Revision of Depreciation Equipment with a cost of $354,500 has an estimated residual value of $38,000, has an estimated useful life of 15 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. 21,100 V b. Determine the book value after 10 full years of use. c. Assuming that at the start of the year 11 the remaíning life is estimated to be 8 years and the residual value is estimated to be $38,700, determine the depreciation expense for each of the remaining 8 years. Feedback Check My Viork Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life. The book value is the foxed asset cost less accumulated depreciation. Revising depreciation is necessary when estimates of residual values and/or useful lives of foced assets change due to abnormal wear and tear or obsolescence

Revision of Depreciation Equipment with a cost of $354,500 has an estimated residual value of $38,000, has an estimated useful life of 15 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. 21,100 V b. Determine the book value after 10 full years of use. c. Assuming that at the start of the year 11 the remaíning life is estimated to be 8 years and the residual value is estimated to be $38,700, determine the depreciation expense for each of the remaining 8 years. Feedback Check My Viork Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life. The book value is the foxed asset cost less accumulated depreciation. Revising depreciation is necessary when estimates of residual values and/or useful lives of foced assets change due to abnormal wear and tear or obsolescence

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 19E

Related questions

Question

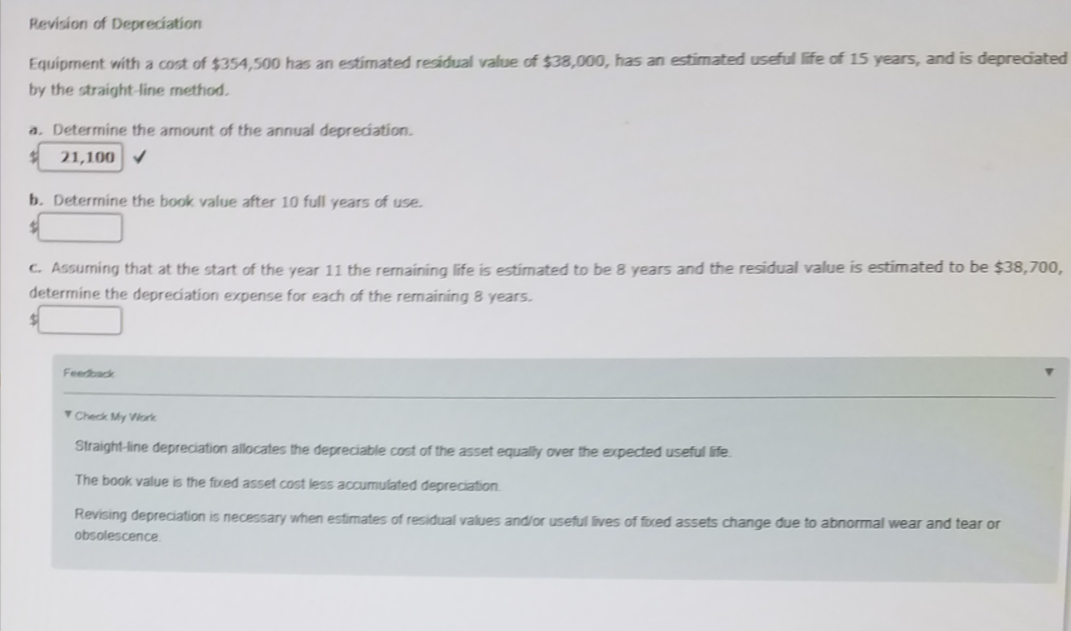

Transcribed Image Text:Revision of Depreciation

Equipment with a cost of $354,500 has an estimated residual value of $38,000, has an estimated useful life of 15 years, and is depreciated

by the straight-line method.

a. Determine the amount of the annual depreciation.

21,100 V

b. Determine the book value after 10 full years of use.

c. Assuming that at the start of the year 11 the remaíning life is estimated to be 8 years and the residual value is estimated to be $38,700,

determine the depreciation expense for each of the remaining 8 years.

Feedback

Check My Viork

Straight-line depreciation allocates the depreciable cost of the asset equally over the expected useful life.

The book value is the foxed asset cost less accumulated depreciation.

Revising depreciation is necessary when estimates of residual values and/or useful lives of foced assets change due to abnormal wear and tear or

obsolescence

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub