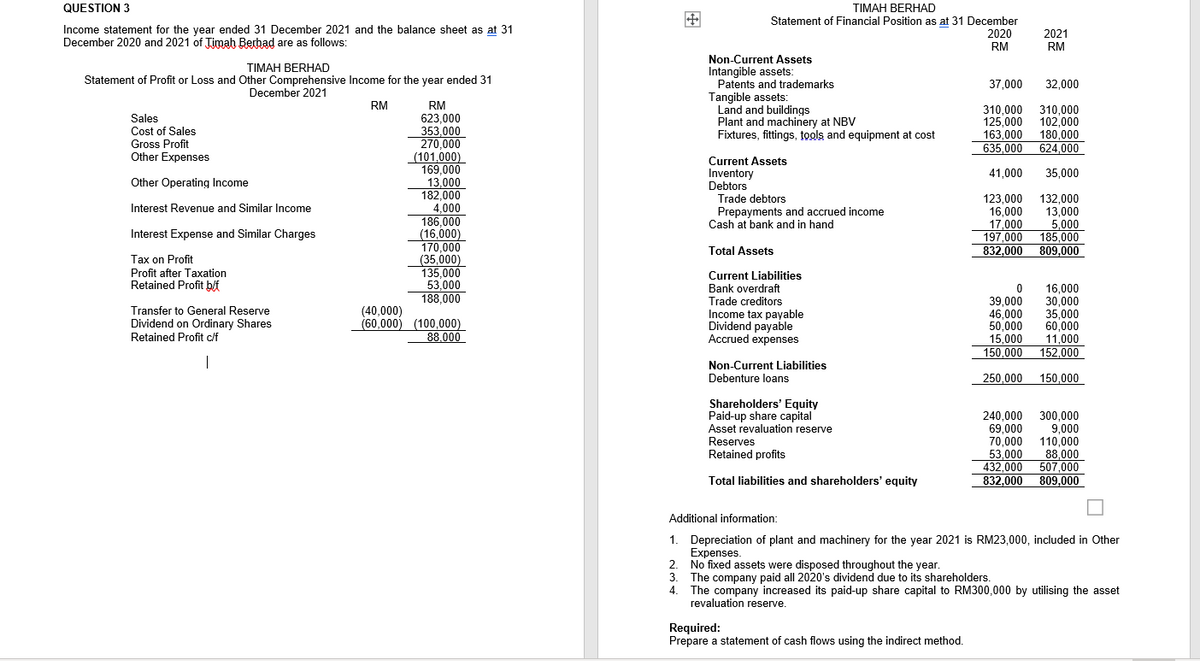

QUESTION 3 Income statement for the year ended 31 December 2021 and the balance sheet as at 31 December 2020 and 2021 of Timah Berhad are as follows: TIMAH BERHAD Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 RM Sales RM 623,000 353,000 Cost of Sales Gross Profit 270.000 Other Expenses (101,000) 169.000 Other Operating Income 13,000 182,000 Interest Revenue and Similar Income 4,000 186,000 Interest Expense and Similar Charges (16,000) 170,000 Tax on Profit (35,000) 135.000 Profit after Taxation Retained Profit b/f 53,000 188,000 (40,000) Transfer to General Reserve Dividend on Ordinary Shares Retained Profit c/f (60,000) (100,000) 88.000 I TIMAH BERHAD Statement of Financial Position as at 31 December 2020 2021 RM RM Non-Current Assets Intangible assets: 37,000 32,000 Patents and trademarks Tangible assets: Land and buildings Plant and machinery at NBV 310,000 310,000 125,000 102,000 163,000 180,000 635,000 624,000 Fixtures, fittings, tools and equipment at cost Current Assets Inventory 41,000 35,000 Debtors Trade debtors 123,000 132,000 Prepayments and accrued income 16,000 13,000 Cash at bank and in hand 17,000 5,000 197,000 185,000 809,000 Total Assets 832.000 Current Liabilities Bank overdraft 0 16,000 Trade creditors 39,000 30,000 Income tax payable 46,000 35,000 50,000 60,000 Dividend payable Accrued expenses 15,000 11,000 150,000 152,000 Non-Current Liabilities Debenture loans 250,000 150,000 240,000 300,000 Shareholders' Equity Paid-up share capital Asset revaluation reserve Reserves 69,000 9,000 70,000 110,000 Retained profits 53,000 88,000 432,000 507,000 Total liabilities and shareholders' equity 832,000 809,000 Additional information: 1. Depreciation of plant and machinery for the year 2021 is RM23,000, included in Other Expenses. 2. No fixed assets were disposed throughout the year. The company paid all 2020's dividend due to its shareholders. 4. The company increased its paid-up share capital to RM300,000 by utilising the asset revaluation reserve. Required: Prepare a statement of cash flows using the indirect method.

QUESTION 3 Income statement for the year ended 31 December 2021 and the balance sheet as at 31 December 2020 and 2021 of Timah Berhad are as follows: TIMAH BERHAD Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2021 RM Sales RM 623,000 353,000 Cost of Sales Gross Profit 270.000 Other Expenses (101,000) 169.000 Other Operating Income 13,000 182,000 Interest Revenue and Similar Income 4,000 186,000 Interest Expense and Similar Charges (16,000) 170,000 Tax on Profit (35,000) 135.000 Profit after Taxation Retained Profit b/f 53,000 188,000 (40,000) Transfer to General Reserve Dividend on Ordinary Shares Retained Profit c/f (60,000) (100,000) 88.000 I TIMAH BERHAD Statement of Financial Position as at 31 December 2020 2021 RM RM Non-Current Assets Intangible assets: 37,000 32,000 Patents and trademarks Tangible assets: Land and buildings Plant and machinery at NBV 310,000 310,000 125,000 102,000 163,000 180,000 635,000 624,000 Fixtures, fittings, tools and equipment at cost Current Assets Inventory 41,000 35,000 Debtors Trade debtors 123,000 132,000 Prepayments and accrued income 16,000 13,000 Cash at bank and in hand 17,000 5,000 197,000 185,000 809,000 Total Assets 832.000 Current Liabilities Bank overdraft 0 16,000 Trade creditors 39,000 30,000 Income tax payable 46,000 35,000 50,000 60,000 Dividend payable Accrued expenses 15,000 11,000 150,000 152,000 Non-Current Liabilities Debenture loans 250,000 150,000 240,000 300,000 Shareholders' Equity Paid-up share capital Asset revaluation reserve Reserves 69,000 9,000 70,000 110,000 Retained profits 53,000 88,000 432,000 507,000 Total liabilities and shareholders' equity 832,000 809,000 Additional information: 1. Depreciation of plant and machinery for the year 2021 is RM23,000, included in Other Expenses. 2. No fixed assets were disposed throughout the year. The company paid all 2020's dividend due to its shareholders. 4. The company increased its paid-up share capital to RM300,000 by utilising the asset revaluation reserve. Required: Prepare a statement of cash flows using the indirect method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 60APSA: Problem 1-60A Income Statement and Balance Sheet The following information for Rogers Enterprises is...

Related questions

Question

Transcribed Image Text:QUESTION 3

Income statement for the year ended 31 December 2021 and the balance sheet as at 31

December 2020 and 2021 of Timah Berhad are as follows:

TIMAH BERHAD

Statement of Profit or Loss and Other Comprehensive Income for the year ended 31

December 2021

RM

Sales

RM

623,000

353,000

Cost of Sales

Gross Profit

270,000

Other Expenses

(101,000)

169.000

Other Operating Income

13,000

182,000

Interest Revenue and Similar Income

4,000

186,000

Interest Expense and Similar Charges

(16,000)

170,000

Tax on Profit

(35,000)

Profit after Taxation

135,000

Retained Profit b/f

53,000

188,000

(40,000)

Transfer to General Reserve

Dividend on Ordinary Shares

Retained Profit c/f

(60,000) (100,000)

88.000

|

TIMAH BERHAD

Statement of Financial Position as at 31 December

2020

RM

2021

RM

Non-Current Assets

Intangible assets:

Patents and trademarks

37,000 32,000

Tangible assets:

Land and buildings

310,000

310,000

Plant and machinery at NBV

125,000 102,000

Fixtures, fittings, tools and equipment at cost

163,000 180,000

635,000 624,000

Current Assets

Inventory

41,000

35,000

Debtors

Trade debtors

123,000

132,000

Prepayments and accrued income

16.000

13,000

Cash at bank and in hand

17,000

5,000

197,000

185,000

Total Assets

832,000 809,000

Current Liabilities

Bank overdraft

0

16,000

30,000

Trade creditors

39,000

Income tax payable

46,000

35,000

50,000

60,000

Dividend payable

Accrued expenses

15,000 11,000

150,000

152,000

Non-Current Liabilities

Debenture loans

250,000 150,000

Shareholders' Equity

Paid-up share capital

240,000 300,000

69,000

Asset revaluation reserve

9,000

Reserves

70,000

110,000

Retained profits

53,000

88,000

432,000

507,000

Total liabilities and shareholders' equity

832,000

809,000

Additional information:

1. Depreciation of plant and machinery for the year 2021 is RM23,000, included in Other

Expenses.

2.

No fixed assets were disposed throughout the year.

3.

The company paid all 2020's dividend due to its shareholders.

4.

The company increased its paid-up share capital to RM300,000 by utilising the asset

revaluation reserve.

Required:

Prepare a statement of cash flows using the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub