Flow of Product Costs through Accounts Assuming a routine manufacturing activity, present journal entries (account titles only) for each of the following transactions: a. Purchased material on account. Description Debit Credit Accounts payable b. Recorded wages payable (for Indirect labor) earned but not paid. Description Debit Credit Wages payable C. Requisitioned both direct material and indirect material. Description Debit Credit Work in process inventory Manufacturing overhead Materials inventory d. Assigned direct and indirect labor costs. Description Debit Credit Work in process inventory Manufacturing overhead Wages payable e. Recorded factory depreciation and accrued factory property tax. Description Debit Credit Manufacturing overhead Accumulated depreciation-factory Property taxes payable f. Applled manufacturing overhead to production. Description Debit Credit Manufacturing overhead g. Completed work on products. Description Debit Credit Work in process inventory h. Sold finished goods on account. Description Debit Credit Cost of goods sold To transfer cost to expense. To record sale of goods. L. Paid wages Debit Credit Description Accounts receivable To pay wages earned.

Flow of Product Costs through Accounts Assuming a routine manufacturing activity, present journal entries (account titles only) for each of the following transactions: a. Purchased material on account. Description Debit Credit Accounts payable b. Recorded wages payable (for Indirect labor) earned but not paid. Description Debit Credit Wages payable C. Requisitioned both direct material and indirect material. Description Debit Credit Work in process inventory Manufacturing overhead Materials inventory d. Assigned direct and indirect labor costs. Description Debit Credit Work in process inventory Manufacturing overhead Wages payable e. Recorded factory depreciation and accrued factory property tax. Description Debit Credit Manufacturing overhead Accumulated depreciation-factory Property taxes payable f. Applled manufacturing overhead to production. Description Debit Credit Manufacturing overhead g. Completed work on products. Description Debit Credit Work in process inventory h. Sold finished goods on account. Description Debit Credit Cost of goods sold To transfer cost to expense. To record sale of goods. L. Paid wages Debit Credit Description Accounts receivable To pay wages earned.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter8: Standard Cost Accounting—materials, Labor, And Factory Overhead

Section: Chapter Questions

Problem 14E: Journalizing standard costs in two departments Griffin Manufacturing Inc. has two departments,...

Related questions

Question

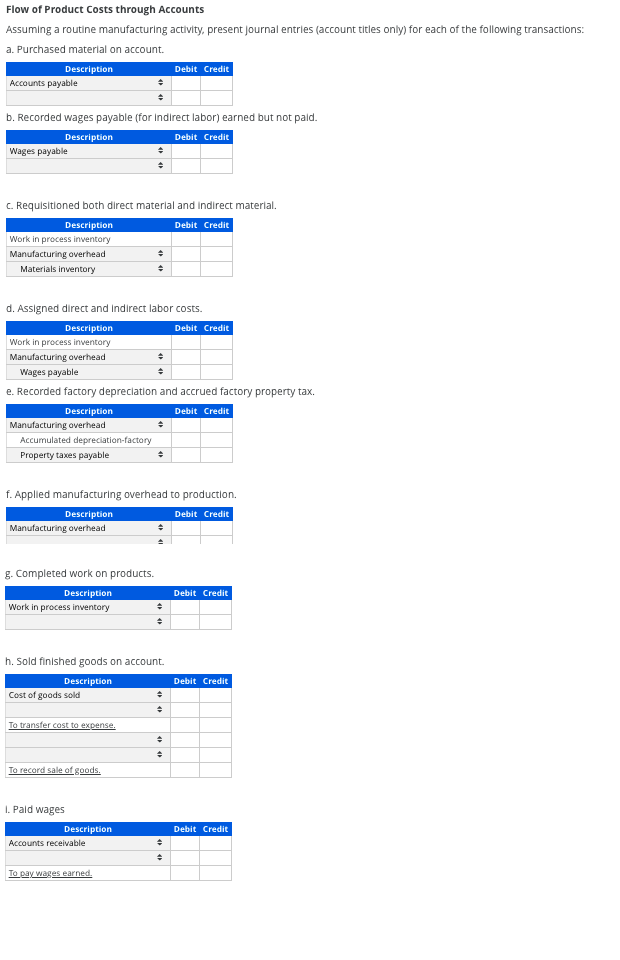

Transcribed Image Text:Flow of Product Costs through Accounts

Assuming a routine manufacturing activity, present Journal entries (account titles only) for each of the following transactions:

a. Purchased materlal on account.

Description

Debit Credit

Accounts payable

b. Recorded wages payable (for Indirect labor) earned but not paid.

Description

Debit Credit

Wages payable

C. Requisitioned both direct material and indirect material.

Description

Debit Credit

Work in process inventory

Manufacturing overhead

Materials inventory

d. Assigned direct and Indirect labor costs.

Description

Debit Credit

Work in process inventory

Manufacturing overhead

Wages payable

e. Recorded factory depreciation and accrued factory property tax.

Description

Debit Credit

Manufacturing overhead

Accumulated depreciation-factory

Property taxes payable

f. Appled manufacturing overhead to production.

Description

Debit Credit

Manufacturing overhead

g. Completed work on products.

Description

Debit Credit

Work in process inventory

h. Sold finished goods on account.

Description

Debit Credit

Cost of goods sold

To transfer cost to expense.

To record sale ofgoods,

I. Pald wages

Description

Debit Credit

Accounts receivable

To pay wages earned.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning