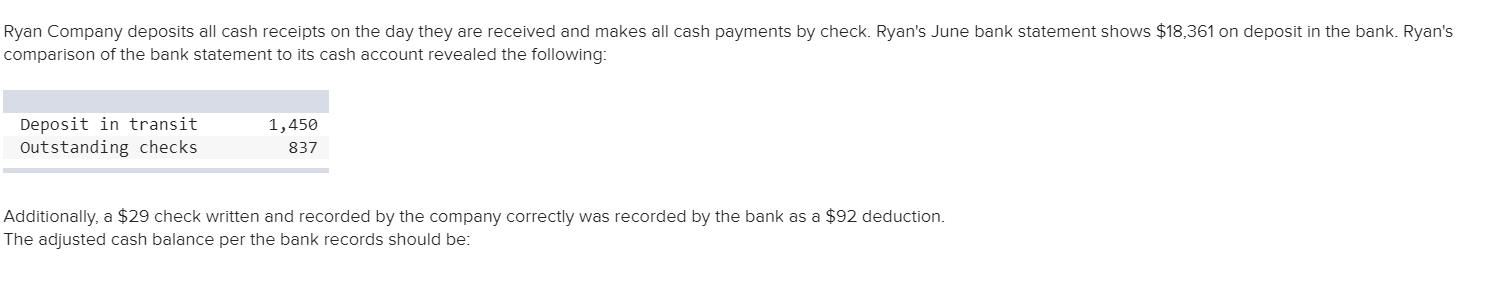

Ryan Company deposits all cash receipts on the day they are received and makes all cash payments by check. Ryan's June bank statement shows $18,361 on deposit in the bank. Ryan's comparison of the bank statement to its cash account revealed the following: Deposit in transit Outstanding checks 1,450 837 Additionally, a $29 check written and recorded by the company correctly was recorded by the bank as a $92 deduction The adjusted cash balance per the bank records should be:

Ryan Company deposits all cash receipts on the day they are received and makes all cash payments by check. Ryan's June bank statement shows $18,361 on deposit in the bank. Ryan's comparison of the bank statement to its cash account revealed the following: Deposit in transit Outstanding checks 1,450 837 Additionally, a $29 check written and recorded by the company correctly was recorded by the bank as a $92 deduction The adjusted cash balance per the bank records should be:

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

100%

Transcribed Image Text:Ryan Company deposits all cash receipts on the day they are received and makes all cash payments by check. Ryan's June bank statement shows $18,361 on deposit in the bank. Ryan's

comparison of the bank statement to its cash account revealed the following:

Deposit in transit

Outstanding checks

1,450

837

Additionally, a $29 check written and recorded by the company correctly was recorded by the bank as a $92 deduction

The adjusted cash balance per the bank records should be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning