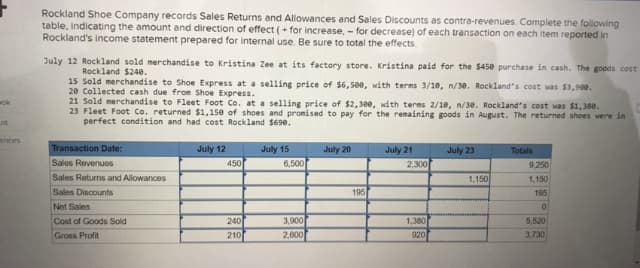

Rockland Shoe Company records Sales Returns and Allowances and Sales Discounts as contra-revenues. Complete the following table, indicating the amount and direction of effect (+ for increase, - for decrease) of each transaction on each item reported in Rockland's income statement prepared for internal use Be sure to total the effects. July 12 Rockland sold merchandise to Kristina Zee at its factory store. Kristina paid for the 545e purchase in cash. The goods cos Rockland $240. 15 Sold merchandise to Shoe Express ata selling price of $6,500, ith terms 3/1e, n/3e. Rockland's cost was $3,00. 20 Collected cash due fron Shoe Express. 21 Sold merchandise to Fleet Foot Co. at a selling price of $2,300, with terms 2/10, /30. Rockland's cost was $1,380. 23 Fleet Foot Co. returned $1,150 of shoes and promised to pay for the renaining goods in August. The returned shoes were in perfect condition and had cost Rockland $690. Transaction Date: July 12 July 15 July 20 July 21 July 23 Totals Sales Revenues Sales Retums and Allowances Sales Discounts 450 6,500 2,300 9.250 1.150 1,150 195 195 Net Sales 240 210 3.900 2.600 Cost of Goods Sold 1.380 5.520 Gross Profit 920 3,730

Rockland Shoe Company records Sales Returns and Allowances and Sales Discounts as contra-revenues. Complete the following table, indicating the amount and direction of effect (+ for increase, - for decrease) of each transaction on each item reported in Rockland's income statement prepared for internal use Be sure to total the effects. July 12 Rockland sold merchandise to Kristina Zee at its factory store. Kristina paid for the 545e purchase in cash. The goods cos Rockland $240. 15 Sold merchandise to Shoe Express ata selling price of $6,500, ith terms 3/1e, n/3e. Rockland's cost was $3,00. 20 Collected cash due fron Shoe Express. 21 Sold merchandise to Fleet Foot Co. at a selling price of $2,300, with terms 2/10, /30. Rockland's cost was $1,380. 23 Fleet Foot Co. returned $1,150 of shoes and promised to pay for the renaining goods in August. The returned shoes were in perfect condition and had cost Rockland $690. Transaction Date: July 12 July 15 July 20 July 21 July 23 Totals Sales Revenues Sales Retums and Allowances Sales Discounts 450 6,500 2,300 9.250 1.150 1,150 195 195 Net Sales 240 210 3.900 2.600 Cost of Goods Sold 1.380 5.520 Gross Profit 920 3,730

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 4PA: The following transactions relate to Hawkins, Inc., an office store wholesaler, during June of this...

Related questions

Topic Video

Question

Transcribed Image Text:Rockland Shoe Company records Sales Returns and Allowances and Sales Discounts as contra-revenues. Complete the following

table, indicating the amount and direction of effect (+ for increase, - for decrease) of each transaction on each item reported in

Rockland's income statement prepared for internal use. Be sure to total the effects.

July 12 Rockland sold merchandise to Kristina Zee at its factory store. Kristina paid for the $450 purchase in cash. The goods cost

Rockland $24e.

15 Sold merchandise to Shoe Express at a selling price of $6,500, with terms 3/10, n/30. Rockland's cost was $3,900.

20 Collected cash due from Shoe Express.

21 Sold merchandise to Fleet Foot Co. at a selling price of $2, 300, with terms 2/10, n/3e. Rockland's cost was $1,380.

23 Fleet Foot Co. returned $1,150 of shoes and promised to pay for the renaining goods in August. The returned shoes were in

perfect condition and had cost Rockland $690.

wok

ences

Transaction Date:

July 15

6,500

July 12

July 20

July 21

July 23

Totals

Sales Revenues

Sales Returns and Allowances

Sales Discounts

Net Sales

450

2,300

9.250

1.150

1,150

195

195

3,900

2,600

Cost of Goods Sold

240

1.380

5,520

Gross Profit

210

920

3,730

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College