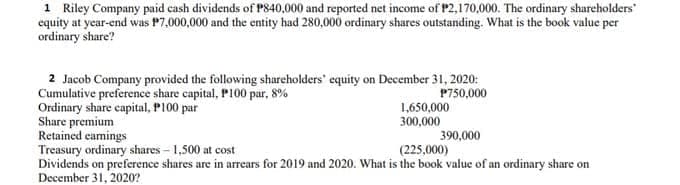

Riley Company paid cash dividends of P840,000 and reported net income of P2,170,000. The ordinary shareholders equity at year-end was P7,000,000 and the entity had 280,000 ordinary shares outstanding. What is the book value per ordinary share?

Q: For 2010 and 2011, Sabil Corporation earned net income of $480,000 and S640.000 and paid dividends…

A: Journal entries is the recording of transaction at the initial stage of incurring the transactions.

Q: Richards Corporation had net income of $196,700 and paid dividends to common stockholders of…

A: Earning per Share= Net income-(preferred stock dividend)/No. of shares outstanding Price earning…

Q: Ecker Company reports $1,950,000 of net income and declares $273,000 of cash dividends on its…

A: In order to determine the Earning per share, the Earnings available to common shareholders are…

Q: Longmont Corporation earned net income of $86,000 this year. The company began the year with 600…

A: Formula: Earnings per share = Earnings available for Common Stockholders’/ Weighted Average number…

Q: Millers company had retained earnings of $85,000 and stockholders' equity of $105,000 at the…

A: Equity statement: It refers to a financial statement that shows the total equity of the business…

Q: At year end, National Corporation balance sheet showed total assets of P70,000,000, total…

A: Given: Total assets = P70,000,000, Total liabilities = P35,000,000 Preferred share capital =…

Q: Florida Co. just paid total dividends of $750,000 and reported additions to retained earnings of…

A: Dividend paid =$750,000 Addition retained earnings =$2250000 Shares =585000 PE ratio= 16 times

Q: Malit Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: Stockholders are the company's business owners who invest in the company's equity. As a return on…

Q: AUBURN Corporation had 120,000 of ordinary shares issued and outstanding at January 1, 2021. On…

A: Formula: Basic earnings per share = Net income available to Ordinary shareholders / No. of Ordinary…

Q: The financial statements for Highland Corporation included the following selected information:…

A: The additional paid in capital is calculated as total money raised from share issuance less value of…

Q: MJ INC. paid out $44.8 million in total common dividend and reported $289.4 million of retained…

A: “Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: Kelley Company reports $960,000 of net Income and declares \$120,000 of cash dividends on its…

A: Earnings per share refer to the amount earned by each stockholder. This can be identified by…

Q: Atanfo LTD made a profit for the year ended 31 March 2020 of Gh 30,000. During that year ,the…

A: Workings: profit earned for the year ended 31 March 2020 is Gh 30,000.

Q: On January 1, 2021, Paver Corporation had 84,000 common shares, recorded at $659,000, and retained…

A: Calculation of the number of common shares at the end of the year:- Number of common shares:-…

Q: #22 At the beginning of the current year, Flor company had retained earnings of P4,800,000. During…

A: Retained Earnings - Retained Earnings is the amount accumulated by the company over a period of…

Q: The accounts below appear in the current year-end trial balance of Trogss Company: Accounts payable…

A: Net income = sales - total expenses = 16000000 - 12480000 = 3520000 Ending retained earnings balance…

Q: Longmont Corporation earned net income of $85,000 this year. The company began the year with 700…

A: Formula: EPS = ( Net income - Preferred dividend) / ( Outstanding common shares )

Q: Fischer Company has outstanding 8,000 shares of $100 par value, 5% preferred stock, and 50,000…

A: Dividends: This is the amount of cash distributed to stockholders by a company out its earnings,…

Q: The Harbinger Corporation reported net income of $6 million and total assets of $7 million in its…

A: Earnings per share (EPS): The amount of net income available to each shareholder per common share…

Q: Mangold Corporation reported income from continuing operations of $78,400 and loss from…

A: Formula: EPS = ( Income from operations - Loss from discontinuing segment ) / Common shares…

Q: Richards Corporation had net income of $241,562 and paid dividends to common stockholders of…

A: Price earning ratio is calculated as market value of share divided by earning per share. Earning per…

Q: ST Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: Given, Balance in retained earnings = 175,000 Cash balance = 350,000

Q: For its fiscal year- end, Calvan Water Corporation (CWC) reported net income of $12 million and a…

A: Before calculating diluted EPS, you need to calculate number of common stock increse due to…

Q: Clair, Inc reports net income of $700,000. It declares and pays dividends of $100,000 for the year,…

A: Given that, Net income = $700000 Preference dividend = $50000 Common stock dividend = $50000 The…

Q: Mara Company provided the following data at year-end: Authorized share capital 5,000,000 Unissued…

A: Shareholders' equity in the balance sheet represents the amount which can be obtained by deducting…

Q: McDonnell-Myer Corporation reported net income of 3180 million. the company had 584 million common…

A: Definition: Earnings per share (EPS): The amount of net income available to each shareholder per…

Q: Benkart Corporation has sales of \$5,000,000 , net Income of 800,000, total assets of \$2,000,000 ,…

A: A ratio that provides information regarding the share price of a company by relating it to the…

Q: AUBURN Corporation had 120,000 of ordinary shares issued and January 2 of the same year, the company…

A: Earnings per share represent the earnings held in hands of each shareholder of the company. It is…

Q: The total income since incorporation is P420,000. The total cash dividends paid is P130,000. The…

A: Retained earnings or accumulated profit is the shareholder's equity component which states the…

Q: Malit Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: The dividend is declared by the company from the available retained earnings.

Q: At the end of this fiscal year, ABC Company's balance sheet showed $5,470,208 of long term debt,…

A: Market value of capital = Market value of long term debt + Market value of equity shares and…

Q: Ecker Company reports $2,700,000 of net income and declares $388,020 of cash dividends on its…

A: Earnings per share (EPS): The amount of net income available to each shareholder per common share…

Q: Quaker State Wings has 245,000 shares outstanding and net income of $905,000. The company stock is…

A: The share price is the current market price of the share. It is the price of the share at any…

Q: Houghton Company has the following items: share capital- ordinary, $820,000; treasury shares,…

A: Shareholder's equity represents the residual amount that the business owners would receive after all…

Q: National Company has 100,000 shares of P10 par value common stock issued and outstanding. Total…

A: Earning Per Share = Net incomeNumber of shares outstanding =…

Q: Kawther Inc. has net income of $200,000, average equity/ordinary shares outstanding of 40,000, and…

A: Earnings per share = (Net Income - preferred dividend) /ordinary shares outstanding

Q: Husain Corporation has the following account it trial balance at the end of year: Retained earnings…

A: Balance sheet is defined as the financial statement which reports the shareholders' equity, assets…

Q: The year-end balance sheet of Pointe Company shows average Pointe shareholders’ equity attributable…

A: Given: Net income = $2,513 Equity = $7,997

Q: Cell Enterprise Corporation reported $55 million of net income and $320 million of retained earnings…

A: Given, Net income = $55 million Ending Retained earnings = $320 million Beginning retained earnings…

Q: Junior Berhad is a company that, during the year ended 31 December2020, paid RM25,000 debenture…

A: Profit of the business can be calculated by subtracting all the costs from the total sales revenue…

Q: Malit Corporation has a total shareholders' equity of P1,000,000, including retained earnings of…

A: >The stockholders are the owner of the corporation who invest their money in the common stock of…

Q: AUBURN Corporation had 120,000 of ordinary shares issued and outstanding at January 1, 2021. On On…

A: Earnings per share indicate the profits per share of common stockholders. It can be calculated by…

Q: Tezos Co. reported the following capital structure at the beginning of the current year: Ordinary…

A: Net income means PAT i.e Profit after taxation. Particulars Amount PAT 1,920,000 Less:…

Q: ezos Co. reported the following capital structure at the beginning of the current year= ordinary…

A: EPS is calculated by taking into account the earnings available for equity shareholders. WHERE,…

Q: Arya Inc.'s latest net income was $1,250,000, and it had 225,000 shares outstanding. The company…

A: Net income = $ 1,250,000 Number of shares = 225,000 Payout ratio = 45%

Q: Requirements 1. Compute the average ordinary shares outstanding 2. Present the basic earnings per…

A: Average ordinary shares outstanding refers to the total number of common shares that a company…

Q: Helio Co. has retained earnings at the beginning of the current year of $400,000. During the current…

A: First, compute the dividends paid as shown below: Dividends paid = 50,000*$1.00 Dividends paid =…

Q: On January 1, 2021, Eugene Co. had retained earnings of P1,240,000. During 2021, the co. earned net…

A: Retained earnings balances are adjusted for many reasons. This is the summary of retained earnings.…

Step by step

Solved in 2 steps

- Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?

- Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Longmont Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the numerator of the EPS calculation for Longmont?