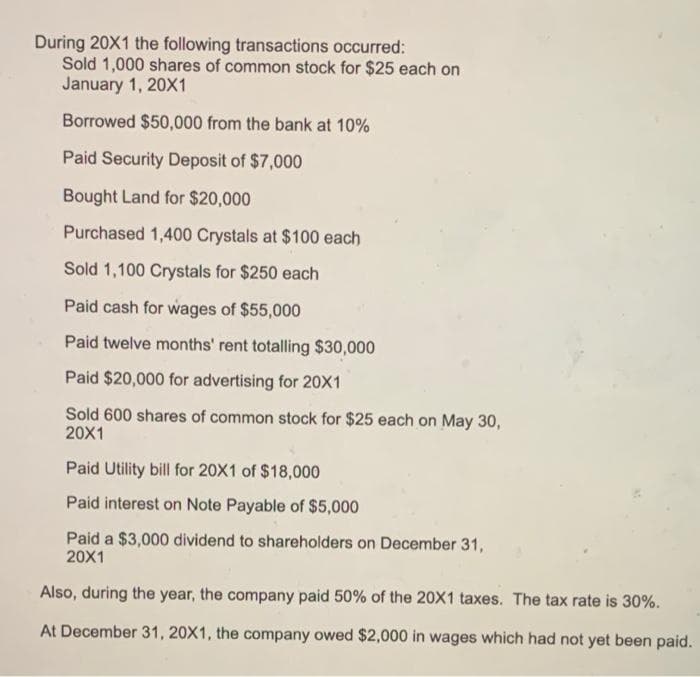

During 20X1 the following transactions occurred: Sold 1,000 shares of common stock for $25 each on January 1, 20X1 Borrowed $50,000 from the bank at 10% Paid Security Deposit of $7,000 Bought Land for $20,000 Purchased 1,400 Crystals at $100 each Sold 1,100 Crystals for $250 each Paid cash for wages of $55,000 Paid twelve months' rent totalling $30,000 Paid $20,000 for advertising for 20X1 Sold 600 shares of common stock for $25 each on May 30, 20X1 Paid Utility bill for 20X1 of $18,000 Paid interest on Note Payable of $5,000 Paid a $3,000 dividend to shareholders on December 31, 20X1 Also, during the year, the company paid 50% of the 20X1 taxes. The tax rate is 30%. At December 31, 20X1, the company owed $2,000 in wages which had not yet been paid.

During 20X1 the following transactions occurred: Sold 1,000 shares of common stock for $25 each on January 1, 20X1 Borrowed $50,000 from the bank at 10% Paid Security Deposit of $7,000 Bought Land for $20,000 Purchased 1,400 Crystals at $100 each Sold 1,100 Crystals for $250 each Paid cash for wages of $55,000 Paid twelve months' rent totalling $30,000 Paid $20,000 for advertising for 20X1 Sold 600 shares of common stock for $25 each on May 30, 20X1 Paid Utility bill for 20X1 of $18,000 Paid interest on Note Payable of $5,000 Paid a $3,000 dividend to shareholders on December 31, 20X1 Also, during the year, the company paid 50% of the 20X1 taxes. The tax rate is 30%. At December 31, 20X1, the company owed $2,000 in wages which had not yet been paid.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 17BEA

Related questions

Question

prepare

Transcribed Image Text:During 20X1 the following transactions occurred:

Sold 1,000 shares of common stock for $25 each on

January 1, 20X1

Borrowed $50,000 from the bank at 10%

Paid Security Deposit of $7,000

Bought Land for $20,000

Purchased 1,400 Crystals at $100 each

Sold 1,100 Crystals for $250 each

Paid cash for wages of $55,000

Paid twelve months' rent totalling $30,000

Paid $20,000 for advertising for 20X1

Sold 600 shares of common stock for $25 each on May 30,

20X1

Paid Utility bill for 20X1 of $18,000

Paid interest on Note Payable of $5,000

Paid a $3,000 dividend to shareholders on December 31,

20X1

Also, during the year, the company paid 50% of the 20X1 taxes. The tax rate is 30%.

At December 31, 20X1, the company owed $2,0000 in wages which had not yet been paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning