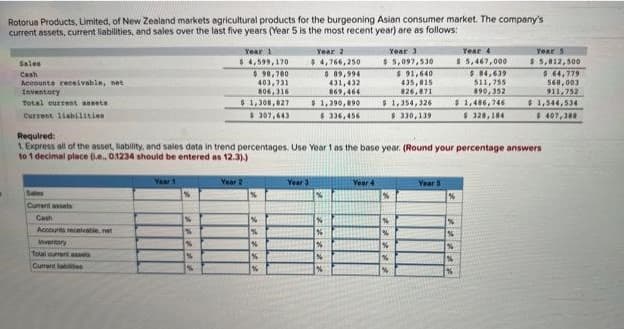

Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales cash Accounts receivable, net Inventory Total current assets Current liabilities Sales Current assets Accounts receivable net Total curent asses Cument abs Year 1 $4,599,170 $ 98,780 403,731 806,316 $1,308,827 $ 307,643 Required: 1 Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (.e., 0.1234 should be entered as 12.3).) % % 1% Year 2 Year 2 $4,766,250 $89,994 431,432 869,464 $ 1,390,890 $336,456 Year 3 % % % Year 3 $5,097,530 $ 91,640 435,015 826,871 $1,354,326 $ 330,139 Year 4 % % Year 4 $ 5,467,000 $84,639 511,755 890,352 $ 1,486,746 $ 328,184 Year 5 Tear 5 $ 5,812,500 $ 64,779 568,003 911,752 $1,544,534 $ 407,388 %

Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales cash Accounts receivable, net Inventory Total current assets Current liabilities Sales Current assets Accounts receivable net Total curent asses Cument abs Year 1 $4,599,170 $ 98,780 403,731 806,316 $1,308,827 $ 307,643 Required: 1 Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (.e., 0.1234 should be entered as 12.3).) % % 1% Year 2 Year 2 $4,766,250 $89,994 431,432 869,464 $ 1,390,890 $336,456 Year 3 % % % Year 3 $5,097,530 $ 91,640 435,015 826,871 $1,354,326 $ 330,139 Year 4 % % Year 4 $ 5,467,000 $84,639 511,755 890,352 $ 1,486,746 $ 328,184 Year 5 Tear 5 $ 5,812,500 $ 64,779 568,003 911,752 $1,544,534 $ 407,388 %

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.13MCE

Related questions

Question

Transcribed Image Text:Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's

current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows:

Sales

Cash

Accounts receivable, net

Inventory

Total current assets

Current liabilities

Sains

Current assets

Cash

Accounts receivable, net

inventory

Total current asses

Cument labes

Year 1

%

%

%

Year 1

$4,599,170

$ 98,780

403,731

806,316

$1,308,827

$ 307,643

Required:

1, Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers

to 1 decimal place (.e., 0.1234 should be entered as 12.3).)

%

Year 2

%

%

%

%

%

Year 2

$4,766,250

$89,994

431,432

869,464

$1,390,890

$336,456

Year 3

%

%

%

%

%

Year 3

$ 5,097,530

$91,640

435,815

826,871

$1,354,326

$330,139

Year 4

%

%

%

Year 4

$ 5,467,000

$84,639

511,755

890,352

$1,486,746

Year 5

Year 5

$ 5,812,500

%

%

%

64,779

560,003

911,752

$1,544,534

$ 407,308

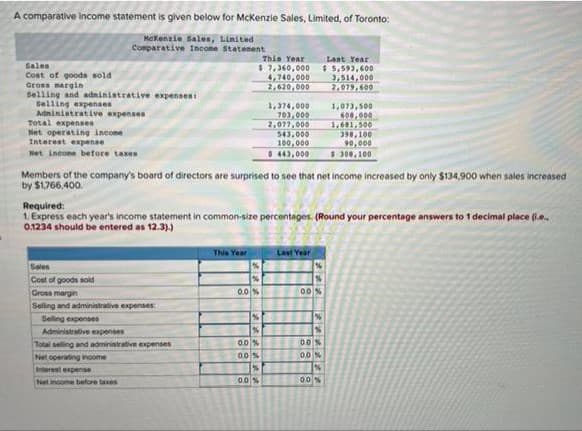

Transcribed Image Text:A comparative Income statement is given below for McKenzie Sales, Limited, of Toronto:

McKenzie Sales, Limited

Comparative Income Statement

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expenses

Administrative expenses

Total expenses

Net operating income

Interest expense

Net incone before taxes

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Selling expenses

Administrative expenses

Total selling and administrative expenses

This Year

$ 7,360,000

4,740,000

2,620,000

Net operating income

Interest expense

Net income before taxes

This Year

Members of the company's board of directors are surprised to see that net income increased by only $134,900 when sales increased

by

Required:

1 Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal place (ie..

0.1234 should be entered as 12.3).)

0.0 %

%

%

0.0 %

0.0 %

1,374,000

703,000

2,077,000

%

543,000

100,000

0443,000

0.0 %

Last Year

Last Year

$5,593,600

3,514,000

2,079,600

00%

%

1,073,500

600,000

1,681,500

0.0 %

0,0 %

%

0.0 %

398,100

90,000

$300,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub