roneously debited to Building of an account receivable by nonth was omitted. quisition of office equipment or r cash but made no record of th

roneously debited to Building of an account receivable by nonth was omitted. quisition of office equipment or r cash but made no record of th

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter11: Auditing Inventory, Goods And Services, And Accounts Payable: The Acquisition And Payment Cycle

Section: Chapter Questions

Problem 7CYBK

Related questions

Topic Video

Question

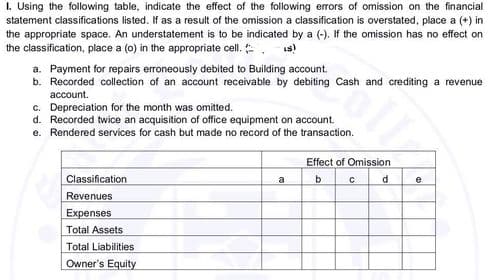

Transcribed Image Text:I. Using the following table, indicate the effect of the following errors of omission on the financial

statement classifications listed. If as a result of the omission a classification is overstated, place a (+) in

the appropriate space. An understatement is to be indicated by a (-). If the omission has no effect on

the classification, place a (0) in the appropriate cell. .

a. Payment for repairs erroneously debited to Building account.

b. Recorded collection of an account receivable by debiting Cash and crediting

revenue

асcount.

c. Depreciation for the month was omitted.

d. Recorded twice an acquisition of office equipment on account.

e. Rendered services for cash but made no record of the transaction.

Effect of Omission

Classification

a

b.

e

Revenues

Expenses

Total Assets

Total Liabilities

Owner's Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning