Risk-free rate (rRF) Q1 Market risk premium (RPM) Q2 Happy Corp. stock’s beta Q3 Required rate of return on Happy Corp. stock Q4 An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.’s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst’s prediction. Happy Corp.’s new required rate of return is Q5.____ The SML helps determine the risk-aversion level among investors. The higher the level of risk aversion, the Q6.____ the slope of the SML. Q7. Which of the following statements best describes a shift in the SML caused by increased risk aversion? The risk-free rate will remain constant. The risk-free rate will increase. The risk-free rate will decrease. Please refer the graph and help me mouse over the points on the graph to see their coordinates. Q1. Option 1 7.6% or Option 2 4.0% or Option 3 2.2% or Option 4 4.4% Q2. Option 1 10.8% or Option 2 4.5% or Option 3 6.0% or Option 4 7.8% Q3. Option 1 1.0 or Option 2 0.6 or Option 3 1.4 or Option 4 0.2 Q4. Option 1 9.5% or Option 2 6.5% or Option 3 7.6% or Option 4 6.8% Q5. Option 1 10.6% or Option 2 6.7% Option 3 9.6% or Option 4 22.1% Q6. Option 1 Flatter or Option 2 Steeper.

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

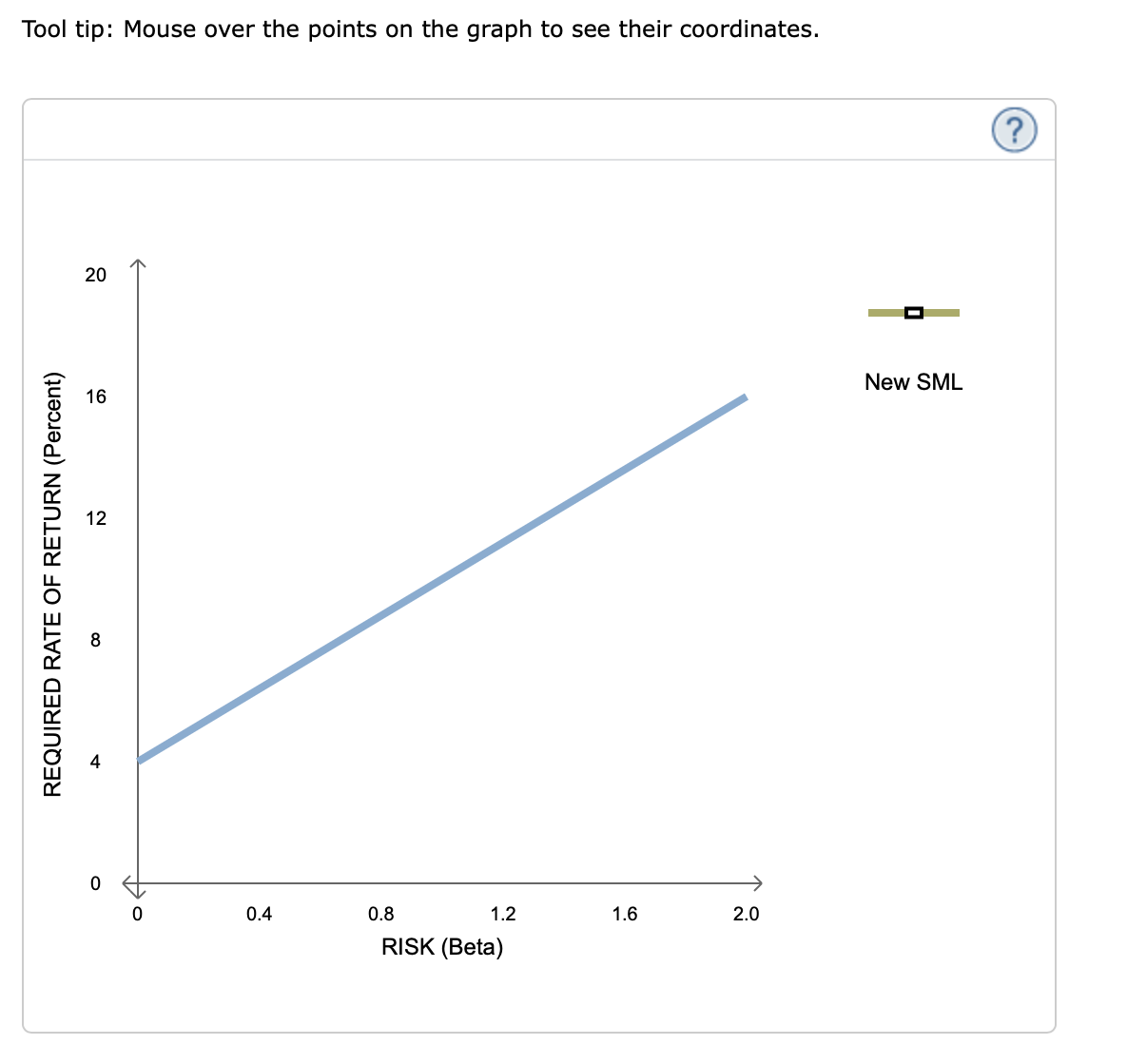

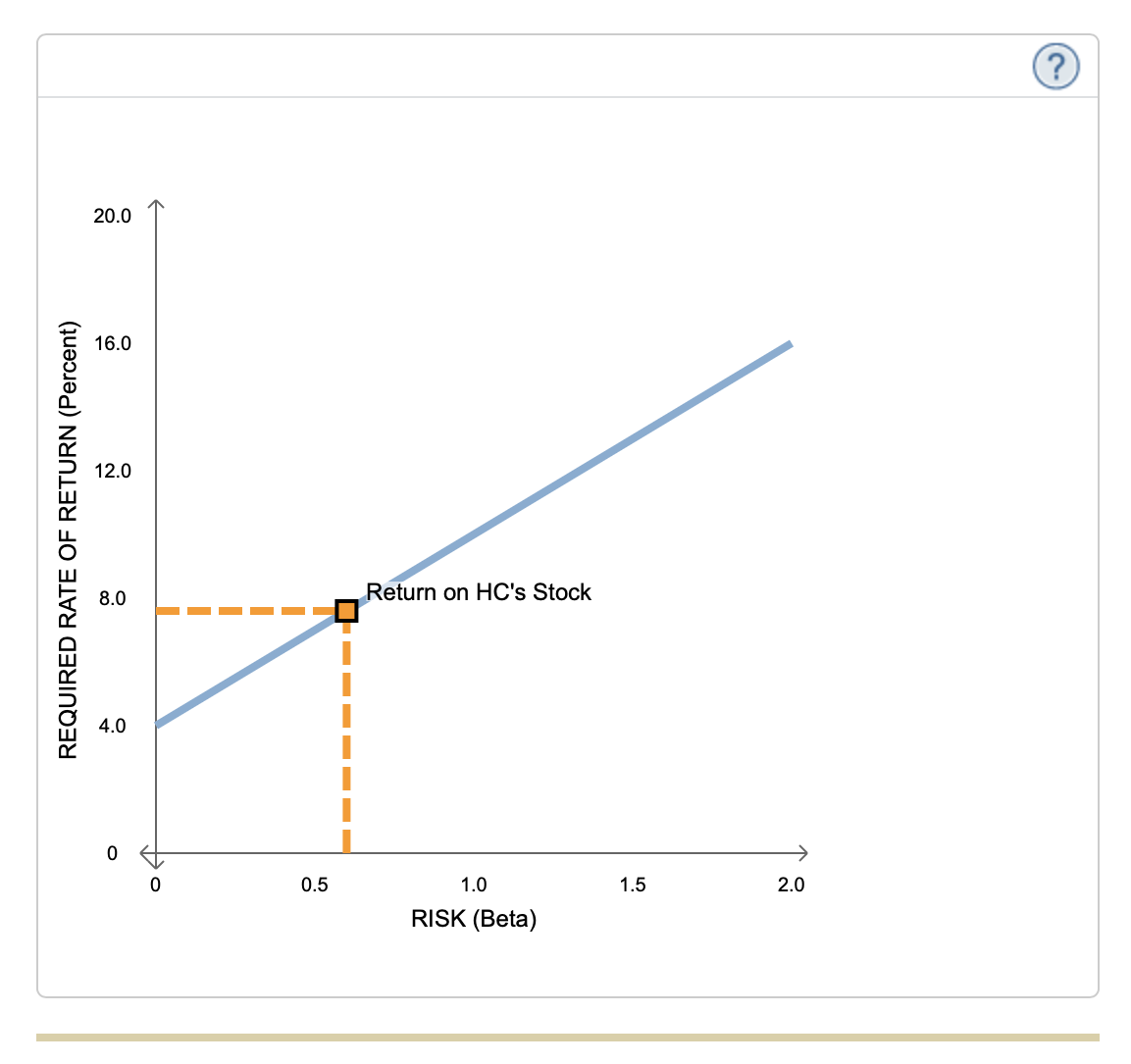

The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows:

| CAPM Elements | Value |

|---|---|

| Risk-free rate (rRF) | Q1 |

| Market risk premium (RPM) | Q2 |

| Happy Corp. stock’s beta | Q3 |

| Required |

Q4 |

An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the

Calculate Happy Corp.’s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst’s prediction.

Happy Corp.’s new required rate of return is Q5.____

The SML helps determine the risk-aversion level among investors. The higher the level of risk aversion, the Q6.____ the slope of the SML.

Q7. Which of the following statements best describes a shift in the SML caused by increased risk aversion?

The risk-free rate will remain constant.

The risk-free rate will increase.

The risk-free rate will decrease.

Please refer the graph and help me mouse over the points on the graph to see their coordinates.

Q1. Option 1 7.6% or Option 2 4.0% or Option 3 2.2% or Option 4 4.4%

Q2. Option 1 10.8% or Option 2 4.5% or Option 3 6.0% or Option 4 7.8%

Q3. Option 1 1.0 or Option 2 0.6 or Option 3 1.4 or Option 4 0.2

Q4. Option 1 9.5% or Option 2 6.5% or Option 3 7.6% or Option 4 6.8%

Q5. Option 1 10.6% or Option 2 6.7% Option 3 9.6% or Option 4 22.1%

Q6. Option 1 Flatter or Option 2 Steeper.

Please refer to the attached graph for more information and answer everything. I can separate the questions because they are part of the set. Thank you

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images