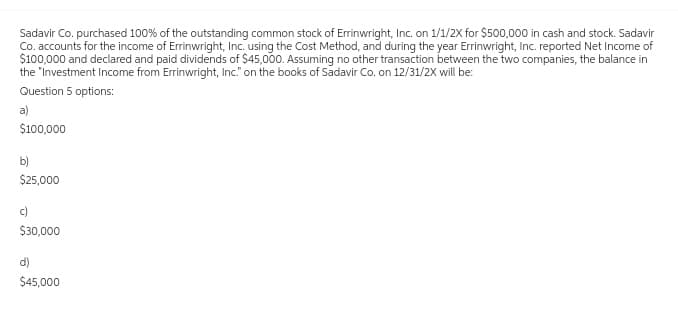

Sadavir Co. purchased 100% of the outstanding common stock of Errinwright, Inc. on 1/1/2X for $500,000 in cash and stock. Sadavir Co. accounts for the income of Errinwright, Inc., using the Cost Method, and during the year Errinwright, Inc. reported Net Income of $100,000 and declared and paid dividends of $45,000. Assuming no other transaction between the two companies, the balance in the "Investment Income from Errinwright, Inc." on the books of Sadavir Co. on 12/31/2X will be: Question 5 options: a) $100,000 b) $25,000 c) $30,000 $45,000

Sadavir Co. purchased 100% of the outstanding common stock of Errinwright, Inc. on 1/1/2X for $500,000 in cash and stock. Sadavir Co. accounts for the income of Errinwright, Inc., using the Cost Method, and during the year Errinwright, Inc. reported Net Income of $100,000 and declared and paid dividends of $45,000. Assuming no other transaction between the two companies, the balance in the "Investment Income from Errinwright, Inc." on the books of Sadavir Co. on 12/31/2X will be: Question 5 options: a) $100,000 b) $25,000 c) $30,000 $45,000

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 25CE

Related questions

Question

Please help me.

Thankyou.

Transcribed Image Text:Sadavir Co. purchased 100% of the outstanding common stock of Errinwright, Inc. on 1/1/2X for $500,000 in cash and stock. Sadavir

Co. accounts for the income of Errinwright, Inc. using the Cost Method, and during the year Errinwright, Inc. reported Net Income of

$100,000 and declared and paid dividends of $45,000. Assuming no other transaction between the two companies, the balance in

the "Investment Income from Errinwright, Inc." on the books of Sadavir Co. on 12/31/2X will be:

Question 5 options:

a)

$100,000

b)

$25,000

c)

$30,000

$45,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you