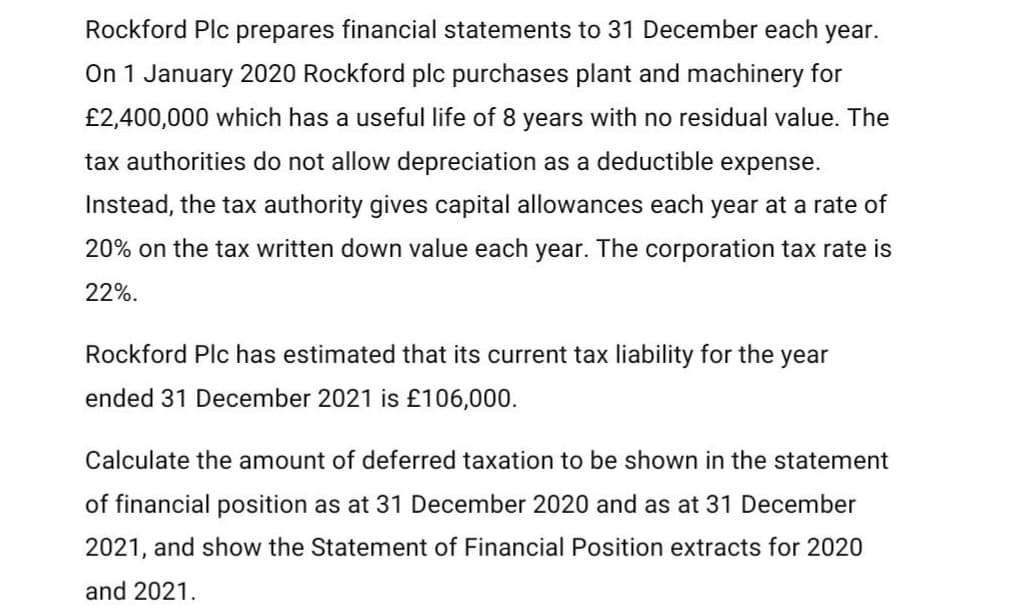

Rockford Plc prepares financial statements to 31 December each year. On 1 January 2020 Rockford plc purchases plant and machinery for £2,400,000 which has a useful life of 8 years with no residual value. The tax authorities do not allow depreciation as a deductible expense. Instead, the tax authority gives capital allowances each year at a rate of 20% on the tax written down value each year. The corporation tax rate is 22%. Rockford Plc has estimated that its current tax liability for the year ended 31 December 2021 is £106,000. Calculate the amount of deferred taxation to be shown in the statement of financial position as at 31 December 2020 and as at 31 December 2021, and show the Statement of Financial Position extracts for 2020 and 2021.

Rockford Plc prepares financial statements to 31 December each year. On 1 January 2020 Rockford plc purchases plant and machinery for £2,400,000 which has a useful life of 8 years with no residual value. The tax authorities do not allow depreciation as a deductible expense. Instead, the tax authority gives capital allowances each year at a rate of 20% on the tax written down value each year. The corporation tax rate is 22%. Rockford Plc has estimated that its current tax liability for the year ended 31 December 2021 is £106,000. Calculate the amount of deferred taxation to be shown in the statement of financial position as at 31 December 2020 and as at 31 December 2021, and show the Statement of Financial Position extracts for 2020 and 2021.

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 70IIP

Related questions

Question

Transcribed Image Text:Rockford Plc prepares financial statements to 31 December each year.

On 1 January 2020 Rockford plc purchases plant and machinery for

£2,400,000 which has a useful life of 8 years with no residual value. The

tax authorities do not allow depreciation as a deductible expense.

Instead, the tax authority gives capital allowances each year at a rate of

20% on the tax written down value each year. The corporation tax rate is

22%.

Rockford Plc has estimated that its current tax liability for the year

ended 31 December 2021 is £106,000.

Calculate the amount of deferred taxation to be shown in the statement

of financial position as at 31 December 2020 and as at 31 December

2021, and show the Statement of Financial Position extracts for 2020

and 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning