rship Liquid

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

100%

Required:

Prepare a statement of Partnership Liquidation

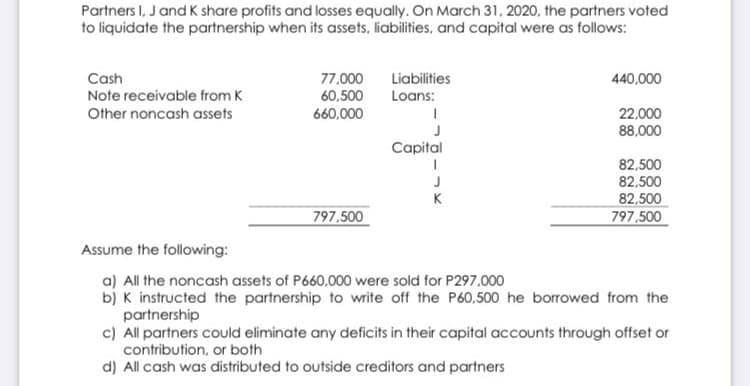

Transcribed Image Text:Partners I, J and K share profits and losses equally. On March 31, 2020, the partners voted

to liquidate the partnership when its assets, liabilities, and capital were as follows:

77.000

60,500

Cash

Liabilities

440,000

Note receivable from K

Loans:

Other noncash assets

660,000

22,000

88,000

Capital

82,500

82,500

82,500

797,500

J

K

797,500

Assume the following:

a) All the noncash assets of P660,000 were sold for P297,000

b) K instructed the partnership to write off the P60,500 he borrowed from the

partnership

c) All partners could eliminate any deficits in their capital accounts through offset or

contribution, or both

d) All cash was distributed to outside creditors and partners

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT