OASDI Тахаble HI Tаxable Wages Annual OASDI HI Employe Salary Wages Тах Тах Stern, Myra Lundy, Hal Franks, Rob Haggerty, Alan Ward, Randy Hoskin, Al Wee, Pam Prince, Harry Maven, Mary Harley, David $ 42,150 39,500 46,000 161,280 40,800 39,600 106,800 76,800 52,000 68,960 Totals Employer's OASDI Tax Employer's HI Tax

OASDI Тахаble HI Tаxable Wages Annual OASDI HI Employe Salary Wages Тах Тах Stern, Myra Lundy, Hal Franks, Rob Haggerty, Alan Ward, Randy Hoskin, Al Wee, Pam Prince, Harry Maven, Mary Harley, David $ 42,150 39,500 46,000 161,280 40,800 39,600 106,800 76,800 52,000 68,960 Totals Employer's OASDI Tax Employer's HI Tax

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

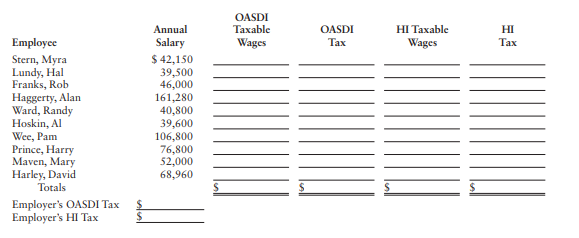

Haggerty Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for

20-- follows. Compute the following for the payroll of December 31:

Transcribed Image Text:OASDI

Тахаble

HI Tаxable

Wages

Annual

OASDI

HI

Employe

Salary

Wages

Тах

Тах

Stern, Myra

Lundy, Hal

Franks, Rob

Haggerty, Alan

Ward, Randy

Hoskin, Al

Wee, Pam

Prince, Harry

Maven, Mary

Harley, David

$ 42,150

39,500

46,000

161,280

40,800

39,600

106,800

76,800

52,000

68,960

Totals

Employer's OASDI Tax

Employer's HI Tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you