s that it should be replaced. He gives you the following analysis, which he says verifies the correctness of the decision to buy the machinery ten years ago. He bases his statement on the 21% return he calculated, which is higher tha

s that it should be replaced. He gives you the following analysis, which he says verifies the correctness of the decision to buy the machinery ten years ago. He bases his statement on the 21% return he calculated, which is higher tha

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.2.2P: Differential analysis report for machine replacement proposal Catalina Tooling Company is...

Related questions

Question

Using Capital Budgeting

Ten years ago Kramer Company, of which you are controller, bought machinery at a cost of $250,000. The purchase was made at the insistence of the production manager. The machinery is now worthless, and the production manager believes that it should be replaced. He gives you the following analysis, which he says verifies the correctness of the decision to buy the machinery ten years ago. He bases his statement on the 21% return he calculated, which is higher than the 16% cutoff

Required: Do you agree that the investment was wise? Why or why not?

Transcribed Image Text:ndall giving and

your recommendation regarding the proposal.

CASES

7-39 Ten years ago Kramer Company, of which you are controller, bought machinery at a

Reevaluating cost of $250,000. The purchase was made at the insistence of the production man-

an investment ager. The machinery is now worthless, and the production manager believes that it

Transcribed Image Text:ter 7 Capital Budgeting Decisions-Part I

313

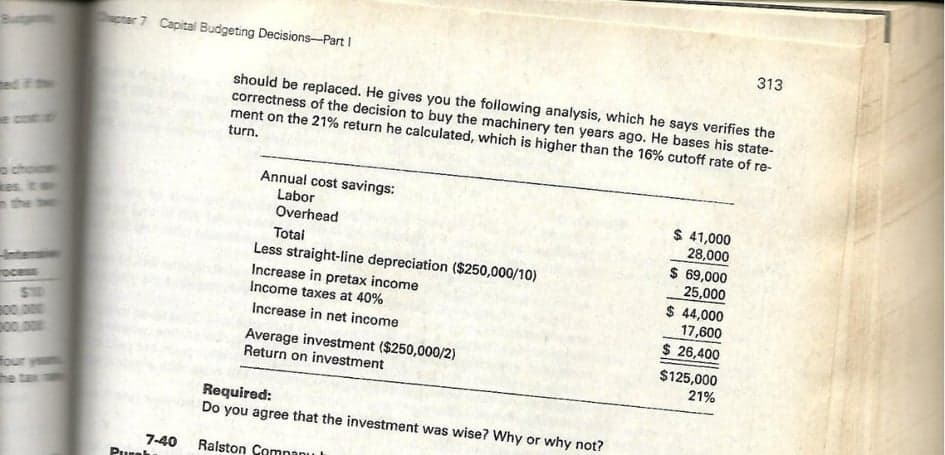

should be replaced. He gives you the following analysis, which he says verifies the

correctness of the decision to buy the machinery ten years ago. He bases his state-

ment on the 21% return he calculated, which is higher than the 16% cutoff rate of re-

turn.

ed

eco

o choi

Res.

the

Annual cost savings:

Labor

Overhead

$ 41,000

28,000

Totai

Less straight-line depreciation ($250,000/10)

Increase in pretax income

Income taxes at 40%

$ 69,000

25,000

$ 44,000

17,600

nteni

rocess

S10

B00.000

p00.00m

Increase in net income

$ 26,400

Average investment ($250,000/2)

Return on investment

$125,000

21%

four yeu

he tax

Required:

Do you agree that the investment was wise? Why or why not?

7-40

Pure

Ralston Comnanu

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning