Rodriguez Company pays $410,670 for real estate with land, land improvements, and a building. Land is appraised at $189,000; land improvements are appraised at $42,000; and the building is appraised at $189,000. 1. A 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among t

Rodriguez Company pays $410,670 for real estate with land, land improvements, and a building. Land is appraised at $189,000; land improvements are appraised at $42,000; and the building is appraised at $189,000. 1. A 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among t

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 7E: Loban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for...

Related questions

Question

do not give solution in image format

Transcribed Image Text:ces

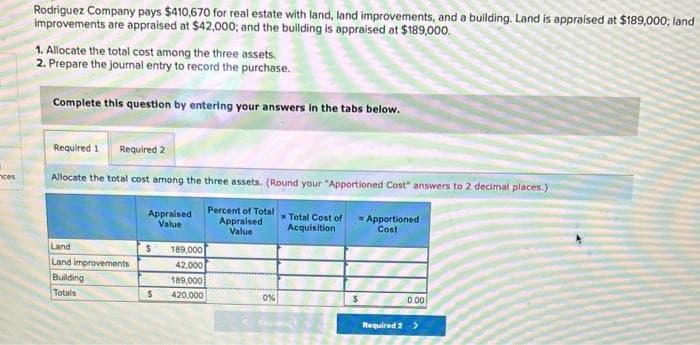

Rodriguez Company pays $410,670 for real estate with land, land improvements, and a building. Land is appraised at $189,000; land

improvements are appraised at $42,000; and the building is appraised at $189,000.

1. Allocate the total cost among the three assets.

2. Prepare the journal entry to record the purchase.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Allocate the total cost among the three assets. (Round your "Apportioned Cost" answers to 2 decimal places.)

Percent of Total

Appraised

Value

Land

Land improvements

Building

Totals

Appraised

Value

$

$

189,000

42,000

189,000

420,000

0%

* Total Cost of

Acquisition

= Apportioned

Cost

$

0.00

Required 2 >

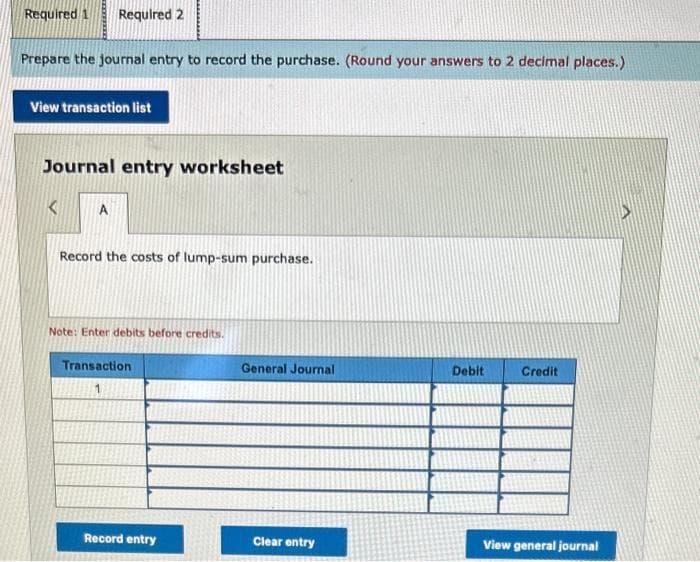

Transcribed Image Text:Required 1 Required 2

Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places.)

View transaction list

Journal entry worksheet

A

Record the costs of lump-sum purchase.

Note: Enter debits before credits.

Transaction

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College