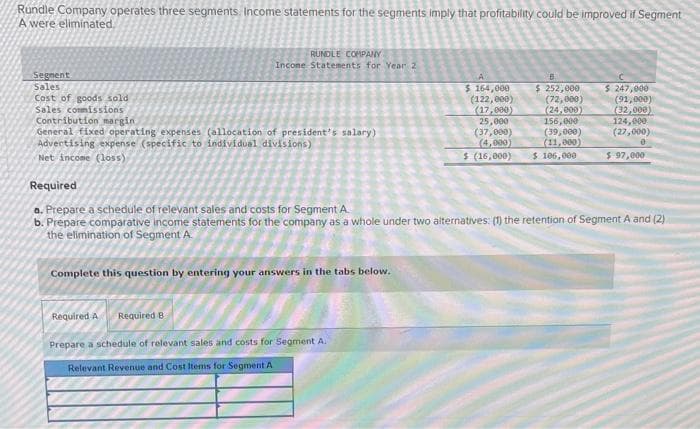

Rundle Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions RUNDLE COMPANY Income Statements for Year 2 Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss) $164,000 (122,000) (17,000) 25,000 (37,000) (4,000) $ (16,000) $ 106,000 $ 252,000 (72,000) (24,000) 156,000 (39,000) (11,000) $ 247,000 (91,000) (32,000) 124,000 (27,000) 0 $ 97,000 Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A

Rundle Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions RUNDLE COMPANY Income Statements for Year 2 Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss) $164,000 (122,000) (17,000) 25,000 (37,000) (4,000) $ (16,000) $ 106,000 $ 252,000 (72,000) (24,000) 156,000 (39,000) (11,000) $ 247,000 (91,000) (32,000) 124,000 (27,000) 0 $ 97,000 Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 38E: Sundahl Companys income statements for the past 2 years are as follows: Refer to the information for...

Related questions

Question

Please help me with all answers thanku

Transcribed Image Text:Rundle Company operates three segments Income statements for the segments imply that profitability could be improved if Segment

A were eliminated.

Segment

Sales

Cost of goods sold

Sales commissions

RUNDLE COMPANY

Income Statements for Year 2

Contribution margin,

General fixed operating expenses (allocation of president's salary)

Advertising expense (specific to individual divisions)

Net income (loss)

Complete this question by entering your answers in the tabs below.

$164,000

(122,000)

(17,000)

25,000

(37,000)

(4,000)

$ (16,000)

Required A Required B

Prepare a schedule of relevant sales and costs for Segment A.

Relevant Revenue and Cost Items for Segment A

B

$ 252,000

(72,000)

(24,000)

156,000

(39,000)

(11,000)

$ 106,000

$ 247,000

(91,000)

(32,000)

124,000

(27,000)

0

Required

a. Prepare a schedule of relevant sales and costs for Segment A.

b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2)

the elimination of Segment A

$ 97,000

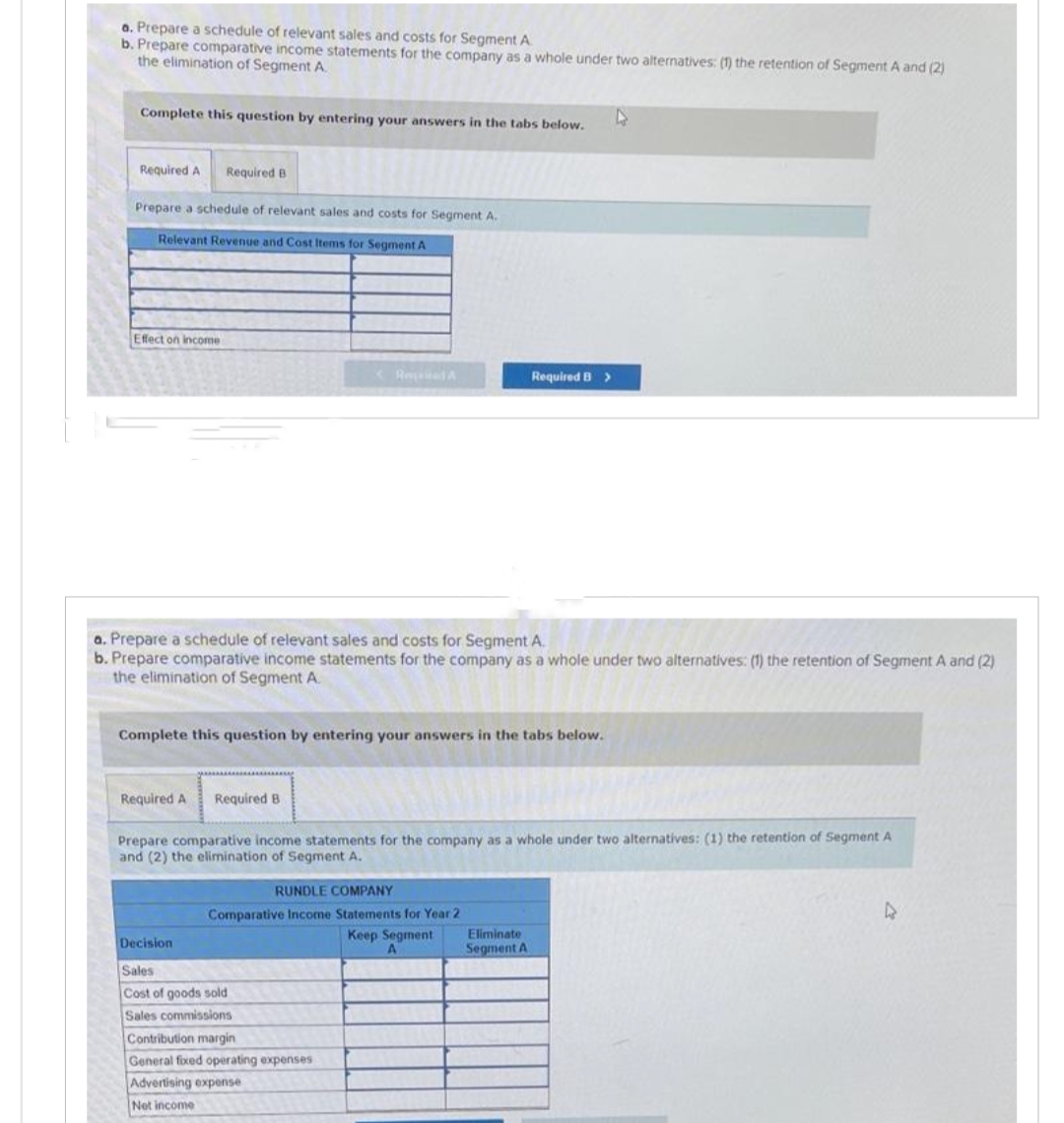

Transcribed Image Text:a. Prepare a schedule of relevant sales and costs for Segment A

b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2)

the elimination of Segment A

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare a schedule of relevant sales and costs for Segment A.

Relevant Revenue and Cost Items for Segment A

Effect on income

a. Prepare a schedule of relevant sales and costs for Segment A.

b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2)

the elimination of Segment A.

Required A Required B

<RA

Complete this question by entering your answers in the tabs below.

Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A

and (2) the elimination of Segment A.

RUNDLE COMPANY

Comparative Income Statements for Year 2

Keep Segment

A

Decision

Sales

Cost of goods sold

Sales commissions

Required B >

Contribution margin

General fixed operating expenses

Advertising expense

Net income

Eliminate

Segment A

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub