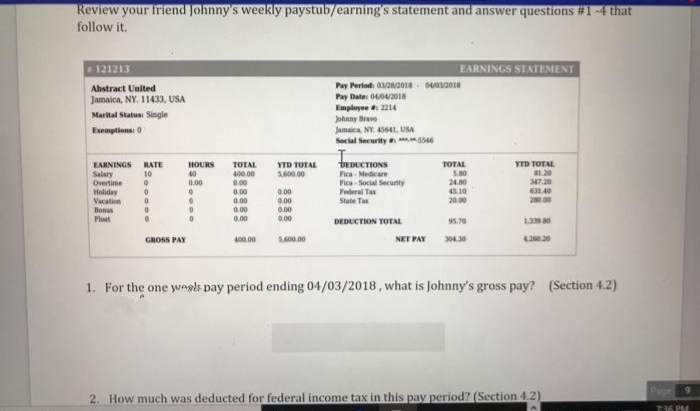

Review your friend Johnny's weekly paystub/earning's statement and answer questions #1-4 that follow it. S. 121213 EARNINGS STATEMENT Pay Pertodi Z2018- 04201 Pay Date 0018 Employee 2214 Abstract United Jamaica, NY. 11433, USA Marital Status Single Johnny Brave Eemptions 0 Jamaica NY. 44I, USA Secial Security.ss46 tEDUCTIONS YTD TOTAL 5.600.00 KARNINGS RATE Salary Overtime Holiday Vacatin Bons Ploat HOURS 40 0.00 TOTAL 400.00 0.00 0.00 0.00 0.00 0.00 TOTAL YTD TOTAL B1.20 347.20 631.40 20.00 Pca Medicare FeaSocial Secunty 10 240 45.10 20.00 0.00 0.00 00 00 Federal Ta State Tax DEDUCTION TOTAL 95.70 GROSS PAY 400.00 S00.00 NET PAY 30430 4.20.20 1. For the one weols pay period ending 04/03/2018, what is Johnny's gross pay? (Section 4.2) 2. How much was deducted for federal income tax in this pay period? (Section 4.2)

Review your friend Johnny's weekly paystub/earning's statement and answer questions #1-4 that follow it. S. 121213 EARNINGS STATEMENT Pay Pertodi Z2018- 04201 Pay Date 0018 Employee 2214 Abstract United Jamaica, NY. 11433, USA Marital Status Single Johnny Brave Eemptions 0 Jamaica NY. 44I, USA Secial Security.ss46 tEDUCTIONS YTD TOTAL 5.600.00 KARNINGS RATE Salary Overtime Holiday Vacatin Bons Ploat HOURS 40 0.00 TOTAL 400.00 0.00 0.00 0.00 0.00 0.00 TOTAL YTD TOTAL B1.20 347.20 631.40 20.00 Pca Medicare FeaSocial Secunty 10 240 45.10 20.00 0.00 0.00 00 00 Federal Ta State Tax DEDUCTION TOTAL 95.70 GROSS PAY 400.00 S00.00 NET PAY 30430 4.20.20 1. For the one weols pay period ending 04/03/2018, what is Johnny's gross pay? (Section 4.2) 2. How much was deducted for federal income tax in this pay period? (Section 4.2)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 84.1C

Related questions

Question

Transcribed Image Text:Review your triend Johnny's weekly paystub/earning's statement and answer questions #1 -4 that

follow it.

121213

EARNINGS STATEMENT

Pay Periodi 22018- 042018

Pay Date: 0402018

Employee 2214

Abstract United

Jamaica, NY. 11433, USA

Marital Status Single

Johnny Brave

Jamaica. NY. 45641, USA

Social Security s46

Eemptions: 0

EARNINGS RATE

Salary

Overtime

Holiday

Vacation

Bonus

Ploat

DEDUCTIONS

Fica - Medicare

Fica - Social Security

Federal Tax

State Ta

HOURS

YTD TOTAL

B1.20

347.20

631.40

280.00

TOTAL

400.00

YTD TOTAL

5,600.00

TOTAL

5.80

24.80

45.10

20.00

10

40

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

DEDUCTION TOTAL

95.70

GROSS PAY

400.00

S00.00

NET PAY

30430

420.20

1. For the one wngls pay period ending 04/03/2018, what is Johnny's gross pay? (Section 4.2)

Page

2. How much was deducted for federal income tax in this pay period? (Section 4.2)

7:36 PM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning