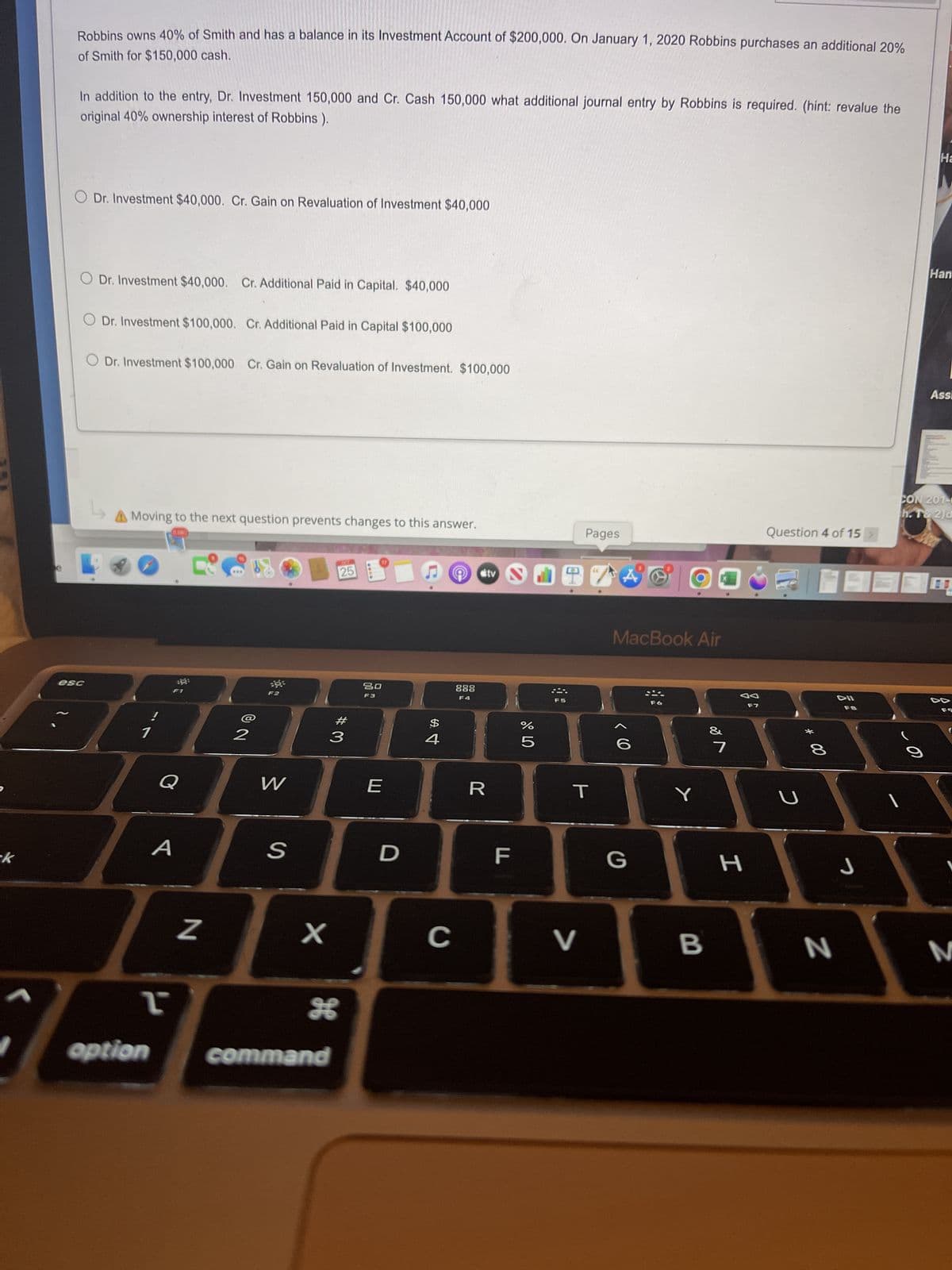

Robbins owns 40% of Smith and has a balance in its Investment Account of $200,000. On January 1, 2020 Robbins purchases an additional 20% of Smith for $150,000 cash. In addition to the entry, Dr. Investment 150,000 and Cr. Cash 150,000 what additional journal entry by Robbins is required. (hint: revalue the original 40% ownership interest of Robbins). O Dr. Investment $40,000. Cr. Gain on Revaluation of Investment $40,000 O Dr. Investment $40,000. Cr. Additional Paid in Capital. $40,000 Dr. Investment $100,000. Cr. Additional Paid in Capital $100,000 Dr. Investment $100,000 Cr. Gain on Revaluation of Investment. $100,000

Robbins owns 40% of Smith and has a balance in its Investment Account of $200,000. On January 1, 2020 Robbins purchases an additional 20% of Smith for $150,000 cash. In addition to the entry, Dr. Investment 150,000 and Cr. Cash 150,000 what additional journal entry by Robbins is required. (hint: revalue the original 40% ownership interest of Robbins). O Dr. Investment $40,000. Cr. Gain on Revaluation of Investment $40,000 O Dr. Investment $40,000. Cr. Additional Paid in Capital. $40,000 Dr. Investment $100,000. Cr. Additional Paid in Capital $100,000 Dr. Investment $100,000 Cr. Gain on Revaluation of Investment. $100,000

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 22P

Related questions

Question

Transcribed Image Text:k

Robbins owns 40% of Smith and has a balance in its Investment Account of $200,000. On January 1, 2020 Robbins purchases an additional 20%

of Smith for $150,000 cash.

In addition to the entry, Dr. Investment 150,000 and Cr. Cash 150,000 what additional journal entry by Robbins is required. (hint: revalue the

original 40% ownership interest of Robbins).

O Dr. Investment $40,000. Cr. Gain on Revaluation of Investment $40,000

O Dr. Investment $40,000. Cr. Additional Paid in Capital. $40,000

esc

Dr. Investment $100,000. Cr. Additional Paid in Capital $100,000

Dr. Investment $100,000 Cr. Gain on Revaluation of Investment. $100,000

↳

Moving to the next question prevents changes to this answer.

$180

!

1

option

A

P

N

#

3

5088AAG

2

W

S

X

H

25

command

20

E

D

$

4

888

F4

C

tv

R

F

%

Pages

T

V

A

MacBook Air

G

Y

B

&

7

H

F7

Question 4 of 15

コ

*00

8

N

DII

F8

J

Ha

Han

Assi

CON 201-0

h. T& 2)d

FO

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT