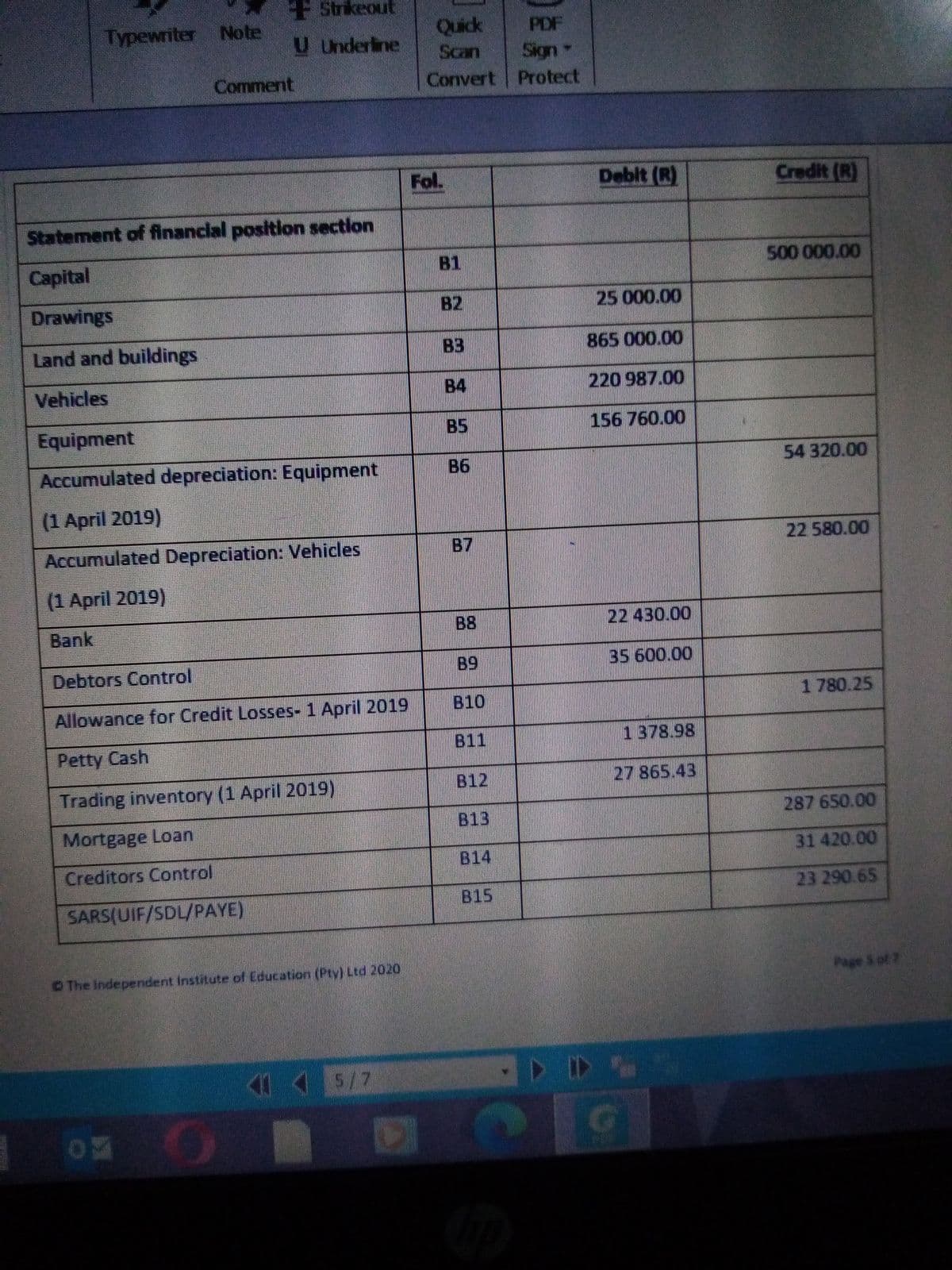

rovide for depreciation as follows : On motor vehicles :15% per annum on reducing balance method. On equipment :10% on cost. Note new piece of equipment was purchased on 1 September 2019 costing 54 000.

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Provide for

On motor vehicles :15% per annum on

On equipment :10% on cost. Note new piece of equipment was purchased on 1 September 2019 costing 54 000.

Step by step

Solved in 2 steps