gross Profit Operating expenses 2014 Amount 225,000 -3,840 (a) 66,000 98,000 164,000 -60,225 (b) (c) 467 3,600 388 (f) 204 175 1,907 (h) 99,905 -12,123 87,782 Vertical analysis (% Net Sales) 101.74 (e) 100 29.84 44.31 74.15 27.23 (d) 53.08 0.21 1.63 0.18 (g) 0.09 0.08 0.86 7.9 45.17 -5.48 39.69 .

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter6: Receivables And Inventories

Section: Chapter Questions

Problem 6.4.4P: Inventory by three cost flow methods Details regarding the inventory of appliances on January 1,...

Related questions

Question

The amount of (h) and (D) equal to

H) =17,800

D) 4.06%

True or false?

Transcribed Image Text:Revenue

Sales

Less: Sales returns and allowances

Net Sales

Cost of goods sold

Merchandise inventory, January 1

Purchases less returns and allowances

Total Cost of merchandise available for sale

Less: Merchandise inventory, March 31

Cost of goods sold

Delivery expenses

Depreciation expense-equipment

Payroll taxes expense

Salary expense

Supplies expense

Telephone expense

Utilities expense

Total operating expenses

Net Income before federal income tax

Federal income tax

Net income after federal income tax

The amount of (h) and (d) equal to :

Gross Profit

Operating expenses

2014

Amount

225,000

-3,840

(a)

66,000

98,000

164,000

-60,225

(b)

(c)

467

3,600

388

204

175

1,907

(h)

99,905

-12,123

87,782

Vertical analysis (% Net Sales)

101.74

(e)

100

29.84

44.31

74.15

27.23

(d)

53.08

0.21

1.63

0.18

(g)

0.09

0.08

0.86

7.9

45.17

-5.48

39.69

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning