S.no Date а) Account Title and Explanation Debit Credit Raw material inventory Accounts payable (To Record the purchase of Raw Material) WIP inventory Manufacturing overhead Raw material inventory (To Record the issue of materail for production) WIP inventory Manufacturing overhead Salaries and wages payable (To Record the labor cost incurred) Manufacturing overhead Accumulated depreciation-Factory equipment |(To Record the Depreciation on Equipment) Manufacturing overhead Accounts payable (To Record the manufacturing overheads incurred) WIP inventory (30000*8) Manufacturing overhead (To Record the application of Manufacturing overhead) Finished goods inventory WIP inventory (To Record the transfer of goods to finished goods inventory) Accounts receivable (480000*125%) 210,000 210,000 b) 178,000 12,000 190,000 c) 90,000 110,000 200,000 d) 40,000 40,000 e) 70,000 70,000 f) 240,000 240,000 g) 520,000 520,000 h) 600,000 Sales 600,000 (To Record the sale of goods on account) Cost of goods sold Finished goods inventory (To Record the Cost of Goods Sold) 480,000 480,000

S.no Date а) Account Title and Explanation Debit Credit Raw material inventory Accounts payable (To Record the purchase of Raw Material) WIP inventory Manufacturing overhead Raw material inventory (To Record the issue of materail for production) WIP inventory Manufacturing overhead Salaries and wages payable (To Record the labor cost incurred) Manufacturing overhead Accumulated depreciation-Factory equipment |(To Record the Depreciation on Equipment) Manufacturing overhead Accounts payable (To Record the manufacturing overheads incurred) WIP inventory (30000*8) Manufacturing overhead (To Record the application of Manufacturing overhead) Finished goods inventory WIP inventory (To Record the transfer of goods to finished goods inventory) Accounts receivable (480000*125%) 210,000 210,000 b) 178,000 12,000 190,000 c) 90,000 110,000 200,000 d) 40,000 40,000 e) 70,000 70,000 f) 240,000 240,000 g) 520,000 520,000 h) 600,000 Sales 600,000 (To Record the sale of goods on account) Cost of goods sold Finished goods inventory (To Record the Cost of Goods Sold) 480,000 480,000

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 7MC: Conversion costs include all of the following except: A. wages of production workers B. depreciation...

Related questions

Question

100%

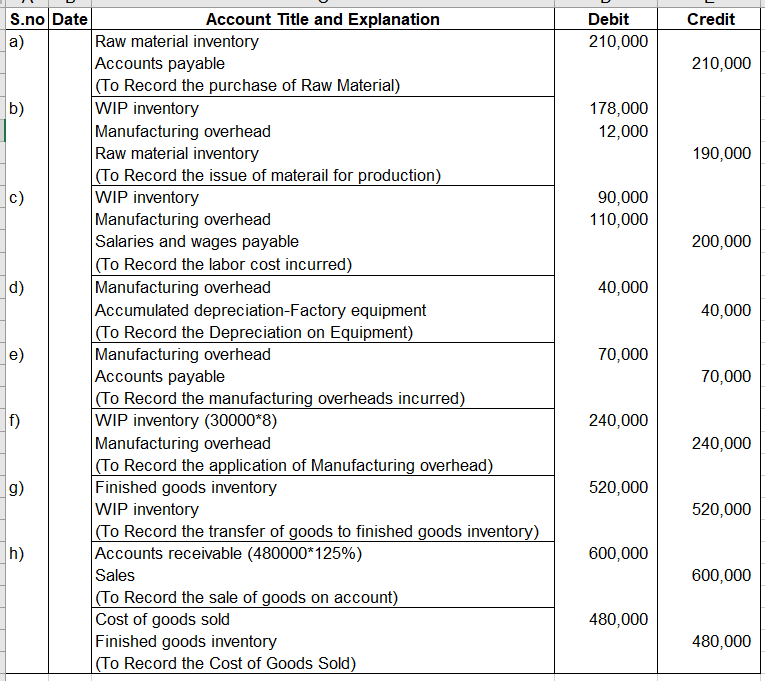

Make a T-Account for the following

Transcribed Image Text:S.no Date

a)

Account Title and Explanation

Debit

Credit

Raw material inventory

Accounts payable

(To Record the purchase of Raw Material)

WIP inventory

Manufacturing overhead

Raw material inventory

(To Record the issue of materail for production)

WIP inventory

Manufacturing overhead

Salaries and wages payable

(To Record the labor cost incurred)

Manufacturing overhead

Accumulated depreciation-Factory equipment

(To Record the Depreciation on Equipment)

Manufacturing overhead

Accounts payable

(To Record the manufacturing overheads incurred)

WIP inventory (30000*8)

Manufacturing overhead

(To Record the application of Manufacturing overhead).

Finished goods inventory

WIP inventory

(To Record the transfer of goods to finished goods inventory)

Accounts receivable (480000*125%)

210,000

210,000

b)

178,000

12,000

190,000

c)

90,000

110,000

200,000

d)

40,000

40,000

e)

70,000

70,000

f)

240,000

240,000

g)

520,000

520,000

h)

600,000

Sales

600,000

(To Record the sale of goods on account)

Cost of goods sold

Finished goods inventory

(To Record the Cost of Goods Sold)

480,000

480,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College