roblem Schedule of Goods Manufactured; Income Statement; Cost Behavi -оз, LO4, LO5] Carlton Manufacturing Company provided the following details about operations in February: Purchases of raw naterials $178, 000 Maintenance, factory Direct labour 41, 800 35, 700 61, 400 Depreciation, factory equipment Indirect naterials, factory Selling and administrative salaries Utilities, factory Sales commissions Insurance, factory equipment Depreciation, sales equipment 3, 800 47, 300 29, 200 19, 100 4, 800 23, 200

roblem Schedule of Goods Manufactured; Income Statement; Cost Behavi -оз, LO4, LO5] Carlton Manufacturing Company provided the following details about operations in February: Purchases of raw naterials $178, 000 Maintenance, factory Direct labour 41, 800 35, 700 61, 400 Depreciation, factory equipment Indirect naterials, factory Selling and administrative salaries Utilities, factory Sales commissions Insurance, factory equipment Depreciation, sales equipment 3, 800 47, 300 29, 200 19, 100 4, 800 23, 200

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 15.9EX: Classifying costs The following is a manufacturing cost report of Marching Ants Inc. Evaluate and...

Related questions

Question

100%

Please illustrate how to calculated rent factory building, thanks

![Problem 2-24 Schedule of Cost of Goods Manufactured; Income Statement; Cost Behaviour [LO1, LO2,

LO3, LO4, LO5]

Carlton Manufacturing Company provided the following details about operations in February:

$178, 000

41, 800

35, 700

61, 400

3, 800

47, 300

29, 200

19, 100

4, 800

23, 200

115, 500

Purchases of raw materials

Maintenance, factory

Direct labour

Depreciation, factory equipment

Indirect materials, factory

Selling and administrative salaries

Utilities, factory

Sales commissions

Insurance, factory equipment

Depreciation, sales equipment

Advertising expenses

Rent, factory building

The company also provided details regarding the balances in the inventory accounts at the beginning and end of the month as follows:

Beginning

of Month

$ 41, 000

End of

Month

Raw materials

Work in process

Finished goods

30, 400

23, 000

?

Raw materials used in production cost $192,920, total overhead costs for the year were $219,920, the goods available for sale totalled

$424,000, and the cost of goods sold totalled $365,500.

Required:

1-a. Prepare a schedule of cost of goods manufactured of the company's income statement for the year.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F517c093b-3e51-490c-a74b-f2bff995cd4c%2F89cbb8af-945b-4b8d-9012-d96f0592c89c%2Fwazcsvj_processed.png&w=3840&q=75)

Transcribed Image Text:Problem 2-24 Schedule of Cost of Goods Manufactured; Income Statement; Cost Behaviour [LO1, LO2,

LO3, LO4, LO5]

Carlton Manufacturing Company provided the following details about operations in February:

$178, 000

41, 800

35, 700

61, 400

3, 800

47, 300

29, 200

19, 100

4, 800

23, 200

115, 500

Purchases of raw materials

Maintenance, factory

Direct labour

Depreciation, factory equipment

Indirect materials, factory

Selling and administrative salaries

Utilities, factory

Sales commissions

Insurance, factory equipment

Depreciation, sales equipment

Advertising expenses

Rent, factory building

The company also provided details regarding the balances in the inventory accounts at the beginning and end of the month as follows:

Beginning

of Month

$ 41, 000

End of

Month

Raw materials

Work in process

Finished goods

30, 400

23, 000

?

Raw materials used in production cost $192,920, total overhead costs for the year were $219,920, the goods available for sale totalled

$424,000, and the cost of goods sold totalled $365,500.

Required:

1-a. Prepare a schedule of cost of goods manufactured of the company's income statement for the year.

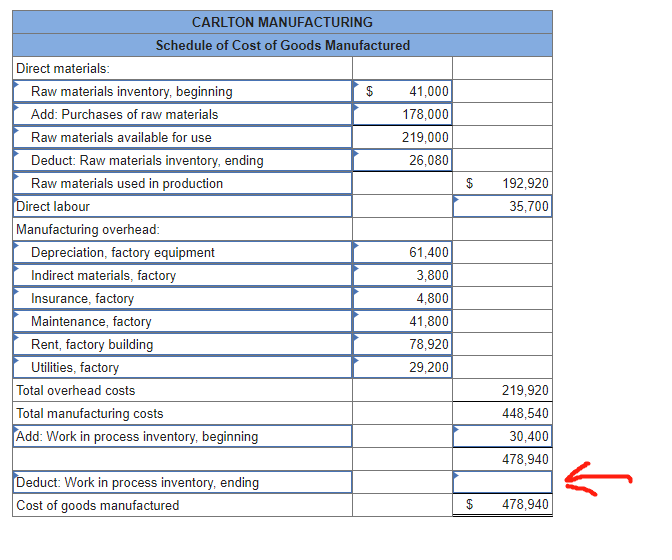

Transcribed Image Text:CARLTON MANUFACTURING

Schedule of Cost of Goods Manufactured

Direct materials:

Raw materials inventory, beginning

$

41,000

Add: Purchases of raw materials

178,000

Raw materials available for use

219,000

Deduct: Raw materials inventory, ending

26,080

Raw materials used in production

$

192,920

Direct labour

Manufacturing overhead:

Depreciation, factory equipment

35,700

61,400

Indirect materials, factory

3,800

Insurance, factory

4,800

Maintenance, factory

41,800

Rent, factory building

78,920

29,200

Utilities, factory

Total overhead costs

Total manufacturing costs

Add: Work in process inventory, beginning

219,920

448,540

30,400

478,940

Deduct: Work in process inventory, ending

Cost of goods manufactured

$

478,940

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning