riton Company provided the following information concerning a defined at the beginning of current year prior to the adoption of revised PAS 19: De Fair value of plan assets 4,750,000 Unamortized past service cost 1,250,0 Projected benefit obligation Unrecognized actuarial gain 5,500,000 850,0 ransactions for the current year relating to the defined benefit plan are as Current service cost 925,000 Discount rate 6% Actual return on plan ass 485,000 1,350,000 995,000 Contribution to the plan Benefits paid to ret

riton Company provided the following information concerning a defined at the beginning of current year prior to the adoption of revised PAS 19: De Fair value of plan assets 4,750,000 Unamortized past service cost 1,250,0 Projected benefit obligation Unrecognized actuarial gain 5,500,000 850,0 ransactions for the current year relating to the defined benefit plan are as Current service cost 925,000 Discount rate 6% Actual return on plan ass 485,000 1,350,000 995,000 Contribution to the plan Benefits paid to ret

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 7RE

Related questions

Question

Asap

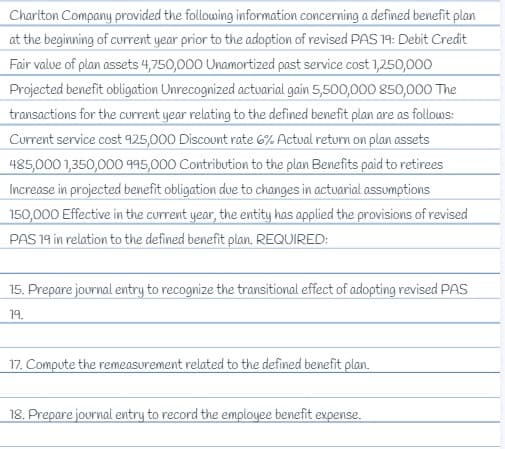

Transcribed Image Text:Charlton Company provided the following information concerning a defined benefit plan

at the beginning of current year prior to the adoption of revised PAS 19: Debit Credit

Fair value of plan assets 4,750,000 Unamortized past service cost 1,250,000

Projected benefit obligation Unrecognized actuarial gain 5,500,000 850,000 The

transactions for the current year relating to the defined benefit plan are as follows:

Current service cost 925,000 Discount rate 6% Actual return on plan assets

485,000 1,350,000 995,000 Contribution to the plan Benefits paid to retirees

Increase in projected benefit obligation due to changes in actuarial assumptions

150,000 Effective in the current year, the entity has applied the provisions of revised

PAS 19 in relation to the defined benefit plan. REQUIRED:

15. Prepare journal entry to recognize the transitional effect of adopting revised PAS

19.

17. Compute the remeasurement related to the defined benefit plan.

18. Prepare journal entry to record the employee benefit expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT