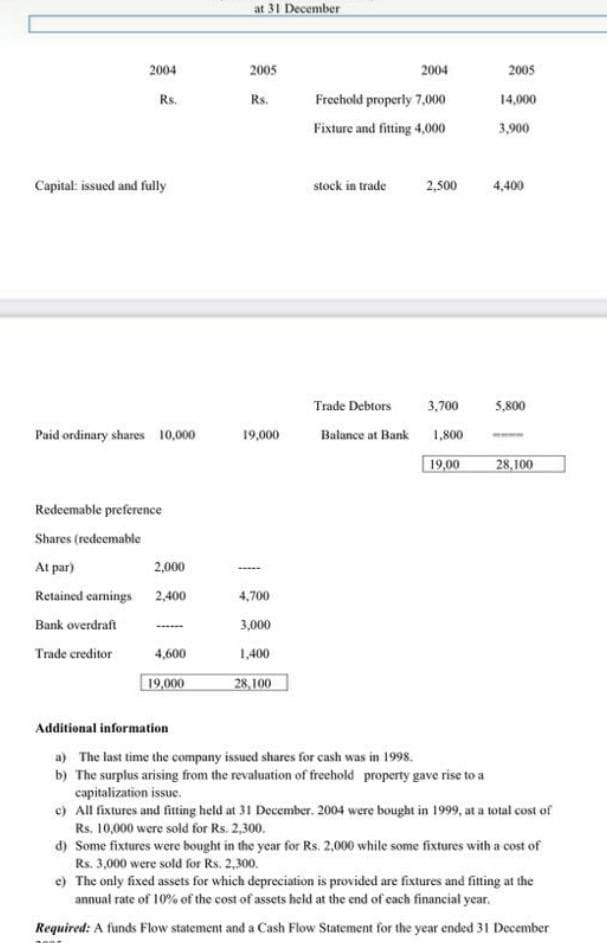

Rs. Rs. Frechold properly 7,000 14,000 Fixture and fitting 4,000 3,900 Capital: issued and fully stock in trade 2,500 4,400 Trade Debtors 3,700 5,800 Paid ordinary shares 10,000 19,000 Balance at Bank 1,800 19,00 28, 100 Redeemable preference Shares (redeemable At par) 2,000 Retained earnings 2,400 4,700 Bank overdraft 3,000 Trade creditor 4,600 1,400 19,000 28,100 Additional information a) The last time the company issued shares for cash was in 1998. b) The surplus arising from the revaluation of freehold property gave rise to a capitalization issue. c) All fixtures and fitting held at 31 December. 2004 were bought in 1999, at a total cost of Rs. 10,000 were sold for Rs. 2,300. d) Some fixtures were bought in the year for Rs. 2,000 while some fixtures with a cost of Rs. 3,000 were sold for Rs. 2,300. e) The only fixed assets for which depreciation is provided are fixtures and fitting at the annual rate of 10% of the cost of assets held at the end of cach financial year. Required: A funds Flow statement and a Cash Flow Statement for the year ended 31 December

Rs. Rs. Frechold properly 7,000 14,000 Fixture and fitting 4,000 3,900 Capital: issued and fully stock in trade 2,500 4,400 Trade Debtors 3,700 5,800 Paid ordinary shares 10,000 19,000 Balance at Bank 1,800 19,00 28, 100 Redeemable preference Shares (redeemable At par) 2,000 Retained earnings 2,400 4,700 Bank overdraft 3,000 Trade creditor 4,600 1,400 19,000 28,100 Additional information a) The last time the company issued shares for cash was in 1998. b) The surplus arising from the revaluation of freehold property gave rise to a capitalization issue. c) All fixtures and fitting held at 31 December. 2004 were bought in 1999, at a total cost of Rs. 10,000 were sold for Rs. 2,300. d) Some fixtures were bought in the year for Rs. 2,000 while some fixtures with a cost of Rs. 3,000 were sold for Rs. 2,300. e) The only fixed assets for which depreciation is provided are fixtures and fitting at the annual rate of 10% of the cost of assets held at the end of cach financial year. Required: A funds Flow statement and a Cash Flow Statement for the year ended 31 December

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 17E

Related questions

Question

Please answer it

Transcribed Image Text:at 31 December

2004

2005

2004

2005

Rs.

Rs.

Frechold properly 7,000

14,000

Fixture and fiting 4,000

3,900

Capital: issued and fully

stock in trade

2,500

4,400

Trade Debtors

3,700

5,800

Paid ordinary shares 10,000

19,000

Balance at Bank

1,800

19,00

28,100

Redeemable preference

Shares (redeemable

At par)

2,000

Retained earnings 2,400

4,700

Bank overdraft

3,000

Trade creditor

4,600

1,400

19,000

28,100

Additional information

a) The last time the company issued shares for cash was in 1998.

b) The surplus arising from the revaluation of freehold property gave rise to a

capitalization issuc.

e) All fixtures and fitting held at 31 December. 2004 were bought in 1999, at a total cost of

Rs. 10,000 were sold for Rs. 2,300.

d) Some fixtures were bought in the year for Rs. 2,000 while some fixtures with a cost of

Rs. 3,000 were sold for Rs. 2,300.

e) The only fixed assets for which depreciation is provided are fixtures and fitting at the

annual rate of 10% of the cost of assets held at the end of cach financial year.

Required: A funds Flow statement and a Cash Flow Statement for the year ended 31 December

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning