S. Lamar performed legal services for E. Garr. Due to a cash shortage, an agreement was reached whereby E. Garr would pay s. Lamar a legal fee of approximately $12,000 by issuing 3,000 shares of its common stock (par $1). The stock trades on a daily basis and the market price of the stock on the day the debt was settled is $4.50 per share. Given this information, the journal entry for E. Garr. to record this transaction is: Organization Expense Common Stock Organization Expense 13,500 13,500 12,000 Common Stock 12,000 Organization Expense 13,500 Common Stock Paid-in Capital in Excess of ParCommon 3,000 10,500 Organization Expense 12,000 3,000 9,000 Common Stock Paid-in Capital in Excess of ParCommon

S. Lamar performed legal services for E. Garr. Due to a cash shortage, an agreement was reached whereby E. Garr would pay s. Lamar a legal fee of approximately $12,000 by issuing 3,000 shares of its common stock (par $1). The stock trades on a daily basis and the market price of the stock on the day the debt was settled is $4.50 per share. Given this information, the journal entry for E. Garr. to record this transaction is: Organization Expense Common Stock Organization Expense 13,500 13,500 12,000 Common Stock 12,000 Organization Expense 13,500 Common Stock Paid-in Capital in Excess of ParCommon 3,000 10,500 Organization Expense 12,000 3,000 9,000 Common Stock Paid-in Capital in Excess of ParCommon

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:QUESTION 17

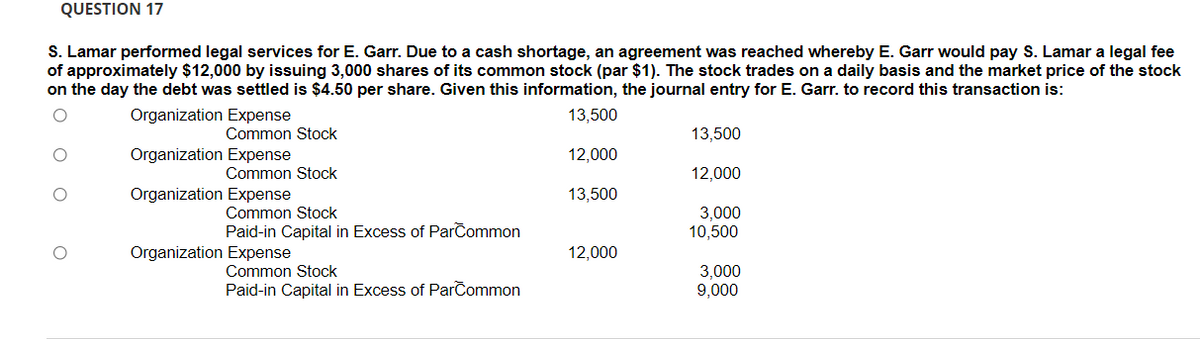

S. Lamar performed legal services for E. Garr. Due to a cash shortage, an agreement was reached whereby E. Garr would pay S. Lamar a legal fee

of approximately $12,000 by issuing 3,000 shares of its common stock (par $1). The stock trades on a daily basis and the market price of the stock

on the day the debt was settled is $4.50 per share. Given this information, the journal entry for E. Garr. to record this transaction is:

Organization Expense

13,500

Common Stock

13,500

Organization Expense

12,000

Common Stock

12,000

Organization Expense

13,500

Common Stock

3,000

10,500

Paid-in Capital in Excess of ParCommon

Organization Expense

12,000

Common Stock

3,000

9,000

Paid-in Capital in Excess of ParCommon

O o o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you