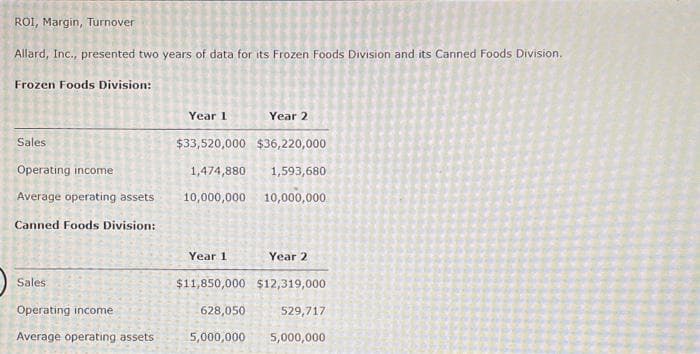

ROI, Margin, Turnover Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division. Frozen Foods Division: Year 1 Year 2 Sales $33,520,000 $36,220,000 Operating income 1,474,880 1,593,680 Average operating assets 10,000,000 10,000,000 Canned Foods Division: Year 1 Year 2 Sales $11,850,000 $12,319,000 Operating income 628,050 529,717 Average operating assets 5,000,000 5,000,000

ROI, Margin, Turnover Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division. Frozen Foods Division: Year 1 Year 2 Sales $33,520,000 $36,220,000 Operating income 1,474,880 1,593,680 Average operating assets 10,000,000 10,000,000 Canned Foods Division: Year 1 Year 2 Sales $11,850,000 $12,319,000 Operating income 628,050 529,717 Average operating assets 5,000,000 5,000,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 37P

Related questions

Question

100%

Transcribed Image Text:ROI, Margin, Turnover

Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division.

Frozen Foods Division:

Year 1

Year 2

Sales

$33,520,000 $36,220,000

Operating income

1,474,880 1,593,680

Average operating assets

10,000,000

10,000,000

Canned Foods Division:

Year 1

Year 2

Sales

$11,850,000 $12,319,000

Operating income

628,050

529,717

Average operating assets

5,000,000

5,000,000

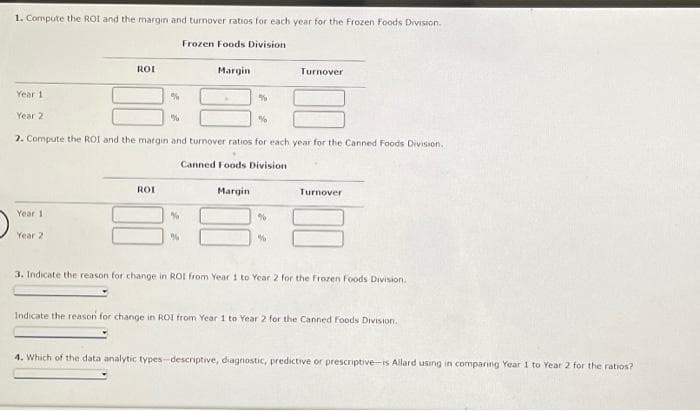

Transcribed Image Text:1. Compute the ROI and the margin and turnover ratios for each year for the Frozen Foods Division.

Frozen Foods Division

ROI

Margin

Turnover

Year 11

%

%

Year 2

%

%

2. Compute the ROI and the margin and turnover ratios for each year for the Canned Foods Division..

Canned Foods Division

ROI

Turnover

Margin

%

Year 1

%

Year 2

%

%

3. Indicate the reason for change in ROI from Year 1 to Year 2 for the Frozen Foods Division.

Indicate the reason for change in ROI from Year 1 to Year 2 for the Canned Foods Division.

4. Which of the data analytic types-descriptive, diagnostic, predictive or prescriptive-is Allard using in comparing Year 1 to Year 2 for the ratios?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,