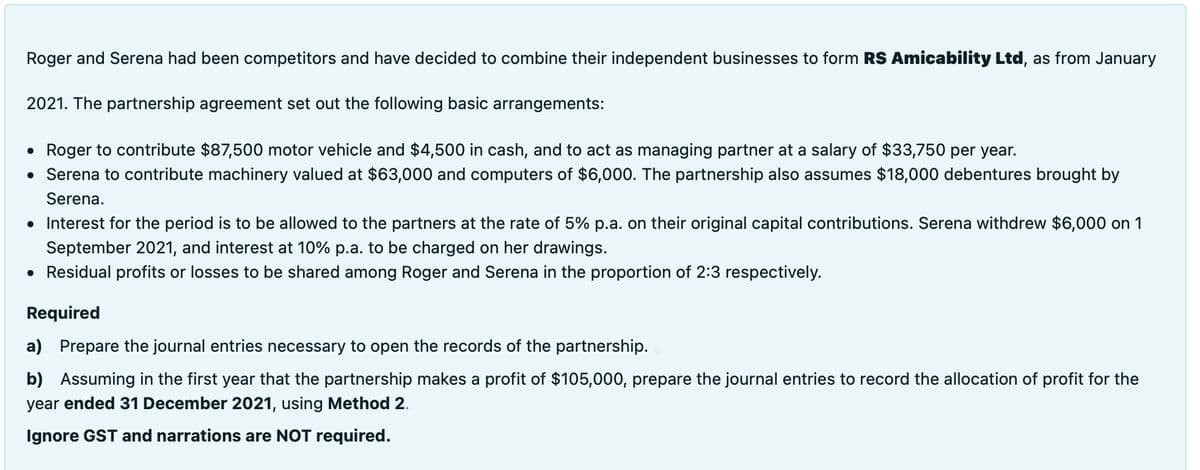

Roger and Serena had been competitors and have decided to combine their independent businesses to form RS Amicability Ltd, as from January 2021. The partnership agreement set out the following basic arrangements: • Roger to contribute $87,500 motor vehicle and $4,500 in cash, and to act as managing partner at a salary of $33,750 per year. • Serena to contribute machinery valued at $63,000 and computers of $6,000. The partnership also assumes $18,000 debentures brought by Serena. • Interest for the period is to be allowed to the partners at the rate of 5% p.a. on their original capital contributions. Serena withdrew $6,000 on 1 September 2021, and interest at 10% p.a. to be charged on her drawings. • Residual profits or losses to be shared among Roger and Serena in the proportion of 2:3 respectively. Required a) Prepare the journal entries necessary to open the records of the partnership. b) Assuming in the first year that the partnership makes a profit of $105,000, prepare the journal entries to record the allocation of profit for the year ended 31 December 2021, using Method 2. Ignore GST and narrations are NOT required.

Roger and Serena had been competitors and have decided to combine their independent businesses to form RS Amicability Ltd, as from January 2021. The partnership agreement set out the following basic arrangements: • Roger to contribute $87,500 motor vehicle and $4,500 in cash, and to act as managing partner at a salary of $33,750 per year. • Serena to contribute machinery valued at $63,000 and computers of $6,000. The partnership also assumes $18,000 debentures brought by Serena. • Interest for the period is to be allowed to the partners at the rate of 5% p.a. on their original capital contributions. Serena withdrew $6,000 on 1 September 2021, and interest at 10% p.a. to be charged on her drawings. • Residual profits or losses to be shared among Roger and Serena in the proportion of 2:3 respectively. Required a) Prepare the journal entries necessary to open the records of the partnership. b) Assuming in the first year that the partnership makes a profit of $105,000, prepare the journal entries to record the allocation of profit for the year ended 31 December 2021, using Method 2. Ignore GST and narrations are NOT required.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Roger and Serena had been competitors and have decided to combine their independent businesses to form RS Amicability Ltd, as from January

2021. The partnership agreement set out the following basic arrangements:

• Roger to contribute $87,500 motor vehicle and $4,500 in cash, and to act as managing partner at a salary of $33,750 per year.

• Serena to contribute machinery valued at $63,000 and computers of $6,000. The partnership also assumes $18,000 debentures brought by

Serena.

• Interest for the period is to be allowed to the partners at the rate of 5% p.a. on their original capital contributions. Serena withdrew $6,000 on 1

September 2021, and interest at 10% p.a. to be charged on her drawings.

• Residual profits or losses to be shared among Roger and Serena in the proportion of 2:3 respectively.

Required

a) Prepare the journal entries necessary to open the records of the partnership.

b) Assuming in the first year that the partnership makes a profit of $105,000, prepare the journal entries to record the allocation of profit for the

year ended 31 December 2021, using Method 2.

Ignore GST and narrations are NOT required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning